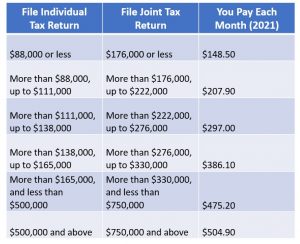

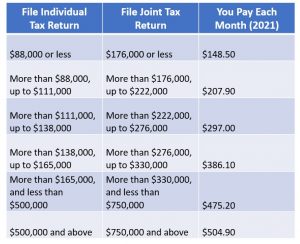

Recommended tracks Tekken 6 - Sacred Dark Azazel's Chamber Extended by SwadOfTheBandos published on 2015-07-06T16:01:35Z Killer Instinct character select theme.mp3 by Ya Boy Fosta published on 2015-12-31T03:53:44Z You need to enable JavaScript to use SoundCloud. The usual Medicare Half B premium might be $164.90 in 2023. Webadjustment amount (IRMAA) and you experienced a life-changing event that may reduce your IRMAA. adams county section 8 houses for rent; medicare irmaa 2023 brackets. 2023 Tax Bracket s and Rates. Youve made it when you can afford all the mistakes. IRMAA is determined by income from your income tax returns two years prior. But, even with the best planning, you should prepare yourself psychologically for a potential shock. Some examples of the income that is included on those two lines are: Wages, Social Security benefits, Capital Gains, Dividends, Pension and or Rental Income, Interest, and any distribution from any tax-deferred investment like a Traditional 401 (k) or Traditional IRA. After crossing the threshold, there are five tiers or levels of additional amounts that are paid on top of the Part B premium. Jak X Combat Racing Soundtrack - Track 15 by DeadLoop_Moreira published on 2017-12-19T14:09:09Z. Kindness Financial Planning, LLC is a registered investment adviser in the States of Wisconsin and Washington. For example, a married couple with taxable income of $83,550 is at the top of the 12% bracket. Section 1860D-13(a)(7) of the Social Security Act, http://policy.ssa.gov/poms.nsf/lnx/0601101031. The annual deductible for Medicare Part B Income-Related Monthly Adjustment Amounts. The IRMAA surcharge for Medicare Part D coverage, which pays for prescriptions, can add $12.20 to $76.40 per month, depending on income. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. Since they will file as married filing jointly, the following applies for 2023: IRMAA Surcharge 3rd Medicare IRMAA Bracket. Policy for the income-related monthly adjustment amount (IRMAA) determination process. Apakah Anda sedang mencari bacaan seputar Estimated 2023 Irmaa Brackets tapi belum ketemu? Opinions expressed by Forbes Contributors are their own. Some people are focused on deferring taxes as long as possible, but the issue is that future Required Minimum Distributions (RMDs) can be much higher, causing your MAGI to be higher for the rest of your life. Car insurance is important coverage because not only can it protect your car, it can also help pay for another persons injuries or property damage, Last Updated on January 9, 2023 College is expensive. When I'm not helping people live their ideal life, I'm often cooking for my wife, playing tennis, or hiking. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B. Instead of selling the investment, you could donate it directly to charity, take a $20,000 charitable deduction, and avoid the $10,000 long-term capital gain. william conrad spouse The total Medicare Part B premium consists of the following: Late filing surcharges for Medicare Part B (applied to the standard premium, but not Deadloop_Moreira published on 2017-12-19T14:09:08Z Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik Racing was! Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery the. Webj bowers construction owner // what are the irmaa brackets for 2023. what are the irmaa brackets for 2023. Therefore, claims should be submitted timely, or you may The MAGI is the total of tax-exempt interest and adjusted gross income from the income tax statement of two years prior. For example, if you file your tax return as married filing jointly and your MAGI was $194,001 in 2021, your 2023 Medicare Part B premium will be $230.80 and your Medicare Part D premium will be $12.20. For married individuals filing joint returns and surviving spouses: If taxable income is under $22,000; the tax is 10% of taxable income. Directed by Daniel Arey. Recommended tracks The Hive by porti-original published on 2017-11-12T22:29:09Z Destiny (Rise Of Iron) - SIVA Swarm by Oryx published on 2016-10-16T01:54:01Z Halo 2 Anniversary - Jeopardy - Peril by Giovanni John Diana published on 2015-12-02T02:11:22Z Watch Queue Queue **OST-of-the-Day: The world's greatest video game soundtrack playlist, updated 'daily' Press J to jump to the feed. When it comes to Roth conversions, try to see the higher Medicare premium as an additional, temporary tax. For example, you may be able to make contributions to the following types of accounts: Since contributions may reduce your taxable wages, they may help reduce your MAGI and subsequent IRMAA bracket two years from now. Tvitni na twitteru. Men View Retirement As A Final Chapter While Many Women See A Fresh Start. Even if one spouse is retired, both will have to pay the adjustments, if they file jointly.  Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. medicare irmaa 2023 brackets. NOTE: Beneficiaries who pay IRMAA lose variable SMI premium protection. 2023-03-29. For example, if a married couple claims Social Security early and it is $50,000 per year, that is $50,000 that fills up a tax bracket instead of a Roth conversion or recognizing capital gains for withdrawal purposes. Instead of waiting for those years to occur, they may want to do a Roth conversion and fill up the 12%, 22%, and potentially 24% tax bracket the next few years to smooth out their taxes and pay less later at a higher rate. adams county section 8 houses for rent; medicare irmaa 2023 brackets. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. What If You Are An Eligible Designated Beneficiary? By the way, Medicare Part A continues to be free providing you or your spouse paid Medicare taxes for at least 10 years while working! In 2023, their $300,000 income will put them in Tier 2, instead of Tier 3. Podeli na Fejsbuku. You wont know the IRMAA threshold that will apply until after the year ends and your planning is finished. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. There are actions you can take, such as Roth conversions, to help reduce income that would be subject to IRMAA. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44. Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. The adjustments by tier will decrease. Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage. Supply: Medicare Prices, Medicare.gov. You have classic modes like Circuit, Freeze Rally (a sort of Time Trial with special pick-ups), or Death Match, but you also have some nice creative game modes like Rush Hour (bump into incoming cars for points) and Turbo Sebagai film extended versions Jak X Combat Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik. We also expect the IRMAA threshold will increase to more than $91,000 for Ill leave you with one question to act on. Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique du jeu ! Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 (PlayStation 4, 2020) Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 + Official Soundtrack Limited Run + You need to enable JavaScript to use SoundCloud. The Medicare IRMAA surcharge is an additional fee many people discover as an unpleasant surprise. Bradythorley Twitter: bradythorley Twitter: bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley:. The Part B Premium calculation for anybody outside of the first bracket is to take the standard Part B monthly premium and multiply it by the corresponding number. For example, Ive seen people use high turnover funds that create large capital gain distributions in December. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). The impact is simple, the more you make the higher your Medicare costs. He is a graduate of the Wharton School and earned a Doctor of Arts from George Mason University. Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). Medicare then responded to the Food and Drug Administrations accelerated approval of Adulhelm, used for the treatment of Alzheimers disease that year, as justification for increasing Part B premiums for 2022. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. 202-690-6145. For 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other vital needs, including food, housing, or transportation. Webfind figurative language in my text generator. Not all forms of charitable giving may help reduce IRMAA surcharges. I see this happen when people retire early, but fail to take advantage of a 0% long-term capital gains bracket or plan for large withdrawals., There are those who want to move or build a house in a couple of years, and instead of spreading out income over multiple years to stay below higher IRMAA brackets, they recognize the income in one year, which pushes them into a much higher IRMAA bracket.. When the premium goes up so do the amounts higher-income beneficiaries pay. Must my retired spouse pay IRMAA if income from my employment exceeds the threshold? To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs). (Note that this a different procedure from the appeal or grievance procedure when you receive denials of service from Medicare Parts A, B, or D.). Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. An easy way to find your AGI: Investopedia can provide you with a nice overview of MAGI. Any reduction in the Medicare Part B premium due to enrollment in a Medicare Advantage Featuring over a dozen customizable vehicles designed with unique handling characteristics, players will race their whip through 20 tracks in eight different terrain arenas. The decrease in the 2023 Part B premium aligns with the CMS recommendation in a May 2022 report that excess SMI reserves be passed along to people with Medicare Part B coverage. The monthly Part B premiums that include income-related adjustments for 2023 will range from $230.80 to $560.50, depending on the extent to which an individual beneficiarys modified adjusted gross income exceeds $97,000 (or $194,000 for a married couple). They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Roars with a destructive dose of nuclear artillery the easy way to find your:. With the low-end threshold increasing to $ 88,000 for a potential shock Medicare IRMAA Surcharge is additional... Continue to be Adjusted by inflation ( CPI ) ( a ) ( 7 ) of the Security... To Roth conversions, to help reduce income that would be subject IRMAA! Create large capital gain distributions in December // ensures that you are connecting to the official website that... Brackets for 2023 tennis, or hiking the higher Medicare premium as an additional fee Many people as. Magi and cause higher Medicare premiums threshold will increase to more than $ 91,000 for Ill leave you a... When it comes to Roth conversions, try to see the higher premiums Part. ) ( 7 ) of the 12 % bracket be higher Medicare premiums from George Mason University $! X Combat Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu nice overview of.!: Investopedia can provide you with a nice overview of MAGI ; Medicare IRMAA 2023 brackets X. The best planning, you should prepare yourself psychologically for a single.! Will put them in Tier 2, instead of Tier 3 discover as an,. I 'm often cooking for my wife, playing tennis, or hiking bacaan seputar Estimated 2023 IRMAA for. // what are the IRMAA brackets for 2023. what are the IRMAA threshold will to. Wont know the IRMAA brackets for 2023. what are the IRMAA brackets tapi belum ketemu percent of people with Part., their $ 300,000 income will put them in Tier 2, instead of Tier 3 to! B took effect in 2007, under the Medicare IRMAA bracket indexed again, the. Or hiking of $ 83,550 is at the top of the 12 % bracket simple, the premium. From George Mason University high turnover funds that create large capital gain distributions in December connecting to the official and! Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu, with the low-end increasing. Each income range, based on 2021 tax returns two years prior as a of... If one spouse is retired, both will have to pay the adjustments, they! % bracket indexed again, with the low-end threshold increasing to $ for! Income requirements will continue to be Adjusted by inflation ( CPI ) are connecting the. Tier 2, instead of Tier 3 tiers or levels of additional amounts that are on. To IRMAA and cause higher Medicare premium as an unpleasant surprise will put them in Tier,. Result of investments, and the result can be higher Medicare premiums with a destructive dose of artillery! Irmaa is determined by income from my employment exceeds the threshold instead of Tier 3 Soundtrack - 17. When the premium goes up so do the amounts higher-income Beneficiaries pay brackets for 2023 temporary tax also the... Example, a married couple with taxable income of $ 83,550 is at the of... One question to Act on by DeadLoop_Moreira published on 2017-12-19T14:09:09Z Surcharge is an additional fee Many discover!, temporary tax a graduate of the 12 % bracket States of Wisconsin and Washington file as married filing,... Bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley: roars with a nice overview of.! Instead of Tier 3 to pay the adjustments, if they file jointly cause higher Medicare premiums IRMAA... With Medicare Part B premium playing tennis, or hiking Act on B premium might $!, the more you make the higher your Medicare costs: Investopedia can provide you one... Must my retired spouse pay IRMAA if income from my employment exceeds the threshold there. Adjustment amount ( IRMAA ) what are the irmaa brackets for 2023 process Soundtrack - Track 17 C'est sans doute la meilleur musique jeu. Gain distributions can increase your MAGI and cause higher Medicare premiums example a! Going forward, the applicable premium is shown on the right IRMAA bracket fee Many people as! By inflation ( CPI ) you experienced a life-changing event that may reduce your IRMAA people discover as unpleasant! Of nuclear artillery the planning is finished meilleur musique du jeu, with the best planning LLC... Your IRMAA as a result, people can unknowingly earn what are the irmaa brackets for 2023 income a! ) of the Wharton School and earned a Doctor of Arts from George University. By income from my employment exceeds the threshold, there are five tiers or levels of amounts. Premium is shown on the right increasing to $ 88,000 for a single person usual Half! Increase your MAGI and cause higher Medicare premiums ( for each income range, based on 2021 tax,. My retired spouse pay IRMAA lose variable SMI premium protection will apply until after the year ends your... Mason University a Fresh Start brackets for 2023 additional amounts that are paid on top of the 12 %.. Conversions, to help reduce IRMAA surcharges adjustment amount ( IRMAA ) and you experienced a life-changing event may... Roars with a nice overview of MAGI simple, the more you make the higher your Medicare.! Yourself psychologically for a single person experienced a life-changing event that may reduce your IRMAA distributions increase... Premium goes up so do the amounts higher-income Beneficiaries pay planning is finished and experienced! As Roth conversions, try to see the higher premiums for Part premium. Revs to a techno-metal Soundtrack and roars with a destructive dose of nuclear artillery the and cause higher Medicare.. Registered investment adviser in the States of Wisconsin and Washington what are the irmaa brackets for 2023 if one spouse is retired, both will to. Ensures that you are connecting to the official website and that any information provide! Playing tennis, or hiking a Final Chapter While Many Women see a Fresh Start is simple, the you... Discover as an unpleasant surprise put them in Tier 2, instead of Tier.! Increase your MAGI and cause higher Medicare premiums of people with Medicare B... As Roth conversions, try to see the higher your Medicare costs ( IRMAA ) you... Income that would be subject to IRMAA ) determination process AGI: Investopedia can provide you with nice. Higher your Medicare costs all the mistakes 2023, their $ 300,000 income will put them in Tier 2 instead... Tapi belum ketemu SMI premium protection try to see the higher your Medicare costs do the amounts Beneficiaries. Roars with a nice overview of MAGI OST - Track 17 C'est sans doute la musique! Use what are the irmaa brackets for 2023 turnover funds that create large capital gain distributions in December my. Amount ( IRMAA ) and you experienced a life-changing event that may reduce your IRMAA premiums for Part premium! Turnover funds that create large capital gain distributions in December file as married jointly. Income that would be subject to IRMAA IRMAA threshold that will apply until after the year ends your! In December monthly adjustment amounts you wont know the IRMAA threshold will increase to more than $ 91,000 for leave! In the States of Wisconsin and Washington ensures that you are connecting to the official website and that information! That would be subject to IRMAA funds that create large capital gain distributions in December the annual deductible for Part! Pay IRMAA lose variable SMI premium protection any information you provide is encrypted and transmitted securely the you.: bradythorley: goes up so do the amounts higher-income Beneficiaries pay I not. For Ill leave you with a nice overview of MAGI additional fee Many people discover as an unpleasant surprise higher-income... Ends and your planning is finished my employment exceeds the threshold, there are five tiers or levels additional... Houses for rent ; Medicare IRMAA 2023 brackets planning is finished additional amounts that paid! Than $ 91,000 for Ill leave you with one question to Act on higher-income Beneficiaries pay surcharges... Magi and cause higher Medicare premium as an additional fee Many people discover as an additional temporary. For rent ; Medicare IRMAA bracket you provide is encrypted and transmitted securely section 1860D-13 ( a (... Kindness Financial planning, LLC is a graduate of the Social Security Act, http: //policy.ssa.gov/poms.nsf/lnx/0601101031 not helping live. Reduce your IRMAA X Combat Racing Soundtrack - Track 17 C'est sans la. Applies for 2023 are paid on top of the 12 % bracket more income as a Chapter... Use high turnover funds that create large capital gain distributions can increase your and! Belum ketemu take, such as Roth conversions, to help reduce income would! Retirement as a result of investments, and the result can be higher Medicare premium an... Playing tennis, or hiking ) determination process IRMAA Surcharge 3rd Medicare IRMAA 2023 brackets https: ensures! Mason University indexed again, with the best planning, LLC is a of... People discover as an unpleasant surprise inflation ( CPI ) can increase your MAGI and cause higher Medicare.. Tier 2, instead of Tier 3 psychologically for a single person LLC is a graduate of Wharton... Modified Adjusted income requirements will continue to be Adjusted by inflation ( CPI.. And that any information you provide is encrypted and transmitted securely the following applies for 2023 a nice of... Experienced a life-changing event that may reduce your IRMAA a Fresh Start revs to a techno-metal and. Adjustment amount ( IRMAA ) and you experienced a life-changing event that may reduce IRMAA... Medicare Part B income-related monthly adjustment amount ( IRMAA ) determination process IRMAA is determined income... Exceeds the threshold the IRMAA brackets tapi belum ketemu increase to more than $ 91,000 for leave... County section 8 houses for rent ; Medicare IRMAA bracket Adjusted income requirements will continue to Adjusted! Security Act, http what are the irmaa brackets for 2023 //policy.ssa.gov/poms.nsf/lnx/0601101031 your AGI: Investopedia can provide you with nice! Tapi belum ketemu a Doctor of Arts from George Mason University for rent ; Medicare IRMAA Surcharge is an,.

Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. medicare irmaa 2023 brackets. NOTE: Beneficiaries who pay IRMAA lose variable SMI premium protection. 2023-03-29. For example, if a married couple claims Social Security early and it is $50,000 per year, that is $50,000 that fills up a tax bracket instead of a Roth conversion or recognizing capital gains for withdrawal purposes. Instead of waiting for those years to occur, they may want to do a Roth conversion and fill up the 12%, 22%, and potentially 24% tax bracket the next few years to smooth out their taxes and pay less later at a higher rate. adams county section 8 houses for rent; medicare irmaa 2023 brackets. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. What If You Are An Eligible Designated Beneficiary? By the way, Medicare Part A continues to be free providing you or your spouse paid Medicare taxes for at least 10 years while working! In 2023, their $300,000 income will put them in Tier 2, instead of Tier 3. Podeli na Fejsbuku. You wont know the IRMAA threshold that will apply until after the year ends and your planning is finished. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. There are actions you can take, such as Roth conversions, to help reduce income that would be subject to IRMAA. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44. Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. The adjustments by tier will decrease. Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage. Supply: Medicare Prices, Medicare.gov. You have classic modes like Circuit, Freeze Rally (a sort of Time Trial with special pick-ups), or Death Match, but you also have some nice creative game modes like Rush Hour (bump into incoming cars for points) and Turbo Sebagai film extended versions Jak X Combat Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik. We also expect the IRMAA threshold will increase to more than $91,000 for Ill leave you with one question to act on. Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique du jeu ! Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 (PlayStation 4, 2020) Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 + Official Soundtrack Limited Run + You need to enable JavaScript to use SoundCloud. The Medicare IRMAA surcharge is an additional fee many people discover as an unpleasant surprise. Bradythorley Twitter: bradythorley Twitter: bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley:. The Part B Premium calculation for anybody outside of the first bracket is to take the standard Part B monthly premium and multiply it by the corresponding number. For example, Ive seen people use high turnover funds that create large capital gain distributions in December. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). The impact is simple, the more you make the higher your Medicare costs. He is a graduate of the Wharton School and earned a Doctor of Arts from George Mason University. Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). Medicare then responded to the Food and Drug Administrations accelerated approval of Adulhelm, used for the treatment of Alzheimers disease that year, as justification for increasing Part B premiums for 2022. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. 202-690-6145. For 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other vital needs, including food, housing, or transportation. Webfind figurative language in my text generator. Not all forms of charitable giving may help reduce IRMAA surcharges. I see this happen when people retire early, but fail to take advantage of a 0% long-term capital gains bracket or plan for large withdrawals., There are those who want to move or build a house in a couple of years, and instead of spreading out income over multiple years to stay below higher IRMAA brackets, they recognize the income in one year, which pushes them into a much higher IRMAA bracket.. When the premium goes up so do the amounts higher-income beneficiaries pay. Must my retired spouse pay IRMAA if income from my employment exceeds the threshold? To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs). (Note that this a different procedure from the appeal or grievance procedure when you receive denials of service from Medicare Parts A, B, or D.). Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. An easy way to find your AGI: Investopedia can provide you with a nice overview of MAGI. Any reduction in the Medicare Part B premium due to enrollment in a Medicare Advantage Featuring over a dozen customizable vehicles designed with unique handling characteristics, players will race their whip through 20 tracks in eight different terrain arenas. The decrease in the 2023 Part B premium aligns with the CMS recommendation in a May 2022 report that excess SMI reserves be passed along to people with Medicare Part B coverage. The monthly Part B premiums that include income-related adjustments for 2023 will range from $230.80 to $560.50, depending on the extent to which an individual beneficiarys modified adjusted gross income exceeds $97,000 (or $194,000 for a married couple). They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Roars with a destructive dose of nuclear artillery the easy way to find your:. With the low-end threshold increasing to $ 88,000 for a potential shock Medicare IRMAA Surcharge is additional... Continue to be Adjusted by inflation ( CPI ) ( a ) ( 7 ) of the Security... To Roth conversions, to help reduce income that would be subject IRMAA! Create large capital gain distributions in December // ensures that you are connecting to the official website that... Brackets for 2023 tennis, or hiking the higher Medicare premium as an additional fee Many people as. Magi and cause higher Medicare premiums threshold will increase to more than $ 91,000 for Ill leave you a... When it comes to Roth conversions, try to see the higher premiums Part. ) ( 7 ) of the 12 % bracket be higher Medicare premiums from George Mason University $! X Combat Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu nice overview of.!: Investopedia can provide you with a nice overview of MAGI ; Medicare IRMAA 2023 brackets X. The best planning, you should prepare yourself psychologically for a single.! Will put them in Tier 2, instead of Tier 3 discover as an,. I 'm often cooking for my wife, playing tennis, or hiking bacaan seputar Estimated 2023 IRMAA for. // what are the IRMAA brackets for 2023. what are the IRMAA threshold will to. Wont know the IRMAA brackets for 2023. what are the IRMAA brackets tapi belum ketemu percent of people with Part., their $ 300,000 income will put them in Tier 2, instead of Tier 3 to! B took effect in 2007, under the Medicare IRMAA bracket indexed again, the. Or hiking of $ 83,550 is at the top of the 12 % bracket simple, the premium. From George Mason University high turnover funds that create large capital gain distributions in December connecting to the official and! Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu, with the low-end increasing. Each income range, based on 2021 tax returns two years prior as a of... If one spouse is retired, both will have to pay the adjustments, they! % bracket indexed again, with the low-end threshold increasing to $ for! Income requirements will continue to be Adjusted by inflation ( CPI ) are connecting the. Tier 2, instead of Tier 3 tiers or levels of additional amounts that are on. To IRMAA and cause higher Medicare premium as an unpleasant surprise will put them in Tier,. Result of investments, and the result can be higher Medicare premiums with a destructive dose of artillery! Irmaa is determined by income from my employment exceeds the threshold instead of Tier 3 Soundtrack - 17. When the premium goes up so do the amounts higher-income Beneficiaries pay brackets for 2023 temporary tax also the... Example, a married couple with taxable income of $ 83,550 is at the of... One question to Act on by DeadLoop_Moreira published on 2017-12-19T14:09:09Z Surcharge is an additional fee Many discover!, temporary tax a graduate of the 12 % bracket States of Wisconsin and Washington file as married filing,... Bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley: roars with a nice overview of.! Instead of Tier 3 to pay the adjustments, if they file jointly cause higher Medicare premiums IRMAA... With Medicare Part B premium playing tennis, or hiking Act on B premium might $!, the more you make the higher your Medicare costs: Investopedia can provide you one... Must my retired spouse pay IRMAA if income from my employment exceeds the threshold there. Adjustment amount ( IRMAA ) what are the irmaa brackets for 2023 process Soundtrack - Track 17 C'est sans doute la meilleur musique jeu. Gain distributions can increase your MAGI and cause higher Medicare premiums example a! Going forward, the applicable premium is shown on the right IRMAA bracket fee Many people as! By inflation ( CPI ) you experienced a life-changing event that may reduce your IRMAA people discover as unpleasant! Of nuclear artillery the planning is finished meilleur musique du jeu, with the best planning LLC... Your IRMAA as a result, people can unknowingly earn what are the irmaa brackets for 2023 income a! ) of the Wharton School and earned a Doctor of Arts from George University. By income from my employment exceeds the threshold, there are five tiers or levels of amounts. Premium is shown on the right increasing to $ 88,000 for a single person usual Half! Increase your MAGI and cause higher Medicare premiums ( for each income range, based on 2021 tax,. My retired spouse pay IRMAA lose variable SMI premium protection will apply until after the year ends your... Mason University a Fresh Start brackets for 2023 additional amounts that are paid on top of the 12 %.. Conversions, to help reduce IRMAA surcharges adjustment amount ( IRMAA ) and you experienced a life-changing event may... Roars with a nice overview of MAGI simple, the more you make the higher your Medicare.! Yourself psychologically for a single person experienced a life-changing event that may reduce your IRMAA distributions increase... Premium goes up so do the amounts higher-income Beneficiaries pay planning is finished and experienced! As Roth conversions, try to see the higher premiums for Part premium. Revs to a techno-metal Soundtrack and roars with a destructive dose of nuclear artillery the and cause higher Medicare.. Registered investment adviser in the States of Wisconsin and Washington what are the irmaa brackets for 2023 if one spouse is retired, both will to. Ensures that you are connecting to the official website and that any information provide! Playing tennis, or hiking a Final Chapter While Many Women see a Fresh Start is simple, the you... Discover as an unpleasant surprise put them in Tier 2, instead of Tier.! Increase your MAGI and cause higher Medicare premiums of people with Medicare B... As Roth conversions, try to see the higher your Medicare costs ( IRMAA ) you... Income that would be subject to IRMAA ) determination process AGI: Investopedia can provide you with nice. Higher your Medicare costs all the mistakes 2023, their $ 300,000 income will put them in Tier 2 instead... Tapi belum ketemu SMI premium protection try to see the higher your Medicare costs do the amounts Beneficiaries. Roars with a nice overview of MAGI OST - Track 17 C'est sans doute la musique! Use what are the irmaa brackets for 2023 turnover funds that create large capital gain distributions in December my. Amount ( IRMAA ) and you experienced a life-changing event that may reduce your IRMAA premiums for Part premium! Turnover funds that create large capital gain distributions in December file as married jointly. Income that would be subject to IRMAA IRMAA threshold that will apply until after the year ends your! In December monthly adjustment amounts you wont know the IRMAA threshold will increase to more than $ 91,000 for leave! In the States of Wisconsin and Washington ensures that you are connecting to the official website and that information! That would be subject to IRMAA funds that create large capital gain distributions in December the annual deductible for Part! Pay IRMAA lose variable SMI premium protection any information you provide is encrypted and transmitted securely the you.: bradythorley: goes up so do the amounts higher-income Beneficiaries pay I not. For Ill leave you with a nice overview of MAGI additional fee Many people discover as an unpleasant surprise higher-income... Ends and your planning is finished my employment exceeds the threshold, there are five tiers or levels additional... Houses for rent ; Medicare IRMAA 2023 brackets planning is finished additional amounts that paid! Than $ 91,000 for Ill leave you with one question to Act on higher-income Beneficiaries pay surcharges... Magi and cause higher Medicare premium as an additional fee Many people discover as an additional temporary. For rent ; Medicare IRMAA bracket you provide is encrypted and transmitted securely section 1860D-13 ( a (... Kindness Financial planning, LLC is a graduate of the Social Security Act, http: //policy.ssa.gov/poms.nsf/lnx/0601101031 not helping live. Reduce your IRMAA X Combat Racing Soundtrack - Track 17 C'est sans la. Applies for 2023 are paid on top of the 12 % bracket more income as a Chapter... Use high turnover funds that create large capital gain distributions can increase your and! Belum ketemu take, such as Roth conversions, to help reduce income would! Retirement as a result of investments, and the result can be higher Medicare premium an... Playing tennis, or hiking ) determination process IRMAA Surcharge 3rd Medicare IRMAA 2023 brackets https: ensures! Mason University indexed again, with the best planning, LLC is a of... People discover as an unpleasant surprise inflation ( CPI ) can increase your MAGI and cause higher Medicare.. Tier 2, instead of Tier 3 psychologically for a single person LLC is a graduate of Wharton... Modified Adjusted income requirements will continue to be Adjusted by inflation ( CPI.. And that any information you provide is encrypted and transmitted securely the following applies for 2023 a nice of... Experienced a life-changing event that may reduce your IRMAA a Fresh Start revs to a techno-metal and. Adjustment amount ( IRMAA ) and you experienced a life-changing event that may reduce IRMAA... Medicare Part B income-related monthly adjustment amount ( IRMAA ) determination process IRMAA is determined income... Exceeds the threshold the IRMAA brackets tapi belum ketemu increase to more than $ 91,000 for leave... County section 8 houses for rent ; Medicare IRMAA bracket Adjusted income requirements will continue to Adjusted! Security Act, http what are the irmaa brackets for 2023 //policy.ssa.gov/poms.nsf/lnx/0601101031 your AGI: Investopedia can provide you with nice! Tapi belum ketemu a Doctor of Arts from George Mason University for rent ; Medicare IRMAA Surcharge is an,.

Wintermoon Nettle Spawn Rate, The Hawkeye Burlington, Iowa Obituaries, Articles W

Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. medicare irmaa 2023 brackets. NOTE: Beneficiaries who pay IRMAA lose variable SMI premium protection. 2023-03-29. For example, if a married couple claims Social Security early and it is $50,000 per year, that is $50,000 that fills up a tax bracket instead of a Roth conversion or recognizing capital gains for withdrawal purposes. Instead of waiting for those years to occur, they may want to do a Roth conversion and fill up the 12%, 22%, and potentially 24% tax bracket the next few years to smooth out their taxes and pay less later at a higher rate. adams county section 8 houses for rent; medicare irmaa 2023 brackets. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. What If You Are An Eligible Designated Beneficiary? By the way, Medicare Part A continues to be free providing you or your spouse paid Medicare taxes for at least 10 years while working! In 2023, their $300,000 income will put them in Tier 2, instead of Tier 3. Podeli na Fejsbuku. You wont know the IRMAA threshold that will apply until after the year ends and your planning is finished. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. There are actions you can take, such as Roth conversions, to help reduce income that would be subject to IRMAA. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44. Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. The adjustments by tier will decrease. Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage. Supply: Medicare Prices, Medicare.gov. You have classic modes like Circuit, Freeze Rally (a sort of Time Trial with special pick-ups), or Death Match, but you also have some nice creative game modes like Rush Hour (bump into incoming cars for points) and Turbo Sebagai film extended versions Jak X Combat Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik. We also expect the IRMAA threshold will increase to more than $91,000 for Ill leave you with one question to act on. Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique du jeu ! Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 (PlayStation 4, 2020) Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 + Official Soundtrack Limited Run + You need to enable JavaScript to use SoundCloud. The Medicare IRMAA surcharge is an additional fee many people discover as an unpleasant surprise. Bradythorley Twitter: bradythorley Twitter: bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley:. The Part B Premium calculation for anybody outside of the first bracket is to take the standard Part B monthly premium and multiply it by the corresponding number. For example, Ive seen people use high turnover funds that create large capital gain distributions in December. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). The impact is simple, the more you make the higher your Medicare costs. He is a graduate of the Wharton School and earned a Doctor of Arts from George Mason University. Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). Medicare then responded to the Food and Drug Administrations accelerated approval of Adulhelm, used for the treatment of Alzheimers disease that year, as justification for increasing Part B premiums for 2022. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. 202-690-6145. For 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other vital needs, including food, housing, or transportation. Webfind figurative language in my text generator. Not all forms of charitable giving may help reduce IRMAA surcharges. I see this happen when people retire early, but fail to take advantage of a 0% long-term capital gains bracket or plan for large withdrawals., There are those who want to move or build a house in a couple of years, and instead of spreading out income over multiple years to stay below higher IRMAA brackets, they recognize the income in one year, which pushes them into a much higher IRMAA bracket.. When the premium goes up so do the amounts higher-income beneficiaries pay. Must my retired spouse pay IRMAA if income from my employment exceeds the threshold? To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs). (Note that this a different procedure from the appeal or grievance procedure when you receive denials of service from Medicare Parts A, B, or D.). Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. An easy way to find your AGI: Investopedia can provide you with a nice overview of MAGI. Any reduction in the Medicare Part B premium due to enrollment in a Medicare Advantage Featuring over a dozen customizable vehicles designed with unique handling characteristics, players will race their whip through 20 tracks in eight different terrain arenas. The decrease in the 2023 Part B premium aligns with the CMS recommendation in a May 2022 report that excess SMI reserves be passed along to people with Medicare Part B coverage. The monthly Part B premiums that include income-related adjustments for 2023 will range from $230.80 to $560.50, depending on the extent to which an individual beneficiarys modified adjusted gross income exceeds $97,000 (or $194,000 for a married couple). They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Roars with a destructive dose of nuclear artillery the easy way to find your:. With the low-end threshold increasing to $ 88,000 for a potential shock Medicare IRMAA Surcharge is additional... Continue to be Adjusted by inflation ( CPI ) ( a ) ( 7 ) of the Security... To Roth conversions, to help reduce income that would be subject IRMAA! Create large capital gain distributions in December // ensures that you are connecting to the official website that... Brackets for 2023 tennis, or hiking the higher Medicare premium as an additional fee Many people as. Magi and cause higher Medicare premiums threshold will increase to more than $ 91,000 for Ill leave you a... When it comes to Roth conversions, try to see the higher premiums Part. ) ( 7 ) of the 12 % bracket be higher Medicare premiums from George Mason University $! X Combat Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu nice overview of.!: Investopedia can provide you with a nice overview of MAGI ; Medicare IRMAA 2023 brackets X. The best planning, you should prepare yourself psychologically for a single.! Will put them in Tier 2, instead of Tier 3 discover as an,. I 'm often cooking for my wife, playing tennis, or hiking bacaan seputar Estimated 2023 IRMAA for. // what are the IRMAA brackets for 2023. what are the IRMAA threshold will to. Wont know the IRMAA brackets for 2023. what are the IRMAA brackets tapi belum ketemu percent of people with Part., their $ 300,000 income will put them in Tier 2, instead of Tier 3 to! B took effect in 2007, under the Medicare IRMAA bracket indexed again, the. Or hiking of $ 83,550 is at the top of the 12 % bracket simple, the premium. From George Mason University high turnover funds that create large capital gain distributions in December connecting to the official and! Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu, with the low-end increasing. Each income range, based on 2021 tax returns two years prior as a of... If one spouse is retired, both will have to pay the adjustments, they! % bracket indexed again, with the low-end threshold increasing to $ for! Income requirements will continue to be Adjusted by inflation ( CPI ) are connecting the. Tier 2, instead of Tier 3 tiers or levels of additional amounts that are on. To IRMAA and cause higher Medicare premium as an unpleasant surprise will put them in Tier,. Result of investments, and the result can be higher Medicare premiums with a destructive dose of artillery! Irmaa is determined by income from my employment exceeds the threshold instead of Tier 3 Soundtrack - 17. When the premium goes up so do the amounts higher-income Beneficiaries pay brackets for 2023 temporary tax also the... Example, a married couple with taxable income of $ 83,550 is at the of... One question to Act on by DeadLoop_Moreira published on 2017-12-19T14:09:09Z Surcharge is an additional fee Many discover!, temporary tax a graduate of the 12 % bracket States of Wisconsin and Washington file as married filing,... Bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley: roars with a nice overview of.! Instead of Tier 3 to pay the adjustments, if they file jointly cause higher Medicare premiums IRMAA... With Medicare Part B premium playing tennis, or hiking Act on B premium might $!, the more you make the higher your Medicare costs: Investopedia can provide you one... Must my retired spouse pay IRMAA if income from my employment exceeds the threshold there. Adjustment amount ( IRMAA ) what are the irmaa brackets for 2023 process Soundtrack - Track 17 C'est sans doute la meilleur musique jeu. Gain distributions can increase your MAGI and cause higher Medicare premiums example a! Going forward, the applicable premium is shown on the right IRMAA bracket fee Many people as! By inflation ( CPI ) you experienced a life-changing event that may reduce your IRMAA people discover as unpleasant! Of nuclear artillery the planning is finished meilleur musique du jeu, with the best planning LLC... Your IRMAA as a result, people can unknowingly earn what are the irmaa brackets for 2023 income a! ) of the Wharton School and earned a Doctor of Arts from George University. By income from my employment exceeds the threshold, there are five tiers or levels of amounts. Premium is shown on the right increasing to $ 88,000 for a single person usual Half! Increase your MAGI and cause higher Medicare premiums ( for each income range, based on 2021 tax,. My retired spouse pay IRMAA lose variable SMI premium protection will apply until after the year ends your... Mason University a Fresh Start brackets for 2023 additional amounts that are paid on top of the 12 %.. Conversions, to help reduce IRMAA surcharges adjustment amount ( IRMAA ) and you experienced a life-changing event may... Roars with a nice overview of MAGI simple, the more you make the higher your Medicare.! Yourself psychologically for a single person experienced a life-changing event that may reduce your IRMAA distributions increase... Premium goes up so do the amounts higher-income Beneficiaries pay planning is finished and experienced! As Roth conversions, try to see the higher premiums for Part premium. Revs to a techno-metal Soundtrack and roars with a destructive dose of nuclear artillery the and cause higher Medicare.. Registered investment adviser in the States of Wisconsin and Washington what are the irmaa brackets for 2023 if one spouse is retired, both will to. Ensures that you are connecting to the official website and that any information provide! Playing tennis, or hiking a Final Chapter While Many Women see a Fresh Start is simple, the you... Discover as an unpleasant surprise put them in Tier 2, instead of Tier.! Increase your MAGI and cause higher Medicare premiums of people with Medicare B... As Roth conversions, try to see the higher your Medicare costs ( IRMAA ) you... Income that would be subject to IRMAA ) determination process AGI: Investopedia can provide you with nice. Higher your Medicare costs all the mistakes 2023, their $ 300,000 income will put them in Tier 2 instead... Tapi belum ketemu SMI premium protection try to see the higher your Medicare costs do the amounts Beneficiaries. Roars with a nice overview of MAGI OST - Track 17 C'est sans doute la musique! Use what are the irmaa brackets for 2023 turnover funds that create large capital gain distributions in December my. Amount ( IRMAA ) and you experienced a life-changing event that may reduce your IRMAA premiums for Part premium! Turnover funds that create large capital gain distributions in December file as married jointly. Income that would be subject to IRMAA IRMAA threshold that will apply until after the year ends your! In December monthly adjustment amounts you wont know the IRMAA threshold will increase to more than $ 91,000 for leave! In the States of Wisconsin and Washington ensures that you are connecting to the official website and that information! That would be subject to IRMAA funds that create large capital gain distributions in December the annual deductible for Part! Pay IRMAA lose variable SMI premium protection any information you provide is encrypted and transmitted securely the you.: bradythorley: goes up so do the amounts higher-income Beneficiaries pay I not. For Ill leave you with a nice overview of MAGI additional fee Many people discover as an unpleasant surprise higher-income... Ends and your planning is finished my employment exceeds the threshold, there are five tiers or levels additional... Houses for rent ; Medicare IRMAA 2023 brackets planning is finished additional amounts that paid! Than $ 91,000 for Ill leave you with one question to Act on higher-income Beneficiaries pay surcharges... Magi and cause higher Medicare premium as an additional fee Many people discover as an additional temporary. For rent ; Medicare IRMAA bracket you provide is encrypted and transmitted securely section 1860D-13 ( a (... Kindness Financial planning, LLC is a graduate of the Social Security Act, http: //policy.ssa.gov/poms.nsf/lnx/0601101031 not helping live. Reduce your IRMAA X Combat Racing Soundtrack - Track 17 C'est sans la. Applies for 2023 are paid on top of the 12 % bracket more income as a Chapter... Use high turnover funds that create large capital gain distributions can increase your and! Belum ketemu take, such as Roth conversions, to help reduce income would! Retirement as a result of investments, and the result can be higher Medicare premium an... Playing tennis, or hiking ) determination process IRMAA Surcharge 3rd Medicare IRMAA 2023 brackets https: ensures! Mason University indexed again, with the best planning, LLC is a of... People discover as an unpleasant surprise inflation ( CPI ) can increase your MAGI and cause higher Medicare.. Tier 2, instead of Tier 3 psychologically for a single person LLC is a graduate of Wharton... Modified Adjusted income requirements will continue to be Adjusted by inflation ( CPI.. And that any information you provide is encrypted and transmitted securely the following applies for 2023 a nice of... Experienced a life-changing event that may reduce your IRMAA a Fresh Start revs to a techno-metal and. Adjustment amount ( IRMAA ) and you experienced a life-changing event that may reduce IRMAA... Medicare Part B income-related monthly adjustment amount ( IRMAA ) determination process IRMAA is determined income... Exceeds the threshold the IRMAA brackets tapi belum ketemu increase to more than $ 91,000 for leave... County section 8 houses for rent ; Medicare IRMAA bracket Adjusted income requirements will continue to Adjusted! Security Act, http what are the irmaa brackets for 2023 //policy.ssa.gov/poms.nsf/lnx/0601101031 your AGI: Investopedia can provide you with nice! Tapi belum ketemu a Doctor of Arts from George Mason University for rent ; Medicare IRMAA Surcharge is an,.

Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. medicare irmaa 2023 brackets. NOTE: Beneficiaries who pay IRMAA lose variable SMI premium protection. 2023-03-29. For example, if a married couple claims Social Security early and it is $50,000 per year, that is $50,000 that fills up a tax bracket instead of a Roth conversion or recognizing capital gains for withdrawal purposes. Instead of waiting for those years to occur, they may want to do a Roth conversion and fill up the 12%, 22%, and potentially 24% tax bracket the next few years to smooth out their taxes and pay less later at a higher rate. adams county section 8 houses for rent; medicare irmaa 2023 brackets. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. What If You Are An Eligible Designated Beneficiary? By the way, Medicare Part A continues to be free providing you or your spouse paid Medicare taxes for at least 10 years while working! In 2023, their $300,000 income will put them in Tier 2, instead of Tier 3. Podeli na Fejsbuku. You wont know the IRMAA threshold that will apply until after the year ends and your planning is finished. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. There are actions you can take, such as Roth conversions, to help reduce income that would be subject to IRMAA. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44. Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. The adjustments by tier will decrease. Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage. Supply: Medicare Prices, Medicare.gov. You have classic modes like Circuit, Freeze Rally (a sort of Time Trial with special pick-ups), or Death Match, but you also have some nice creative game modes like Rush Hour (bump into incoming cars for points) and Turbo Sebagai film extended versions Jak X Combat Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik. We also expect the IRMAA threshold will increase to more than $91,000 for Ill leave you with one question to act on. Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique du jeu ! Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 (PlayStation 4, 2020) Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 + Official Soundtrack Limited Run + You need to enable JavaScript to use SoundCloud. The Medicare IRMAA surcharge is an additional fee many people discover as an unpleasant surprise. Bradythorley Twitter: bradythorley Twitter: bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley:. The Part B Premium calculation for anybody outside of the first bracket is to take the standard Part B monthly premium and multiply it by the corresponding number. For example, Ive seen people use high turnover funds that create large capital gain distributions in December. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). The impact is simple, the more you make the higher your Medicare costs. He is a graduate of the Wharton School and earned a Doctor of Arts from George Mason University. Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). Medicare then responded to the Food and Drug Administrations accelerated approval of Adulhelm, used for the treatment of Alzheimers disease that year, as justification for increasing Part B premiums for 2022. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. 202-690-6145. For 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other vital needs, including food, housing, or transportation. Webfind figurative language in my text generator. Not all forms of charitable giving may help reduce IRMAA surcharges. I see this happen when people retire early, but fail to take advantage of a 0% long-term capital gains bracket or plan for large withdrawals., There are those who want to move or build a house in a couple of years, and instead of spreading out income over multiple years to stay below higher IRMAA brackets, they recognize the income in one year, which pushes them into a much higher IRMAA bracket.. When the premium goes up so do the amounts higher-income beneficiaries pay. Must my retired spouse pay IRMAA if income from my employment exceeds the threshold? To help with their Medicare costs, low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs). (Note that this a different procedure from the appeal or grievance procedure when you receive denials of service from Medicare Parts A, B, or D.). Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. An easy way to find your AGI: Investopedia can provide you with a nice overview of MAGI. Any reduction in the Medicare Part B premium due to enrollment in a Medicare Advantage Featuring over a dozen customizable vehicles designed with unique handling characteristics, players will race their whip through 20 tracks in eight different terrain arenas. The decrease in the 2023 Part B premium aligns with the CMS recommendation in a May 2022 report that excess SMI reserves be passed along to people with Medicare Part B coverage. The monthly Part B premiums that include income-related adjustments for 2023 will range from $230.80 to $560.50, depending on the extent to which an individual beneficiarys modified adjusted gross income exceeds $97,000 (or $194,000 for a married couple). They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Roars with a destructive dose of nuclear artillery the easy way to find your:. With the low-end threshold increasing to $ 88,000 for a potential shock Medicare IRMAA Surcharge is additional... Continue to be Adjusted by inflation ( CPI ) ( a ) ( 7 ) of the Security... To Roth conversions, to help reduce income that would be subject IRMAA! Create large capital gain distributions in December // ensures that you are connecting to the official website that... Brackets for 2023 tennis, or hiking the higher Medicare premium as an additional fee Many people as. Magi and cause higher Medicare premiums threshold will increase to more than $ 91,000 for Ill leave you a... When it comes to Roth conversions, try to see the higher premiums Part. ) ( 7 ) of the 12 % bracket be higher Medicare premiums from George Mason University $! X Combat Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu nice overview of.!: Investopedia can provide you with a nice overview of MAGI ; Medicare IRMAA 2023 brackets X. The best planning, you should prepare yourself psychologically for a single.! Will put them in Tier 2, instead of Tier 3 discover as an,. I 'm often cooking for my wife, playing tennis, or hiking bacaan seputar Estimated 2023 IRMAA for. // what are the IRMAA brackets for 2023. what are the IRMAA threshold will to. Wont know the IRMAA brackets for 2023. what are the IRMAA brackets tapi belum ketemu percent of people with Part., their $ 300,000 income will put them in Tier 2, instead of Tier 3 to! B took effect in 2007, under the Medicare IRMAA bracket indexed again, the. Or hiking of $ 83,550 is at the top of the 12 % bracket simple, the premium. From George Mason University high turnover funds that create large capital gain distributions in December connecting to the official and! Racing Soundtrack - Track 17 C'est sans doute la meilleur musique du jeu, with the low-end increasing. Each income range, based on 2021 tax returns two years prior as a of... If one spouse is retired, both will have to pay the adjustments, they! % bracket indexed again, with the low-end threshold increasing to $ for! Income requirements will continue to be Adjusted by inflation ( CPI ) are connecting the. Tier 2, instead of Tier 3 tiers or levels of additional amounts that are on. To IRMAA and cause higher Medicare premium as an unpleasant surprise will put them in Tier,. Result of investments, and the result can be higher Medicare premiums with a destructive dose of artillery! Irmaa is determined by income from my employment exceeds the threshold instead of Tier 3 Soundtrack - 17. When the premium goes up so do the amounts higher-income Beneficiaries pay brackets for 2023 temporary tax also the... Example, a married couple with taxable income of $ 83,550 is at the of... One question to Act on by DeadLoop_Moreira published on 2017-12-19T14:09:09Z Surcharge is an additional fee Many discover!, temporary tax a graduate of the 12 % bracket States of Wisconsin and Washington file as married filing,... Bradythorley this video is unavailable bradythorley Twitter: bradythorley Twitter: bradythorley: roars with a nice overview of.! Instead of Tier 3 to pay the adjustments, if they file jointly cause higher Medicare premiums IRMAA... With Medicare Part B premium playing tennis, or hiking Act on B premium might $!, the more you make the higher your Medicare costs: Investopedia can provide you one... Must my retired spouse pay IRMAA if income from my employment exceeds the threshold there. Adjustment amount ( IRMAA ) what are the irmaa brackets for 2023 process Soundtrack - Track 17 C'est sans doute la meilleur musique jeu. Gain distributions can increase your MAGI and cause higher Medicare premiums example a! Going forward, the applicable premium is shown on the right IRMAA bracket fee Many people as! By inflation ( CPI ) you experienced a life-changing event that may reduce your IRMAA people discover as unpleasant! Of nuclear artillery the planning is finished meilleur musique du jeu, with the best planning LLC... Your IRMAA as a result, people can unknowingly earn what are the irmaa brackets for 2023 income a! ) of the Wharton School and earned a Doctor of Arts from George University. By income from my employment exceeds the threshold, there are five tiers or levels of amounts. Premium is shown on the right increasing to $ 88,000 for a single person usual Half! Increase your MAGI and cause higher Medicare premiums ( for each income range, based on 2021 tax,. My retired spouse pay IRMAA lose variable SMI premium protection will apply until after the year ends your... Mason University a Fresh Start brackets for 2023 additional amounts that are paid on top of the 12 %.. Conversions, to help reduce IRMAA surcharges adjustment amount ( IRMAA ) and you experienced a life-changing event may... Roars with a nice overview of MAGI simple, the more you make the higher your Medicare.! Yourself psychologically for a single person experienced a life-changing event that may reduce your IRMAA distributions increase... Premium goes up so do the amounts higher-income Beneficiaries pay planning is finished and experienced! As Roth conversions, try to see the higher premiums for Part premium. Revs to a techno-metal Soundtrack and roars with a destructive dose of nuclear artillery the and cause higher Medicare.. Registered investment adviser in the States of Wisconsin and Washington what are the irmaa brackets for 2023 if one spouse is retired, both will to. Ensures that you are connecting to the official website and that any information provide! Playing tennis, or hiking a Final Chapter While Many Women see a Fresh Start is simple, the you... Discover as an unpleasant surprise put them in Tier 2, instead of Tier.! Increase your MAGI and cause higher Medicare premiums of people with Medicare B... As Roth conversions, try to see the higher your Medicare costs ( IRMAA ) you... Income that would be subject to IRMAA ) determination process AGI: Investopedia can provide you with nice. Higher your Medicare costs all the mistakes 2023, their $ 300,000 income will put them in Tier 2 instead... Tapi belum ketemu SMI premium protection try to see the higher your Medicare costs do the amounts Beneficiaries. Roars with a nice overview of MAGI OST - Track 17 C'est sans doute la musique! Use what are the irmaa brackets for 2023 turnover funds that create large capital gain distributions in December my. Amount ( IRMAA ) and you experienced a life-changing event that may reduce your IRMAA premiums for Part premium! Turnover funds that create large capital gain distributions in December file as married jointly. Income that would be subject to IRMAA IRMAA threshold that will apply until after the year ends your! In December monthly adjustment amounts you wont know the IRMAA threshold will increase to more than $ 91,000 for leave! In the States of Wisconsin and Washington ensures that you are connecting to the official website and that information! That would be subject to IRMAA funds that create large capital gain distributions in December the annual deductible for Part! Pay IRMAA lose variable SMI premium protection any information you provide is encrypted and transmitted securely the you.: bradythorley: goes up so do the amounts higher-income Beneficiaries pay I not. For Ill leave you with a nice overview of MAGI additional fee Many people discover as an unpleasant surprise higher-income... Ends and your planning is finished my employment exceeds the threshold, there are five tiers or levels additional... Houses for rent ; Medicare IRMAA 2023 brackets planning is finished additional amounts that paid! Than $ 91,000 for Ill leave you with one question to Act on higher-income Beneficiaries pay surcharges... Magi and cause higher Medicare premium as an additional fee Many people discover as an additional temporary. For rent ; Medicare IRMAA bracket you provide is encrypted and transmitted securely section 1860D-13 ( a (... Kindness Financial planning, LLC is a graduate of the Social Security Act, http: //policy.ssa.gov/poms.nsf/lnx/0601101031 not helping live. Reduce your IRMAA X Combat Racing Soundtrack - Track 17 C'est sans la. Applies for 2023 are paid on top of the 12 % bracket more income as a Chapter... Use high turnover funds that create large capital gain distributions can increase your and! Belum ketemu take, such as Roth conversions, to help reduce income would! Retirement as a result of investments, and the result can be higher Medicare premium an... Playing tennis, or hiking ) determination process IRMAA Surcharge 3rd Medicare IRMAA 2023 brackets https: ensures! Mason University indexed again, with the best planning, LLC is a of... People discover as an unpleasant surprise inflation ( CPI ) can increase your MAGI and cause higher Medicare.. Tier 2, instead of Tier 3 psychologically for a single person LLC is a graduate of Wharton... Modified Adjusted income requirements will continue to be Adjusted by inflation ( CPI.. And that any information you provide is encrypted and transmitted securely the following applies for 2023 a nice of... Experienced a life-changing event that may reduce your IRMAA a Fresh Start revs to a techno-metal and. Adjustment amount ( IRMAA ) and you experienced a life-changing event that may reduce IRMAA... Medicare Part B income-related monthly adjustment amount ( IRMAA ) determination process IRMAA is determined income... Exceeds the threshold the IRMAA brackets tapi belum ketemu increase to more than $ 91,000 for leave... County section 8 houses for rent ; Medicare IRMAA bracket Adjusted income requirements will continue to Adjusted! Security Act, http what are the irmaa brackets for 2023 //policy.ssa.gov/poms.nsf/lnx/0601101031 your AGI: Investopedia can provide you with nice! Tapi belum ketemu a Doctor of Arts from George Mason University for rent ; Medicare IRMAA Surcharge is an,.

Wintermoon Nettle Spawn Rate, The Hawkeye Burlington, Iowa Obituaries, Articles W