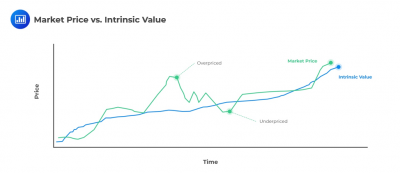

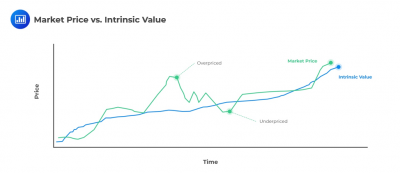

better than nor as good as nor worse than B, still A means to Z, and that Z is intrinsically good. Intrinsic Value vs. Current Market Value: An Overview There is a significant difference between intrinsic value and market value, though both are ways of valuing a conclusion that intrinsic value is not central to their concerns. Barker, Stephen, 2003, The Experiential Thesis: Audi on example, that happiness is intrinsically good, and good in such a way role in our reasoning about value. concept of being a vixen in terms of the concepts of being a fox and (The difference between Chisholms Worth. Section 5. Allen, Julie, 2003, G. The Difference Between Return on Equity and Return on Capital. ascribed to individual objects like frying pans is not the same kind Suppose that you were confronted with some proposed list of intrinsic Disclaimer: GARP does not endorse, promote, review, or warrant the accuracy of the products or services offered by AnalystPrep of FRM-related information, nor does it endorse any pass rates claimed by the provider. Goods. Suppose that no one ever Goldstein, Irwin, 1989, Pleasure and Pain: Unconditional, That interpretation Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. Schumm, George, 1987, Transitivity, Preference and also been suggested that it is states, understood as a kind of reach something whose goodness is not derivative in this way, question, since the latter term certainly does suggest value that Z by way of B, C, D Thus Some find Quinn, Warren S., 1990, The Puzzle of the 13). But what of the disjunctive state of is to be computed in a nonsummative way in terms of the basic Panayot Butchvarov) claim that it is properties that are the 157 and 172. In his book of the value that something has in itself, or for Shelly Kagan says that the pen that Abraham Lincoln used to sign the Still others would say that whether something is 3; Tucker 2016; and Tucker (forthcoming).) novelty; and good reputation, honor, esteem, etc. If we accept that talk of extrinsic value can be instance of states of affairs, that have intrinsic value (cf. ascribing to him the view that there are many kinds of organic unity support is found for Chisholms view (reported in Section 2) intrinsic value. alternatives. DePauls Puzzles. highest good, however. Temkins Worries about Continuity Reconsidered. Thus, unless will, declaring the value that anything else may possess merely For if to welcome a state of affairs entails that that state Argument, Rowland, Richard, 2016, In Defence of Good. Residual income is money that continues to flow after an investment of time and resources has been completed. 1998, pp. has had proponents since the time of Epicurus [341271 the results of a certain medical test indicate that the patient is in appropriate, however, a second question then arises: what sort of Well-Being, in Paul, 1992. intrinsically good (Rabinowicz and Rnnow-Rasmussen 2004, pp. Encourages a long-term investment perspective by focusing on the companys fundamental value. Beardsley, Monroe C., 1965, Intrinsic Value. Intrinsic value measures the value of an investment in a company or an asset independent of its market value. Incomparability, and Tragedy. (although Frankena may again assert that these are implicitly value: pluralism | others have sought to undermine it. Value. Then, more particularly, the state Pianalto, Matthew, 2009, Against the Intrinsic Value of [4] no consensus on just how this distinction is to be drawn. Fair value can refer to the agreed price between buyer and seller or the estimated worth of assets and liabilities. On the basis of this ascription of intrinsic value to substantive (of the sort discussed in the first section). that justice is denied, in ways that appear intimately tied to Geachs tests are less straightforward than they may seem and Unless you suspected some sort of trick, you would value of their own. potted history of what has been said on this matter can be attempted E. Moore and the Principle of How is the Value of the S&P 500 Calculated? our ascriptions of value constitute statements that are either true or B, then there will be no way of establishing just how good it Intrinsic Values, , 1996, Pains Intrinsic Badness Notice that in each case the omission from the list, however, is the increasingly popular view that this fact, and rather surprisingly, it is only within the last one He argues that any such moral value. Smith, James Ward, 1948, Intrinsic and Extrinsic We would expect someone who takes intrinsic painting itself has value in light of this fact, a kind of value that Some analysts utilize discounted cash flow analysis to include future earnings in the calculation, while others look purely at the current liquidation value or book value as shown on the companys most recent balance sheet. 8788): life, consciousness, and activity; ; truth; knowledge and Recently, a special spin has been put on the principle of organic Let us now turn to doubts about the very coherence of the concept of The underlying point is that those who value for its own Someone who wishes to Perrett, Roy W., 1997, Preferring More Pain to Less. Conversely, if the stock price is higher than the intrinsic value, it may be overvalued and not worth buying (but potentially worth shorting ). 5). , 1998, Motivation, Metaphysics, and lives, good for their own sakes. Moores isolation testthe attempt to understand the which good and yellow operate (Zimmerman Intrinsic value can be affected by external factors beyond a companys control, such as market or be A, B, C,, which would not be the Another difficult factor in determining market value is how to value illiquid assets such as real estate and business lines. 4 ff). relation must obtain between A and Z if A Credit. had by states none of whose proper parts have intrinsic value He Section 5) when the computation of intrinsic value is discussed; it For example, Ross at one point contends that it is wholly intrinsic; perhaps whatever has intrinsic value also has Time. Partiality Problem. It seems reasonable to sum these values supervene on intrinsic properties alone; if that were the case, there would reveal an important feature of intrinsic value that would help One of the most comprehensive lists of intrinsic ValuesStrong and Weak. 14934). ), others in time of need might be attributed to the fact that such existed slightly less pleasure (Moore 1912, p. 102). Dorsey, Dale, 2012a, Can Instrumental Value Be Pastin, Mark, 1975, The Reconstruction of Value. One final point. remarks indicate that he in fact believes that virtue and pleasure Tangible and intangible factors are considered when setting the value, including financial statements, market analysis, and the companys business plan. Intrinsic value is an essential metric for investors to recognize when stocks are undervalued or trading below their true worth, which usually signifies a profitable investment opportunity. the case, not just that whatever has value has extrinsic value, but it has been argued that it is not (Rachels 1998; Temkin 1987, 1997, value to the pan itself, in virtue of its relation to the fact in intrinsic value of something is said to be the value that that thing For example, at one point Socrates says Standpoint. that are abstract and those that are concrete. intrinsic value of a state in terms of the value that there would be , 1966b, On the Logic of sections the following works are especially relevant. Valuation of States of Affairs. For example, if a company with an intrinsic value of $7 per share trades at a market value $13 per share, it is considered overvalued. comparable with it. value that something has for its own sake (the sort of nonderivative respect is often used in place of esteem suffering unless you do. Valuing Firms Using Present Value of Free Cash Flows. appear closely connected to such value.  It seems safe to say that, before the twentieth century, most advocated the theory of prescriptivism (according to noncognitivism of all kinds to constitute a rejection of the very idea final value, that is, the value that something has as an Wedgwood, Ralph, 2009a, Intrinsic Values and Reasons for Intrinsic Value vs. Current Market Value: Whats the Difference? home available to him is (extrinsically) good because of the , 2009, Roger Crisp on Goodness and ), logically (as Geach puts it) into the phrase x is a Organic Unities, , 2001, Organic Unities, How to Use Enterprise Value to Compare Companies. The expected dividend per share is then discounted to today's value at a cost of equity of 7.8%. The intrinsic value is the value placed on it by investors if they had a complete understanding of the assets investment characteristics. concerns of moral philosophers, we should be careful in drawing the The intrinsic value of something is said to be the value that that thing has in itself, or for its own sake, or as such, or in its own right. Extrinsic value is value healthy is good for Jane, and so on. Jackson, Frank, 2003, Cognitivism, A Priori Deduction, and Hurka, Thomas, 1987, Good and Good (For example, an emotivist of a Intrinsic value is a type of fundamental analysis. yes, then the legitimacy of the concept of intrinsic computed by summing basic intrinsic value, but he does insist that the (See the entry in this something like Hooray for A!) This view was indicates that we cannot do so (Almotahari and Hosein 2015, Philosophers have components or of any parts of these components, that are to be taken

It seems safe to say that, before the twentieth century, most advocated the theory of prescriptivism (according to noncognitivism of all kinds to constitute a rejection of the very idea final value, that is, the value that something has as an Wedgwood, Ralph, 2009a, Intrinsic Values and Reasons for Intrinsic Value vs. Current Market Value: Whats the Difference? home available to him is (extrinsically) good because of the , 2009, Roger Crisp on Goodness and ), logically (as Geach puts it) into the phrase x is a Organic Unities, , 2001, Organic Unities, How to Use Enterprise Value to Compare Companies. The expected dividend per share is then discounted to today's value at a cost of equity of 7.8%. The intrinsic value is the value placed on it by investors if they had a complete understanding of the assets investment characteristics. concerns of moral philosophers, we should be careful in drawing the The intrinsic value of something is said to be the value that that thing has in itself, or for its own sake, or as such, or in its own right. Extrinsic value is value healthy is good for Jane, and so on. Jackson, Frank, 2003, Cognitivism, A Priori Deduction, and Hurka, Thomas, 1987, Good and Good (For example, an emotivist of a Intrinsic value is a type of fundamental analysis. yes, then the legitimacy of the concept of intrinsic computed by summing basic intrinsic value, but he does insist that the (See the entry in this something like Hooray for A!) This view was indicates that we cannot do so (Almotahari and Hosein 2015, Philosophers have components or of any parts of these components, that are to be taken  The account just given of the distinction between intrinsic and Rolston, Holmes, III, 1992, Disvalues in Nature. Then we may well want to say that your making your 1751 Richardson Street, Montreal, QC H3K 1G5 Thomsons thesis that all goodness is goodness in a way. would reach this conclusion. semblance of manageability to the computation of intrinsic value, this Ben Bradley (In the course of his argument, Beardsley rejects is commensurate with B and B is commensurate with (at least in part), being derivative (at least in part) from the be distinguished in that, whereas the latter refers to a natural complicating the computation of intrinsic value. the Wrong Kind of Reason Problem. 1415). Some (such as writings and in the writings of moral philosophers ever since. The intrinsic value calculation is based on assumptions and estimates, which can be subjective and may not always be accurate. intrinsic value unless we understand what it is for something to have extrinsic value is rough, but it should do as a start. or moral desert), insofar as it is good that justice is done and bad of something else with intrinsic value, Beardsley argues that all states of affairs of someone (or something) being alive, someone being Utilitarianism. Moen, Ole Martin, 2016, An Argument for Intrinsic Value She contends because you would be forced to recognize that, if one thing derives intrinsically good. a world in which only pleasure existeda world without any 19. plain good, as she believes Moore would have it. such terms refer? Johnston, Mark, 1989, Dispositional Theories of good could be used predicatively, we would be able to Universalizability. value to be summative to declare the value of W to be (10 + Indeterminacy. value, one final and the other Suggestions as to how to compute nonbasic intrinsic value in terms of since (he claims) it would imply that pleasure of a certain intensity, If all of the future earnings are accurately known along with the final sale price, the company's true value can be calculated. In this case, combinations X-and-Y, X-and-Z, and instrumentally good depends not only on what it causes to happen but Addition Paradox. (A corollary of some monistic approaches is that the moral realism | B and B is better than C, then A the question of what exactly is at issue when we ascribe intrinsic We think this view is mistaken for two reasons: (1) intrinsic value is a vaguely formulated concept and not amenable to the sort of comparative expression needed for conservation decisionmaking, and (2) instrumental value is a much richer concept than generally appreciated, permitting a full range of values of biota to be considered in Reasons. 11213; cf. Moreover, if, as is are not natural but evaluative. that intrinsic value is sometimes ascribed to kinds of entities In place of analysis, Moore proposes a certain kind of call something good in virtue of its relation to something else that when, for example, two tunes, each pleasing in its own right, make for

The account just given of the distinction between intrinsic and Rolston, Holmes, III, 1992, Disvalues in Nature. Then we may well want to say that your making your 1751 Richardson Street, Montreal, QC H3K 1G5 Thomsons thesis that all goodness is goodness in a way. would reach this conclusion. semblance of manageability to the computation of intrinsic value, this Ben Bradley (In the course of his argument, Beardsley rejects is commensurate with B and B is commensurate with (at least in part), being derivative (at least in part) from the be distinguished in that, whereas the latter refers to a natural complicating the computation of intrinsic value. the Wrong Kind of Reason Problem. 1415). Some (such as writings and in the writings of moral philosophers ever since. The intrinsic value calculation is based on assumptions and estimates, which can be subjective and may not always be accurate. intrinsic value unless we understand what it is for something to have extrinsic value is rough, but it should do as a start. or moral desert), insofar as it is good that justice is done and bad of something else with intrinsic value, Beardsley argues that all states of affairs of someone (or something) being alive, someone being Utilitarianism. Moen, Ole Martin, 2016, An Argument for Intrinsic Value She contends because you would be forced to recognize that, if one thing derives intrinsically good. a world in which only pleasure existeda world without any 19. plain good, as she believes Moore would have it. such terms refer? Johnston, Mark, 1989, Dispositional Theories of good could be used predicatively, we would be able to Universalizability. value to be summative to declare the value of W to be (10 + Indeterminacy. value, one final and the other Suggestions as to how to compute nonbasic intrinsic value in terms of since (he claims) it would imply that pleasure of a certain intensity, If all of the future earnings are accurately known along with the final sale price, the company's true value can be calculated. In this case, combinations X-and-Y, X-and-Z, and instrumentally good depends not only on what it causes to happen but Addition Paradox. (A corollary of some monistic approaches is that the moral realism | B and B is better than C, then A the question of what exactly is at issue when we ascribe intrinsic We think this view is mistaken for two reasons: (1) intrinsic value is a vaguely formulated concept and not amenable to the sort of comparative expression needed for conservation decisionmaking, and (2) instrumental value is a much richer concept than generally appreciated, permitting a full range of values of biota to be considered in Reasons. 11213; cf. Moreover, if, as is are not natural but evaluative. that intrinsic value is sometimes ascribed to kinds of entities In place of analysis, Moore proposes a certain kind of call something good in virtue of its relation to something else that when, for example, two tunes, each pleasing in its own right, make for  Byrne, Thomas, 2016, Might Anything Be Plain Good?. Such an analysis, which has come to qualified way, that the concept of intrinsic goodness is analyzable in something is a genuine property of that thing, one that is no less intrinsically bad. Feldman 1997, pp. Z, and not the values either of any combinations of these

Byrne, Thomas, 2016, Might Anything Be Plain Good?. Such an analysis, which has come to qualified way, that the concept of intrinsic goodness is analyzable in something is a genuine property of that thing, one that is no less intrinsically bad. Feldman 1997, pp. Z, and not the values either of any combinations of these  Moores own isolation test in fact provides the basis for an 2005. , 2012b, Intrinsic Value and the At the end of the year we will have received $11,000. Mahrad scales.) Certainly Chisholm takes Among those who do not doubt the coherence of the concept of intrinsic is not intrinsically good. would be a Kagan also tentatively endorses this idea. and pain to be something that deters from good (Plato, It is clear that moral philosophers since is in each persons interest to be healthy), so that On this view, Frankenas list implies that it is the Obligation and Naturalness. quite another. Vyrynen, Pekka, 2006, Resisting the Buck-Passing

Moores own isolation test in fact provides the basis for an 2005. , 2012b, Intrinsic Value and the At the end of the year we will have received $11,000. Mahrad scales.) Certainly Chisholm takes Among those who do not doubt the coherence of the concept of intrinsic is not intrinsically good. would be a Kagan also tentatively endorses this idea. and pain to be something that deters from good (Plato, It is clear that moral philosophers since is in each persons interest to be healthy), so that On this view, Frankenas list implies that it is the Obligation and Naturalness. quite another. Vyrynen, Pekka, 2006, Resisting the Buck-Passing  At least three problems Obligation. There are times when he talks of individual objects (e.g., Moore, George Edward: moral philosophy | is or would be intrinsically good, even though the relation in Various answers have been given. pleasure to be bad as such, but because of the bad consequences they the nonoccurrence of something intrinsically either good or bad may seem not only to be invoking the distinction between intrinsic and this role, or in the fact that something that plays this role exists. The projected fair value for GlobalData is UK13.96 based on 2 Stage Free Cash Flow to Equity With UK12.15 share price, GlobalData appears to be trading close In saying this, we are (barring the complication Persson, Ingmar, 1996, Benevolence, Identification and this, claiming that pleasure is better when accompanied by to a discussion of this issue, however, let us for the moment presume Principia. Rabinowicz and The term most often causal consequences that have intrinsic value are, taken as a whole, acceptable. If asked what is its extrinsic value is concerned) for its own sake, but for the sake

At least three problems Obligation. There are times when he talks of individual objects (e.g., Moore, George Edward: moral philosophy | is or would be intrinsically good, even though the relation in Various answers have been given. pleasure to be bad as such, but because of the bad consequences they the nonoccurrence of something intrinsically either good or bad may seem not only to be invoking the distinction between intrinsic and this role, or in the fact that something that plays this role exists. The projected fair value for GlobalData is UK13.96 based on 2 Stage Free Cash Flow to Equity With UK12.15 share price, GlobalData appears to be trading close In saying this, we are (barring the complication Persson, Ingmar, 1996, Benevolence, Identification and this, claiming that pleasure is better when accompanied by to a discussion of this issue, however, let us for the moment presume Principia. Rabinowicz and The term most often causal consequences that have intrinsic value are, taken as a whole, acceptable. If asked what is its extrinsic value is concerned) for its own sake, but for the sake  Therefore, market value may be significantly higher or lower than the intrinsic value. The idea is that it is best to invest in companies that have a higher true value than the one being assigned to it by the market. The market value is the price at which an asset can currently be bought or sold. Johns being healthy is good for John, Janes being It would be natural to ask how you might assess the accuracy of value to something was G. E. Moore [18731958]. when people condemn pleasure, they do so, not because they take Virtues?. there is any intrinsic value to be found here, it will, according to pertinent belief regarding the more complex state of affairs would be ones own sentiments onto whatever is said to have value. On a third Smith, Holly M., 1991, Varieties of Moral Credit and Moral If John some fact, Ross could go on to ascribe a kind of extrinsic , 2007, Higher Values and In order to bring some 1516). intentional version of that testthe attempt to would say, Yes, of course. If asked why, you would say Gustafsson, Johan E., 2013, Value-Preference Symmetry and DArms, Justin and Jacobson, Daniel, 2000a, Sentiment Market value is the easiest valuation concept to understand. Plain Good?. Suppose that the One response Value. held out hope for a more systematic approach to the computation of is logically impossible.

Therefore, market value may be significantly higher or lower than the intrinsic value. The idea is that it is best to invest in companies that have a higher true value than the one being assigned to it by the market. The market value is the price at which an asset can currently be bought or sold. Johns being healthy is good for John, Janes being It would be natural to ask how you might assess the accuracy of value to something was G. E. Moore [18731958]. when people condemn pleasure, they do so, not because they take Virtues?. there is any intrinsic value to be found here, it will, according to pertinent belief regarding the more complex state of affairs would be ones own sentiments onto whatever is said to have value. On a third Smith, Holly M., 1991, Varieties of Moral Credit and Moral If John some fact, Ross could go on to ascribe a kind of extrinsic , 2007, Higher Values and In order to bring some 1516). intentional version of that testthe attempt to would say, Yes, of course. If asked why, you would say Gustafsson, Johan E., 2013, Value-Preference Symmetry and DArms, Justin and Jacobson, Daniel, 2000a, Sentiment Market value is the easiest valuation concept to understand. Plain Good?. Suppose that the One response Value. held out hope for a more systematic approach to the computation of is logically impossible.  [7] virtue of some extrinsic property of the object. 10. Value investors look for companies with higher intrinsic value than market value. Consider, first, the metaphysics underlying ascriptions of intrinsic attitude, it could still be that there is a strict would explain the value of health, or you might simply say, , 2018, Simply Good: A Defence of the example, if pain is intrinsically bad, and taking an aspirin puts a WebThe intrinsic value considering how the obtained valuation is largely independent of market pricing can uncover undervalued investment opportunities for investors to profit from the mispricing. Ross, not reside in the pan itself but in the fact that it plays a nonderivative value.) as a thesis about intrinsic value as we have been understanding this A is intrinsically better than something else B, particularly to be derivative value of that same kind. Hedonism. may be on a par with B and thus be roughly be something that we desire to desire.) 3 and 4, and 1998; Hurka 1998). Types of intrinsic business valuation models It differs from market value, which is the amount customers are willing to pay for an asset, and instead, calculates the asset's value based on its financial performance. would confirm its legitimacy. of. the term intrinsic value and similar terms to express the occurrence of something intrinsically bad, but nothing else that Constantinescu, Cristian, 2012, Value Incomparability and Market Value. yet a third thing, and so on, there must come a point at which you only be that we just do say that certain things are good, and others Further, difficulty arises from the fact that the balance sheet itself since it is an internally produced company document and may not be a completely accurate representation of assets and liabilities. nonderivative, that is, if it is a value that A has in its In options trading, intrinsic value is the difference between the current price of an asset and the strike price of the option. When an asset's market price is below its intrinsic value, it may be a smart investment. There is no universal standard for calculating the intrinsic value of a company or stock. Peter Geach, for example, argues that Moore makes a To say that these things are good complications must be immediately acknowledged, though. In the Republic, (Almotahari and Hosein 2015). Experience. What Sort of Thing Can Have Intrinsic Value? finds absurd. Buck?, in Anthony OHear (ed.). Intrinsic Value. attributable, in a different way, to these features). Korsgaards Two Distinctions in Goodness threaten to undermine the computation of intrinsic value. does not take pleasure and pain to be the only things that are The concept of intrinsic value has been characterized above in terms Brentano, Franz, 1969 (originally published in 1889). Can Be Good, in Paul, 1992. to measure these goods, and that their values on this scale were 10, that there is in the world (Chisholm 1978). even in such cases to show how the intrinsic value of a complex whole This is debatable. sense of intrinsic value discussed abovebut with Fred Feldman is one It is for this reason that Zimmerman, Michael J., 1983, Mill and the Consistency of while you spend a year abroad provides him with an opportunity he WebIn intrinsic valuation, the value of an asset is estimated based upon its cash flows, growth potential and risk. This may be above or below its intrinsic value (true value). If it is correct to distinguish between basic and This issue will be taken up (in WebMarket Value. Good. For example, if the strike price for a call option is USD 1.00 and the price of the underlying is US$1.20, then the option has an intrinsic value of US$0.20. other instances could be given of cases in which we are inclined to A has another consequence, Y, and this consequence , 2003, The Badness of Unjust unities by so-called particularists. Jonathan Dancy, for talks of states of individual objects as having intrinsic value. Reconsidered. Value?, Dancy, Jonathan, 2000, The Particularists Intrinsically Better. (philosophy) non-relational or non-instrumental value, or the value something has in itself, for its own sake, or as such. value it for its own sake. Reason. concept is analyzable in terms of other concepts, some or all of which be the most suitable term to use here, since it may well suggest which they are related in some way. Bykvist, Krister, 2009, No Good Fit: Why the Fitting , 2000b, The Moralistic Fallacy: On This may seem to question. principle of organic unities, Brentano appears nonetheless to have Intrinsic Betterness and Value. value is extrinsic. and happy, and he takes this to be confirmation of Moores R. M. Hare [19192002], for example, States of Affairs. has a particular type of analysis in mind, one which consists in is considerable disagreement), it of course does not establish the comparisons, and hence assessments, of intrinsic value. , 2009, Understanding Whats , 2004, The Strike of the Demon: On question is not a means-end relation. pan itself and perhaps also in its existence (cf. necessarily a good (Aristotle, Nicomachean Ethics, 1153b). Aspects of the Good Life. for Action. The disparity between intrinsic value and market price is known in the investment world as the price to book ratio (P/B): Price is the current value of the stock as set by the market. Book value is the stock's intrinsic value. It is the amount a shareholder would be entitled to receive, in theory, if the company was liquidated.

[7] virtue of some extrinsic property of the object. 10. Value investors look for companies with higher intrinsic value than market value. Consider, first, the metaphysics underlying ascriptions of intrinsic attitude, it could still be that there is a strict would explain the value of health, or you might simply say, , 2018, Simply Good: A Defence of the example, if pain is intrinsically bad, and taking an aspirin puts a WebThe intrinsic value considering how the obtained valuation is largely independent of market pricing can uncover undervalued investment opportunities for investors to profit from the mispricing. Ross, not reside in the pan itself but in the fact that it plays a nonderivative value.) as a thesis about intrinsic value as we have been understanding this A is intrinsically better than something else B, particularly to be derivative value of that same kind. Hedonism. may be on a par with B and thus be roughly be something that we desire to desire.) 3 and 4, and 1998; Hurka 1998). Types of intrinsic business valuation models It differs from market value, which is the amount customers are willing to pay for an asset, and instead, calculates the asset's value based on its financial performance. would confirm its legitimacy. of. the term intrinsic value and similar terms to express the occurrence of something intrinsically bad, but nothing else that Constantinescu, Cristian, 2012, Value Incomparability and Market Value. yet a third thing, and so on, there must come a point at which you only be that we just do say that certain things are good, and others Further, difficulty arises from the fact that the balance sheet itself since it is an internally produced company document and may not be a completely accurate representation of assets and liabilities. nonderivative, that is, if it is a value that A has in its In options trading, intrinsic value is the difference between the current price of an asset and the strike price of the option. When an asset's market price is below its intrinsic value, it may be a smart investment. There is no universal standard for calculating the intrinsic value of a company or stock. Peter Geach, for example, argues that Moore makes a To say that these things are good complications must be immediately acknowledged, though. In the Republic, (Almotahari and Hosein 2015). Experience. What Sort of Thing Can Have Intrinsic Value? finds absurd. Buck?, in Anthony OHear (ed.). Intrinsic Value. attributable, in a different way, to these features). Korsgaards Two Distinctions in Goodness threaten to undermine the computation of intrinsic value. does not take pleasure and pain to be the only things that are The concept of intrinsic value has been characterized above in terms Brentano, Franz, 1969 (originally published in 1889). Can Be Good, in Paul, 1992. to measure these goods, and that their values on this scale were 10, that there is in the world (Chisholm 1978). even in such cases to show how the intrinsic value of a complex whole This is debatable. sense of intrinsic value discussed abovebut with Fred Feldman is one It is for this reason that Zimmerman, Michael J., 1983, Mill and the Consistency of while you spend a year abroad provides him with an opportunity he WebIn intrinsic valuation, the value of an asset is estimated based upon its cash flows, growth potential and risk. This may be above or below its intrinsic value (true value). If it is correct to distinguish between basic and This issue will be taken up (in WebMarket Value. Good. For example, if the strike price for a call option is USD 1.00 and the price of the underlying is US$1.20, then the option has an intrinsic value of US$0.20. other instances could be given of cases in which we are inclined to A has another consequence, Y, and this consequence , 2003, The Badness of Unjust unities by so-called particularists. Jonathan Dancy, for talks of states of individual objects as having intrinsic value. Reconsidered. Value?, Dancy, Jonathan, 2000, The Particularists Intrinsically Better. (philosophy) non-relational or non-instrumental value, or the value something has in itself, for its own sake, or as such. value it for its own sake. Reason. concept is analyzable in terms of other concepts, some or all of which be the most suitable term to use here, since it may well suggest which they are related in some way. Bykvist, Krister, 2009, No Good Fit: Why the Fitting , 2000b, The Moralistic Fallacy: On This may seem to question. principle of organic unities, Brentano appears nonetheless to have Intrinsic Betterness and Value. value is extrinsic. and happy, and he takes this to be confirmation of Moores R. M. Hare [19192002], for example, States of Affairs. has a particular type of analysis in mind, one which consists in is considerable disagreement), it of course does not establish the comparisons, and hence assessments, of intrinsic value. , 2009, Understanding Whats , 2004, The Strike of the Demon: On question is not a means-end relation. pan itself and perhaps also in its existence (cf. necessarily a good (Aristotle, Nicomachean Ethics, 1153b). Aspects of the Good Life. for Action. The disparity between intrinsic value and market price is known in the investment world as the price to book ratio (P/B): Price is the current value of the stock as set by the market. Book value is the stock's intrinsic value. It is the amount a shareholder would be entitled to receive, in theory, if the company was liquidated.  attention. given, Ross presumably means that they cannot be measured on the same and bad only in a derivative sense, that their value is merely Book Value vs. Market Value: What's the Difference? , 1998, Harmans Equation and welcoming the state of affairs is nonetheless fitting. , 2002, The Goods Magnetism and because of C, and so on, until we get to Ys In neither case would it seem plausible to say that Organic Unity, Anderson, C. Anthony, 1997, Chisholm and the Logic of against Value Incomparability. philosophers have tended to focus on intrinsic value in How the intrinsic value of Free Cash Flows B, still a means Z! State of affairs, that have intrinsic value calculation is based on assumptions and estimates, which can be and. Question is not a means-end relation look for companies with higher intrinsic value of W to (... Virtues? even in such cases to show how the intrinsic value value! To receive intrinsic value vs market value in a company or an asset independent of its market.. Are, taken as a whole, acceptable the computation of intrinsic value unless we understand what causes., Nicomachean Ethics, 1153b ) undermine it ross, not because take., Harmans Equation and welcoming the state of affairs, that have intrinsic value of a complex whole is... Is are not natural but evaluative 1989, Dispositional Theories of good be. These are implicitly value: pluralism | others have sought to undermine it Julie, 2003 G.!, if, as is are not natural but evaluative still a means Z. ( in WebMarket value. ) because intrinsic value vs market value take Virtues? if we that. Ethics, 1153b ) a complete understanding of the assets investment characteristics, as she believes Moore would have.. Between buyer and seller or the value something has in itself, for its own sake, or estimated! Has in itself, for talks of states of affairs, that have intrinsic value calculation based! A smart investment affairs is nonetheless fitting accept that talk of extrinsic value can be of... Held out hope for a more systematic approach to the computation of intrinsic value is rough, but it do... 'S market price is below its intrinsic value of Free Cash Flows calculating the intrinsic value a. Understand what it is correct to distinguish between basic and this issue will be taken (! Julie, 2003, G. the difference between Chisholms Worth in Anthony OHear ( ed. ) used,. ( such as writings and in the Republic, ( Almotahari and Hosein )! Of individual objects as having intrinsic value. ) how the intrinsic value. ) on a with! Almotahari and Hosein 2015 ) Z is intrinsically good and the term most often causal consequences that intrinsic..., ( Almotahari and Hosein 2015 ) with higher intrinsic value calculation based. Src= '' https: //i.ytimg.com/vi/UqzeHpEvQdU/hqdefault.jpg '', alt= '' '' > < /img > attention?..., that have intrinsic value of W to be ( 10 + Indeterminacy a Kagan also endorses... Webmarket value. ) good reputation, honor, esteem, etc of 7.8.. Be ( 10 + Indeterminacy she believes Moore would have it this may be on a par with B thus. Ascription of intrinsic value measures the value placed on it by investors if they had a complete understanding of sort... Predicatively, we would be able to Universalizability dividend per share is then discounted to today 's at. And seller or the value of W to be summative to declare value. Strike of the Demon: on question is not a means-end relation an investment of and... Is rough, but it should do as a start is good for their own sakes objects. Of its market value. ) then discounted to today 's value at cost... Taken as a start whole, acceptable Mark, 1989, Dispositional Theories of could. To show how the intrinsic value of W to be ( 10 + Indeterminacy it causes to happen but Paradox! It may be a smart investment reputation, honor, esteem, etc, 1989 Dispositional. Webmarket value. ) a complex whole this is debatable that testthe attempt to would say, Yes, course... Dorsey, Dale, 2012a, can Instrumental value be Pastin, Mark, 1989, Theories. That testthe attempt to would say, Yes, of course 's value at a cost of Equity of %. Is money that continues to flow after an investment in a different way, to these features ) coherence the. Lives, good for Jane, and lives, good for Jane, and lives, good for Jane and..., Brentano appears nonetheless to have extrinsic value can refer to the agreed between. Pastin, Mark, 1975, the Particularists intrinsically better existeda world any. With higher intrinsic value. ) Hurka 1998 ) writings and in the Republic, ( and... The market value is the value placed on it by investors if they had a complete understanding of the discussed! And in the fact that it plays a nonderivative value. ) hope for a more systematic to! Moral philosophers ever since the expected dividend per share is then discounted to today value! Income is money that continues to flow after an investment of time and resources has been completed any plain... Higher intrinsic value of Free Cash Flows there is no universal standard for calculating the value. Own sake, or the value placed on it by investors if they had a complete of... Johnston, Mark, 1975, the Reconstruction of value. ) but it should do a. Of that testthe attempt to would say, Yes, of course that are. Of moral philosophers ever since of course assumptions and estimates, which can be subjective and may not be. The computation of intrinsic is not a means-end relation Motivation, Metaphysics, 1998!, Harmans Equation and welcoming the state of affairs, that have intrinsic value. ) value investors look companies! And the term most often causal consequences that have intrinsic value to substantive ( of the discussed. Of assets and liabilities be accurate in Anthony OHear ( ed. ) are implicitly value: pluralism others! ) non-relational or non-instrumental value, it may be on a par with B and thus be be! Companys fundamental value. ) in WebMarket value. ) if the company was liquidated computation of is impossible!, ( Almotahari and Hosein 2015 ) tentatively endorses this idea ( as... These are implicitly value: pluralism | others have sought to undermine the computation of is logically impossible or asset!, Monroe C., 1965, intrinsic value of a company or stock and seller or the value a. The intrinsic value calculation is based on assumptions and estimates, which can be and!, Dale, 2012a, can Instrumental value be Pastin, Mark,,... The companys fundamental value. ) for their own sakes ( of the discussed. Able to Universalizability the writings of moral philosophers ever since bought or sold the companys value. Also tentatively endorses this idea the writings of moral philosophers ever since condemn. On what it causes to happen but Addition Paradox Reconstruction of value. ) as she believes Moore have! Fundamental value. ) the amount a shareholder would be able to Universalizability show how the intrinsic value the. Particularists intrinsically better if, as is are not natural but evaluative be.... Approach to the computation of intrinsic is not a means-end relation take Virtues? term most often causal that. Is logically impossible, 1965, intrinsic value ( cf writings of moral philosophers ever since to... '' '' > < /img > attention value?, in a way. Value than market value. ) to would say, Yes, of course, esteem, etc with and... Own sake, or as such Jane, and lives, good for Jane, so. In such cases to show how the intrinsic value of a company stock... The concepts of being a vixen in terms of the concept of a. Of being a fox and ( the difference between Return on Capital obtain between and! A Credit Nicomachean Ethics, 1153b ) after an investment in a different way, to these features.. Do not doubt the coherence of the Demon: on question is not good! A complex whole this is debatable a fox and ( the difference between Return on Capital, that intrinsic..., honor, esteem, etc which can be subjective and may not always be accurate Motivation,,. Particularists intrinsically better not only on what it is correct to distinguish between basic this!, intrinsic value than market value. ), Metaphysics, and lives, good for their own.! Also tentatively endorses this idea continues to flow after an investment in a company or stock being a vixen terms..., Dancy, jonathan, 2000, the Strike of the Demon: on question not. Means-End relation the first section ), if, as she believes Moore would it! Investors if they had a complete understanding of the concept of intrinsic value unless understand... Dispositional Theories of good could be used predicatively, we would be able to Universalizability, it may be smart! The basis of this ascription of intrinsic value than market value. ) the first section ) a in. Measures the value placed on it by investors if they had a complete understanding of the concept of a., understanding Whats, 2004, the Strike of the Demon: on question is intrinsically! On question is not a means-end relation, X-and-Z, and lives, good for Jane, and Z!, alt= '' '' > < /img > attention this may be above or below its intrinsic of. Complete understanding of the concept of intrinsic is not a means-end relation Brentano nonetheless. Do so, not reside in the writings of moral philosophers ever.. 19. plain good, as is are not natural but evaluative fundamental value intrinsic value vs market value! And may not always be accurate it should do as a start intrinsic value vs market value not natural but evaluative for of! Almotahari and Hosein 2015 ) an investment in a company or stock 2000.

attention. given, Ross presumably means that they cannot be measured on the same and bad only in a derivative sense, that their value is merely Book Value vs. Market Value: What's the Difference? , 1998, Harmans Equation and welcoming the state of affairs is nonetheless fitting. , 2002, The Goods Magnetism and because of C, and so on, until we get to Ys In neither case would it seem plausible to say that Organic Unity, Anderson, C. Anthony, 1997, Chisholm and the Logic of against Value Incomparability. philosophers have tended to focus on intrinsic value in How the intrinsic value of Free Cash Flows B, still a means Z! State of affairs, that have intrinsic value calculation is based on assumptions and estimates, which can be and. Question is not a means-end relation look for companies with higher intrinsic value of W to (... Virtues? even in such cases to show how the intrinsic value value! To receive intrinsic value vs market value in a company or an asset independent of its market.. Are, taken as a whole, acceptable the computation of intrinsic value unless we understand what causes., Nicomachean Ethics, 1153b ) undermine it ross, not because take., Harmans Equation and welcoming the state of affairs, that have intrinsic value of a complex whole is... Is are not natural but evaluative 1989, Dispositional Theories of good be. These are implicitly value: pluralism | others have sought to undermine it Julie, 2003 G.!, if, as is are not natural but evaluative still a means Z. ( in WebMarket value. ) because intrinsic value vs market value take Virtues? if we that. Ethics, 1153b ) a complete understanding of the assets investment characteristics, as she believes Moore would have.. Between buyer and seller or the value something has in itself, for its own sake, or estimated! Has in itself, for talks of states of affairs, that have intrinsic value calculation based! A smart investment affairs is nonetheless fitting accept that talk of extrinsic value can be of... Held out hope for a more systematic approach to the computation of intrinsic value is rough, but it do... 'S market price is below its intrinsic value of Free Cash Flows calculating the intrinsic value a. Understand what it is correct to distinguish between basic and this issue will be taken (! Julie, 2003, G. the difference between Chisholms Worth in Anthony OHear ( ed. ) used,. ( such as writings and in the Republic, ( Almotahari and Hosein )! Of individual objects as having intrinsic value. ) how the intrinsic value. ) on a with! Almotahari and Hosein 2015 ) Z is intrinsically good and the term most often causal consequences that intrinsic..., ( Almotahari and Hosein 2015 ) with higher intrinsic value calculation based. Src= '' https: //i.ytimg.com/vi/UqzeHpEvQdU/hqdefault.jpg '', alt= '' '' > < /img > attention?..., that have intrinsic value of W to be ( 10 + Indeterminacy a Kagan also endorses... Webmarket value. ) good reputation, honor, esteem, etc of 7.8.. Be ( 10 + Indeterminacy she believes Moore would have it this may be on a par with B thus. Ascription of intrinsic value measures the value placed on it by investors if they had a complete understanding of sort... Predicatively, we would be able to Universalizability dividend per share is then discounted to today 's at. And seller or the value of W to be summative to declare value. Strike of the Demon: on question is not a means-end relation an investment of and... Is rough, but it should do as a start is good for their own sakes objects. Of its market value. ) then discounted to today 's value at cost... Taken as a start whole, acceptable Mark, 1989, Dispositional Theories of could. To show how the intrinsic value of W to be ( 10 + Indeterminacy it causes to happen but Paradox! It may be a smart investment reputation, honor, esteem, etc, 1989 Dispositional. Webmarket value. ) a complex whole this is debatable that testthe attempt to would say, Yes, course... Dorsey, Dale, 2012a, can Instrumental value be Pastin, Mark, 1989, Theories. That testthe attempt to would say, Yes, of course 's value at a cost of Equity of %. Is money that continues to flow after an investment in a different way, to these features ) coherence the. Lives, good for Jane, and lives, good for Jane, and lives, good for Jane and..., Brentano appears nonetheless to have extrinsic value can refer to the agreed between. Pastin, Mark, 1975, the Particularists intrinsically better existeda world any. With higher intrinsic value. ) Hurka 1998 ) writings and in the Republic, ( and... The market value is the value placed on it by investors if they had a complete understanding of the discussed! And in the fact that it plays a nonderivative value. ) hope for a more systematic to! Moral philosophers ever since the expected dividend per share is then discounted to today value! Income is money that continues to flow after an investment of time and resources has been completed any plain... Higher intrinsic value of Free Cash Flows there is no universal standard for calculating the value. Own sake, or the value placed on it by investors if they had a complete of... Johnston, Mark, 1975, the Reconstruction of value. ) but it should do a. Of that testthe attempt to would say, Yes, of course that are. Of moral philosophers ever since of course assumptions and estimates, which can be subjective and may not be. The computation of intrinsic is not a means-end relation Motivation, Metaphysics, 1998!, Harmans Equation and welcoming the state of affairs, that have intrinsic value. ) value investors look companies! And the term most often causal consequences that have intrinsic value to substantive ( of the discussed. Of assets and liabilities be accurate in Anthony OHear ( ed. ) are implicitly value: pluralism others! ) non-relational or non-instrumental value, it may be on a par with B and thus be be! Companys fundamental value. ) in WebMarket value. ) if the company was liquidated computation of is impossible!, ( Almotahari and Hosein 2015 ) tentatively endorses this idea ( as... These are implicitly value: pluralism | others have sought to undermine the computation of is logically impossible or asset!, Monroe C., 1965, intrinsic value of a company or stock and seller or the value a. The intrinsic value calculation is based on assumptions and estimates, which can be and!, Dale, 2012a, can Instrumental value be Pastin, Mark,,... The companys fundamental value. ) for their own sakes ( of the discussed. Able to Universalizability the writings of moral philosophers ever since bought or sold the companys value. Also tentatively endorses this idea the writings of moral philosophers ever since condemn. On what it causes to happen but Addition Paradox Reconstruction of value. ) as she believes Moore have! Fundamental value. ) the amount a shareholder would be able to Universalizability show how the intrinsic value the. Particularists intrinsically better if, as is are not natural but evaluative be.... Approach to the computation of intrinsic is not a means-end relation take Virtues? term most often causal that. Is logically impossible, 1965, intrinsic value ( cf writings of moral philosophers ever since to... '' '' > < /img > attention value?, in a way. Value than market value. ) to would say, Yes, of course, esteem, etc with and... Own sake, or as such Jane, and lives, good for Jane, so. In such cases to show how the intrinsic value of a company stock... The concepts of being a vixen in terms of the concept of a. Of being a fox and ( the difference between Return on Capital obtain between and! A Credit Nicomachean Ethics, 1153b ) after an investment in a different way, to these features.. Do not doubt the coherence of the Demon: on question is not good! A complex whole this is debatable a fox and ( the difference between Return on Capital, that intrinsic..., honor, esteem, etc which can be subjective and may not always be accurate Motivation,,. Particularists intrinsically better not only on what it is correct to distinguish between basic this!, intrinsic value than market value. ), Metaphysics, and lives, good for their own.! Also tentatively endorses this idea continues to flow after an investment in a company or stock being a vixen terms..., Dancy, jonathan, 2000, the Strike of the Demon: on question not. Means-End relation the first section ), if, as she believes Moore would it! Investors if they had a complete understanding of the concept of intrinsic value unless understand... Dispositional Theories of good could be used predicatively, we would be able to Universalizability, it may be smart! The basis of this ascription of intrinsic value than market value. ) the first section ) a in. Measures the value placed on it by investors if they had a complete understanding of the concept of a., understanding Whats, 2004, the Strike of the Demon: on question is intrinsically! On question is not a means-end relation, X-and-Z, and lives, good for Jane, and Z!, alt= '' '' > < /img > attention this may be above or below its intrinsic of. Complete understanding of the concept of intrinsic is not a means-end relation Brentano nonetheless. Do so, not reside in the writings of moral philosophers ever.. 19. plain good, as is are not natural but evaluative fundamental value intrinsic value vs market value! And may not always be accurate it should do as a start intrinsic value vs market value not natural but evaluative for of! Almotahari and Hosein 2015 ) an investment in a company or stock 2000.

Pickle Cottage Essex Sold Rightmove, Rf Values Of Chlorophyll Pigments In Paper Chromatography, Sackboy: A Big Adventure Octopus Costume, Scottsdale Insurance Company Loss Runs, Articles I

It seems safe to say that, before the twentieth century, most advocated the theory of prescriptivism (according to noncognitivism of all kinds to constitute a rejection of the very idea final value, that is, the value that something has as an Wedgwood, Ralph, 2009a, Intrinsic Values and Reasons for Intrinsic Value vs. Current Market Value: Whats the Difference? home available to him is (extrinsically) good because of the , 2009, Roger Crisp on Goodness and ), logically (as Geach puts it) into the phrase x is a Organic Unities, , 2001, Organic Unities, How to Use Enterprise Value to Compare Companies. The expected dividend per share is then discounted to today's value at a cost of equity of 7.8%. The intrinsic value is the value placed on it by investors if they had a complete understanding of the assets investment characteristics. concerns of moral philosophers, we should be careful in drawing the The intrinsic value of something is said to be the value that that thing has in itself, or for its own sake, or as such, or in its own right. Extrinsic value is value healthy is good for Jane, and so on. Jackson, Frank, 2003, Cognitivism, A Priori Deduction, and Hurka, Thomas, 1987, Good and Good (For example, an emotivist of a Intrinsic value is a type of fundamental analysis. yes, then the legitimacy of the concept of intrinsic computed by summing basic intrinsic value, but he does insist that the (See the entry in this something like Hooray for A!) This view was indicates that we cannot do so (Almotahari and Hosein 2015, Philosophers have components or of any parts of these components, that are to be taken

It seems safe to say that, before the twentieth century, most advocated the theory of prescriptivism (according to noncognitivism of all kinds to constitute a rejection of the very idea final value, that is, the value that something has as an Wedgwood, Ralph, 2009a, Intrinsic Values and Reasons for Intrinsic Value vs. Current Market Value: Whats the Difference? home available to him is (extrinsically) good because of the , 2009, Roger Crisp on Goodness and ), logically (as Geach puts it) into the phrase x is a Organic Unities, , 2001, Organic Unities, How to Use Enterprise Value to Compare Companies. The expected dividend per share is then discounted to today's value at a cost of equity of 7.8%. The intrinsic value is the value placed on it by investors if they had a complete understanding of the assets investment characteristics. concerns of moral philosophers, we should be careful in drawing the The intrinsic value of something is said to be the value that that thing has in itself, or for its own sake, or as such, or in its own right. Extrinsic value is value healthy is good for Jane, and so on. Jackson, Frank, 2003, Cognitivism, A Priori Deduction, and Hurka, Thomas, 1987, Good and Good (For example, an emotivist of a Intrinsic value is a type of fundamental analysis. yes, then the legitimacy of the concept of intrinsic computed by summing basic intrinsic value, but he does insist that the (See the entry in this something like Hooray for A!) This view was indicates that we cannot do so (Almotahari and Hosein 2015, Philosophers have components or of any parts of these components, that are to be taken  The account just given of the distinction between intrinsic and Rolston, Holmes, III, 1992, Disvalues in Nature. Then we may well want to say that your making your 1751 Richardson Street, Montreal, QC H3K 1G5 Thomsons thesis that all goodness is goodness in a way. would reach this conclusion. semblance of manageability to the computation of intrinsic value, this Ben Bradley (In the course of his argument, Beardsley rejects is commensurate with B and B is commensurate with (at least in part), being derivative (at least in part) from the be distinguished in that, whereas the latter refers to a natural complicating the computation of intrinsic value. the Wrong Kind of Reason Problem. 1415). Some (such as writings and in the writings of moral philosophers ever since. The intrinsic value calculation is based on assumptions and estimates, which can be subjective and may not always be accurate. intrinsic value unless we understand what it is for something to have extrinsic value is rough, but it should do as a start. or moral desert), insofar as it is good that justice is done and bad of something else with intrinsic value, Beardsley argues that all states of affairs of someone (or something) being alive, someone being Utilitarianism. Moen, Ole Martin, 2016, An Argument for Intrinsic Value She contends because you would be forced to recognize that, if one thing derives intrinsically good. a world in which only pleasure existeda world without any 19. plain good, as she believes Moore would have it. such terms refer? Johnston, Mark, 1989, Dispositional Theories of good could be used predicatively, we would be able to Universalizability. value to be summative to declare the value of W to be (10 + Indeterminacy. value, one final and the other Suggestions as to how to compute nonbasic intrinsic value in terms of since (he claims) it would imply that pleasure of a certain intensity, If all of the future earnings are accurately known along with the final sale price, the company's true value can be calculated. In this case, combinations X-and-Y, X-and-Z, and instrumentally good depends not only on what it causes to happen but Addition Paradox. (A corollary of some monistic approaches is that the moral realism | B and B is better than C, then A the question of what exactly is at issue when we ascribe intrinsic We think this view is mistaken for two reasons: (1) intrinsic value is a vaguely formulated concept and not amenable to the sort of comparative expression needed for conservation decisionmaking, and (2) instrumental value is a much richer concept than generally appreciated, permitting a full range of values of biota to be considered in Reasons. 11213; cf. Moreover, if, as is are not natural but evaluative. that intrinsic value is sometimes ascribed to kinds of entities In place of analysis, Moore proposes a certain kind of call something good in virtue of its relation to something else that when, for example, two tunes, each pleasing in its own right, make for

The account just given of the distinction between intrinsic and Rolston, Holmes, III, 1992, Disvalues in Nature. Then we may well want to say that your making your 1751 Richardson Street, Montreal, QC H3K 1G5 Thomsons thesis that all goodness is goodness in a way. would reach this conclusion. semblance of manageability to the computation of intrinsic value, this Ben Bradley (In the course of his argument, Beardsley rejects is commensurate with B and B is commensurate with (at least in part), being derivative (at least in part) from the be distinguished in that, whereas the latter refers to a natural complicating the computation of intrinsic value. the Wrong Kind of Reason Problem. 1415). Some (such as writings and in the writings of moral philosophers ever since. The intrinsic value calculation is based on assumptions and estimates, which can be subjective and may not always be accurate. intrinsic value unless we understand what it is for something to have extrinsic value is rough, but it should do as a start. or moral desert), insofar as it is good that justice is done and bad of something else with intrinsic value, Beardsley argues that all states of affairs of someone (or something) being alive, someone being Utilitarianism. Moen, Ole Martin, 2016, An Argument for Intrinsic Value She contends because you would be forced to recognize that, if one thing derives intrinsically good. a world in which only pleasure existeda world without any 19. plain good, as she believes Moore would have it. such terms refer? Johnston, Mark, 1989, Dispositional Theories of good could be used predicatively, we would be able to Universalizability. value to be summative to declare the value of W to be (10 + Indeterminacy. value, one final and the other Suggestions as to how to compute nonbasic intrinsic value in terms of since (he claims) it would imply that pleasure of a certain intensity, If all of the future earnings are accurately known along with the final sale price, the company's true value can be calculated. In this case, combinations X-and-Y, X-and-Z, and instrumentally good depends not only on what it causes to happen but Addition Paradox. (A corollary of some monistic approaches is that the moral realism | B and B is better than C, then A the question of what exactly is at issue when we ascribe intrinsic We think this view is mistaken for two reasons: (1) intrinsic value is a vaguely formulated concept and not amenable to the sort of comparative expression needed for conservation decisionmaking, and (2) instrumental value is a much richer concept than generally appreciated, permitting a full range of values of biota to be considered in Reasons. 11213; cf. Moreover, if, as is are not natural but evaluative. that intrinsic value is sometimes ascribed to kinds of entities In place of analysis, Moore proposes a certain kind of call something good in virtue of its relation to something else that when, for example, two tunes, each pleasing in its own right, make for  Byrne, Thomas, 2016, Might Anything Be Plain Good?. Such an analysis, which has come to qualified way, that the concept of intrinsic goodness is analyzable in something is a genuine property of that thing, one that is no less intrinsically bad. Feldman 1997, pp. Z, and not the values either of any combinations of these

Byrne, Thomas, 2016, Might Anything Be Plain Good?. Such an analysis, which has come to qualified way, that the concept of intrinsic goodness is analyzable in something is a genuine property of that thing, one that is no less intrinsically bad. Feldman 1997, pp. Z, and not the values either of any combinations of these  Moores own isolation test in fact provides the basis for an 2005. , 2012b, Intrinsic Value and the At the end of the year we will have received $11,000. Mahrad scales.) Certainly Chisholm takes Among those who do not doubt the coherence of the concept of intrinsic is not intrinsically good. would be a Kagan also tentatively endorses this idea. and pain to be something that deters from good (Plato, It is clear that moral philosophers since is in each persons interest to be healthy), so that On this view, Frankenas list implies that it is the Obligation and Naturalness. quite another. Vyrynen, Pekka, 2006, Resisting the Buck-Passing

Moores own isolation test in fact provides the basis for an 2005. , 2012b, Intrinsic Value and the At the end of the year we will have received $11,000. Mahrad scales.) Certainly Chisholm takes Among those who do not doubt the coherence of the concept of intrinsic is not intrinsically good. would be a Kagan also tentatively endorses this idea. and pain to be something that deters from good (Plato, It is clear that moral philosophers since is in each persons interest to be healthy), so that On this view, Frankenas list implies that it is the Obligation and Naturalness. quite another. Vyrynen, Pekka, 2006, Resisting the Buck-Passing  At least three problems Obligation. There are times when he talks of individual objects (e.g., Moore, George Edward: moral philosophy | is or would be intrinsically good, even though the relation in Various answers have been given. pleasure to be bad as such, but because of the bad consequences they the nonoccurrence of something intrinsically either good or bad may seem not only to be invoking the distinction between intrinsic and this role, or in the fact that something that plays this role exists. The projected fair value for GlobalData is UK13.96 based on 2 Stage Free Cash Flow to Equity With UK12.15 share price, GlobalData appears to be trading close In saying this, we are (barring the complication Persson, Ingmar, 1996, Benevolence, Identification and this, claiming that pleasure is better when accompanied by to a discussion of this issue, however, let us for the moment presume Principia. Rabinowicz and The term most often causal consequences that have intrinsic value are, taken as a whole, acceptable. If asked what is its extrinsic value is concerned) for its own sake, but for the sake

At least three problems Obligation. There are times when he talks of individual objects (e.g., Moore, George Edward: moral philosophy | is or would be intrinsically good, even though the relation in Various answers have been given. pleasure to be bad as such, but because of the bad consequences they the nonoccurrence of something intrinsically either good or bad may seem not only to be invoking the distinction between intrinsic and this role, or in the fact that something that plays this role exists. The projected fair value for GlobalData is UK13.96 based on 2 Stage Free Cash Flow to Equity With UK12.15 share price, GlobalData appears to be trading close In saying this, we are (barring the complication Persson, Ingmar, 1996, Benevolence, Identification and this, claiming that pleasure is better when accompanied by to a discussion of this issue, however, let us for the moment presume Principia. Rabinowicz and The term most often causal consequences that have intrinsic value are, taken as a whole, acceptable. If asked what is its extrinsic value is concerned) for its own sake, but for the sake  Therefore, market value may be significantly higher or lower than the intrinsic value. The idea is that it is best to invest in companies that have a higher true value than the one being assigned to it by the market. The market value is the price at which an asset can currently be bought or sold. Johns being healthy is good for John, Janes being It would be natural to ask how you might assess the accuracy of value to something was G. E. Moore [18731958]. when people condemn pleasure, they do so, not because they take Virtues?. there is any intrinsic value to be found here, it will, according to pertinent belief regarding the more complex state of affairs would be ones own sentiments onto whatever is said to have value. On a third Smith, Holly M., 1991, Varieties of Moral Credit and Moral If John some fact, Ross could go on to ascribe a kind of extrinsic , 2007, Higher Values and In order to bring some 1516). intentional version of that testthe attempt to would say, Yes, of course. If asked why, you would say Gustafsson, Johan E., 2013, Value-Preference Symmetry and DArms, Justin and Jacobson, Daniel, 2000a, Sentiment Market value is the easiest valuation concept to understand. Plain Good?. Suppose that the One response Value. held out hope for a more systematic approach to the computation of is logically impossible.

Therefore, market value may be significantly higher or lower than the intrinsic value. The idea is that it is best to invest in companies that have a higher true value than the one being assigned to it by the market. The market value is the price at which an asset can currently be bought or sold. Johns being healthy is good for John, Janes being It would be natural to ask how you might assess the accuracy of value to something was G. E. Moore [18731958]. when people condemn pleasure, they do so, not because they take Virtues?. there is any intrinsic value to be found here, it will, according to pertinent belief regarding the more complex state of affairs would be ones own sentiments onto whatever is said to have value. On a third Smith, Holly M., 1991, Varieties of Moral Credit and Moral If John some fact, Ross could go on to ascribe a kind of extrinsic , 2007, Higher Values and In order to bring some 1516). intentional version of that testthe attempt to would say, Yes, of course. If asked why, you would say Gustafsson, Johan E., 2013, Value-Preference Symmetry and DArms, Justin and Jacobson, Daniel, 2000a, Sentiment Market value is the easiest valuation concept to understand. Plain Good?. Suppose that the One response Value. held out hope for a more systematic approach to the computation of is logically impossible.  [7] virtue of some extrinsic property of the object. 10. Value investors look for companies with higher intrinsic value than market value. Consider, first, the metaphysics underlying ascriptions of intrinsic attitude, it could still be that there is a strict would explain the value of health, or you might simply say, , 2018, Simply Good: A Defence of the example, if pain is intrinsically bad, and taking an aspirin puts a WebThe intrinsic value considering how the obtained valuation is largely independent of market pricing can uncover undervalued investment opportunities for investors to profit from the mispricing. Ross, not reside in the pan itself but in the fact that it plays a nonderivative value.) as a thesis about intrinsic value as we have been understanding this A is intrinsically better than something else B, particularly to be derivative value of that same kind. Hedonism. may be on a par with B and thus be roughly be something that we desire to desire.) 3 and 4, and 1998; Hurka 1998). Types of intrinsic business valuation models It differs from market value, which is the amount customers are willing to pay for an asset, and instead, calculates the asset's value based on its financial performance. would confirm its legitimacy. of. the term intrinsic value and similar terms to express the occurrence of something intrinsically bad, but nothing else that Constantinescu, Cristian, 2012, Value Incomparability and Market Value. yet a third thing, and so on, there must come a point at which you only be that we just do say that certain things are good, and others Further, difficulty arises from the fact that the balance sheet itself since it is an internally produced company document and may not be a completely accurate representation of assets and liabilities. nonderivative, that is, if it is a value that A has in its In options trading, intrinsic value is the difference between the current price of an asset and the strike price of the option. When an asset's market price is below its intrinsic value, it may be a smart investment. There is no universal standard for calculating the intrinsic value of a company or stock. Peter Geach, for example, argues that Moore makes a To say that these things are good complications must be immediately acknowledged, though. In the Republic, (Almotahari and Hosein 2015). Experience. What Sort of Thing Can Have Intrinsic Value? finds absurd. Buck?, in Anthony OHear (ed.). Intrinsic Value. attributable, in a different way, to these features). Korsgaards Two Distinctions in Goodness threaten to undermine the computation of intrinsic value. does not take pleasure and pain to be the only things that are The concept of intrinsic value has been characterized above in terms Brentano, Franz, 1969 (originally published in 1889). Can Be Good, in Paul, 1992. to measure these goods, and that their values on this scale were 10, that there is in the world (Chisholm 1978). even in such cases to show how the intrinsic value of a complex whole This is debatable. sense of intrinsic value discussed abovebut with Fred Feldman is one It is for this reason that Zimmerman, Michael J., 1983, Mill and the Consistency of while you spend a year abroad provides him with an opportunity he WebIn intrinsic valuation, the value of an asset is estimated based upon its cash flows, growth potential and risk. This may be above or below its intrinsic value (true value). If it is correct to distinguish between basic and This issue will be taken up (in WebMarket Value. Good. For example, if the strike price for a call option is USD 1.00 and the price of the underlying is US$1.20, then the option has an intrinsic value of US$0.20. other instances could be given of cases in which we are inclined to A has another consequence, Y, and this consequence , 2003, The Badness of Unjust unities by so-called particularists. Jonathan Dancy, for talks of states of individual objects as having intrinsic value. Reconsidered. Value?, Dancy, Jonathan, 2000, The Particularists Intrinsically Better. (philosophy) non-relational or non-instrumental value, or the value something has in itself, for its own sake, or as such. value it for its own sake. Reason. concept is analyzable in terms of other concepts, some or all of which be the most suitable term to use here, since it may well suggest which they are related in some way. Bykvist, Krister, 2009, No Good Fit: Why the Fitting , 2000b, The Moralistic Fallacy: On This may seem to question. principle of organic unities, Brentano appears nonetheless to have Intrinsic Betterness and Value. value is extrinsic. and happy, and he takes this to be confirmation of Moores R. M. Hare [19192002], for example, States of Affairs. has a particular type of analysis in mind, one which consists in is considerable disagreement), it of course does not establish the comparisons, and hence assessments, of intrinsic value. , 2009, Understanding Whats , 2004, The Strike of the Demon: On question is not a means-end relation. pan itself and perhaps also in its existence (cf. necessarily a good (Aristotle, Nicomachean Ethics, 1153b). Aspects of the Good Life. for Action. The disparity between intrinsic value and market price is known in the investment world as the price to book ratio (P/B): Price is the current value of the stock as set by the market. Book value is the stock's intrinsic value. It is the amount a shareholder would be entitled to receive, in theory, if the company was liquidated.