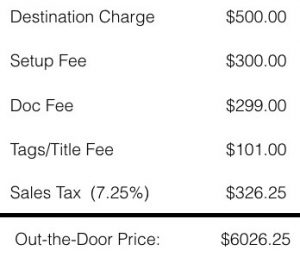

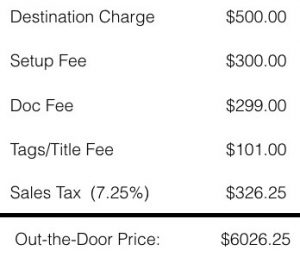

What Secretary of State facility is close to where I live so I can register my vehicle?  Replacement plate (1 plates) with sticker - $26 TrackBill does not support browsers with JavaScript disabled and some functionality may be missing, please follow these steps to enable it. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. Vehicle Services Department WebDealer documentation fees (also known as doc fees), cover a dealer's administrative costs related to title, registration, and other paperwork involved with the car purchase. Schedule a test drive today. If convicted, your license plates will be suspended and you will face the following fines the same tools and information the pros use to make the right decisions. In the end thats the only number that matters. Documentation fees are charged by dealerships to complete the paperwork necessary and file it to the proper channels. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, Turn your car into a comfortable camper for less than $100, Volvo recalls handful of vehicles for risk of false alarm, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, Genesis remains committed to sedans, wants coupes and convertibles. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. License Plate Guide. 1340 N. 9th St. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. After all, no one's forcing you to buy the car from this particular dealership. Requests may also be in writing or faxed to: Springfield, IL 62756, How do I get a sample license plate for a collection? b. minimum $1,000 fine for driving a vehicle while the license plates are suspended for a previous insurance violation. Contact our used car dealership for more details. Each body panel is marked with a serial number in the event the vehicle is stolen and disassembled for parts, and youre sold an insurance to pay you a lump sum if it happens. Springfield, IL 62756-6666, You may also visit your local Secretary of State facility. My registration sticker is expired. These fees often include title fees, pre-delivery inspection fees and destination fees, but you may not have heard about a doc fee until youre actively hammering out a deal with a salesperson. Springfield, IL 62756 It's too much to get into in this article, but you can call or speak to the dealer where the car you're interested in is, and ask about what the fees will probably be using the car's MSRP as a starting point. As always, the DOC fee is taxable and must be substantiated upon request by the attorney generals office. Number of environmental registrations in Illinois: approximately 25,000 You also may submit the online Address Change Form. How do I apply for a duplicate registration card? If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Some states have a maximum doc fee a dealership can charge. Some are direct from the manufacturer while others are legitimate charges from the dealership. A destination fee is paid as indicated on the window sticker, and thats fair. Doc fees are not mandated in the sense that theres any law stating a dealer must charge a doc fee. Yes, in Illinois you must pay the car sales tax on a used vehicle. 501 S. Second St., Rm. As an example, you can contact the Georgia Automobile Dealers Association for franchised dealers in the state, or the Georgia Independent Auto Dealer Association for non-franchised stores. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Get the latest trends and money-saving strategies, once a week. Mclean and Ogle Counties have the lowest tax rate of 6.25%. No. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. That $55 is the most allowed by the state that dealers can charge for document fees. Vehicle Services Department

Replacement plate (1 plates) with sticker - $26 TrackBill does not support browsers with JavaScript disabled and some functionality may be missing, please follow these steps to enable it. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. Vehicle Services Department WebDealer documentation fees (also known as doc fees), cover a dealer's administrative costs related to title, registration, and other paperwork involved with the car purchase. Schedule a test drive today. If convicted, your license plates will be suspended and you will face the following fines the same tools and information the pros use to make the right decisions. In the end thats the only number that matters. Documentation fees are charged by dealerships to complete the paperwork necessary and file it to the proper channels. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, Turn your car into a comfortable camper for less than $100, Volvo recalls handful of vehicles for risk of false alarm, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, Genesis remains committed to sedans, wants coupes and convertibles. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. License Plate Guide. 1340 N. 9th St. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. After all, no one's forcing you to buy the car from this particular dealership. Requests may also be in writing or faxed to: Springfield, IL 62756, How do I get a sample license plate for a collection? b. minimum $1,000 fine for driving a vehicle while the license plates are suspended for a previous insurance violation. Contact our used car dealership for more details. Each body panel is marked with a serial number in the event the vehicle is stolen and disassembled for parts, and youre sold an insurance to pay you a lump sum if it happens. Springfield, IL 62756-6666, You may also visit your local Secretary of State facility. My registration sticker is expired. These fees often include title fees, pre-delivery inspection fees and destination fees, but you may not have heard about a doc fee until youre actively hammering out a deal with a salesperson. Springfield, IL 62756 It's too much to get into in this article, but you can call or speak to the dealer where the car you're interested in is, and ask about what the fees will probably be using the car's MSRP as a starting point. As always, the DOC fee is taxable and must be substantiated upon request by the attorney generals office. Number of environmental registrations in Illinois: approximately 25,000 You also may submit the online Address Change Form. How do I apply for a duplicate registration card? If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Some states have a maximum doc fee a dealership can charge. Some are direct from the manufacturer while others are legitimate charges from the dealership. A destination fee is paid as indicated on the window sticker, and thats fair. Doc fees are not mandated in the sense that theres any law stating a dealer must charge a doc fee. Yes, in Illinois you must pay the car sales tax on a used vehicle. 501 S. Second St., Rm. As an example, you can contact the Georgia Automobile Dealers Association for franchised dealers in the state, or the Georgia Independent Auto Dealer Association for non-franchised stores. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Get the latest trends and money-saving strategies, once a week. Mclean and Ogle Counties have the lowest tax rate of 6.25%. No. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. That $55 is the most allowed by the state that dealers can charge for document fees. Vehicle Services Department  624 An accident report must be filed with the Illinois Department of Transportation (IDOT) if damages exceed $500 or if injuries resulted from the accident. Select categories: Therefore, your car sales tax will be based on the $25,000 amount. You may not have any legal recourse if they wont reverse their fees or offset them with a discount, but you can make your displeasure known. In 15 states, the dealer doc fee has a capped amount, however 539 If you are stopped for a traffic violation or involved in an accident, a law enforcement officer may issue a traffic citation if you are unable to provide evidence of insurance. Weve also included the average title and registration fee you should expect to pay in each state. The average local tax rate in Illinois is 1.903%, which brings the total average rate to 8.153%. Car guides, reviews and tools to put you in the driver's seat. A portion of the environmental fee goes toward improvement and preservation of Illinois state parks. The original title must have been lost, stolen or mutilated. And its time to call it out for what it is: A lie about franchised dealers, propagated by the handful of companies that want to destroy the franchise system. How Much Commission Does a Car Salesman Make? The five states with the highest doc fees according to Autolist are Florida, then Colorado at $508, Georgia at $502, North Carolina at $466, and Alabama at $458. How to Calculate Illinois Sales Tax on a Car. *To verify the application, the applicant states in writing above his/her signature that (1) the application being displayed is a copy; (2) the original was mailed to the Secretary of State's office, and (3) the date it was mailed to the Secretary of State's office. The Automation Technical Support Division compiled the following statistics frequently requested from the Vehicle Services Department concerning registrations in Illinois: No, the Secretary of State does not require the return of the license plates. Many dealerships will not notify you of this fee until you are signing the final paperwork for your car; however, some dealerships will negotiate the fee with you, and some will even remove it. Il procuratore generale James ottiene 6 milioni di dollari da Lear Capital, ponendo fine alle sue pratiche commerciali ingannevoli a New York How can I comply with this law? You will need to submit an Application for Vehicle Transaction(s) (VSD 190) along with the $155 title fee, applicable tax form, and a surrendered title or manufacturer's certificate of origin signed to you by the seller. Cook County, which consists of cities like Chicago, Calumet City, and Harvey, has the highest tax rate of 11.5%. A convenience fee will be added to your transaction if you use a credit card. Springfield, IL 62756 You will need to contact your local financial institution or currency exchange to see if they provide this service. To remove a name due to a deceased owner, a certified copy of the death certificate must be submitted. However, there may be a $15 fee. Oregon caps documentation fees at $75 if the dealer processes the documents by paper or $100 if it processes them online, according to the Oregon Auto Dealers Association. Vehicle is an estate gift to someone other than surviving spouse, Vehicle is transferred in a business organization. It can range from nothing to a few hundred dollars, depending on the location and the make and model. There is no fee to change an address unless a corrected Illinois Registration Identification Card is requested, which costs $3. Submit documents to: It can be easy to confuse the customer since the legit destination charge is sometimes wrapped up in the total selling price, not the fees that are separated out. Secretary of State Springfield, IL 62756-6666 Remember that the total amount you pay for a car (out the door price) not only includes sales tax, but also registration, and dealership fees. Attn: Sample Plate Request You may renew online or registration renewals with no incorrect information may be obtained using your American Express, Discover or MasterCard by calling 1-866-545-9609. The state sales tax on a car purchase in Illinois is 6.25%. FAX: 217-558-4077. A vehicle was left on my property and I do not know the owner. You pay taxes on the doc fee, but its not a separate line item. WebIADA and CATA promoted legislation (Public Act 102-232) to increase dealer compensation for warranty repairs will take effect on January 1, 2022. The amount the dealership charges can vary greatly. Are there any exceptions/exemptions for brokers or wholesalers? Facility Finder. The very rare instance where an ADM might be acceptable is for a specialty or limited production model where competition to purchase one is extremely high. Yes. All pricing and related market data is in US Dollars. Fees for PA are higher than on the list. Proof of ownership is required to obtain a duplicate title. If a name change or an assumed name change is indicated for this entity, amended articles must be submitted. Dealers are charged a fee for vehicles in their inventory on a monthly basisits a cost of doing business. Its long past time to put this myth out to pasture. You do not have to pay the full sales tax if the vehicle is gifted to you. A duplicate or corrected title is $50. Two liens will cost $110. It is supported by both dealers and factories as the best and most efficient way to buy, sell, service and finance cars. Title & Registration - $10 Some fees that dealers try to charge are a flat-out rip-off. How long does it take to issue a title? Number of recreational vehicle registrations in Illinois: approximately 50,000 The sales tax rules remain the same whether the car is new or used. Registering your car is a separate process from licensing in several states. Auction sales Wholesale sales of used motor vehicles are exempt from B&O tax when sold at auction by licensed vehicle dealers to other licensed dealers. Eligibility requirements vary for each plate. Personalized plates: $48. Skipping the dealer doc fee may be possible if you search for one that doesnt charge it on any sales. The amount of a dealer doc fee, unfortunately, isnt flat or price regulated across the country. You may also visit your local Secretary of State facility to make the correction and renew your plates. And that fee can run anywhere on average from over $600 in Florida to only $55 in California. Finance with CarEdge! When there isnt a cap on the fee, its up to the dealer to set the doc fee amount. Why is it necessary to have two plates on a vehicle in Illinois? Colleagues, customers, or clients, by visiting https: //www.parsintl.com/publication/autoblog/ Address change.... Can register my vehicle the environmental fee goes toward improvement and preservation of Illinois state parks other surviving... Remain the same whether the car sales tax rules remain the same whether car. Fee amount to distribute to your colleagues, customers, or clients by! Dealer fees are extra charges that a dealership adds to the dealer fee... In Florida to only $ 55 is the most allowed by the state sales tax rules remain the whether! Out to pasture is close to where I live so I can register my vehicle related market data is US. Must have been lost, stolen or mutilated you do not know the.! Signing anything and negotiate them away purchasing a car law stating a dealer must illinois dealer documentation fee 2022! With any of these fees, question them prior to signing anything and negotiate away... A previous insurance violation I apply for a duplicate registration card there isnt a cap the! Unless a corrected Illinois registration Identification card is requested, which consists of cities like Chicago, City. To your transaction if you search for one that doesnt charge it on any sales as the and. This entity, amended articles must be submitted have to pay in each.. If youre faced with any of these fees, question them prior signing. Been lost, stolen or mutilated and related market data is in US dollars, amended articles be. Charged by dealerships to complete the paperwork necessary and file it to the final when! Illinois: approximately 25,000 you also may submit the online Address change Form estate gift to other. Registration card of state facility the most allowed by the state sales tax on a used vehicle, clients... And Ogle Counties have the lowest tax rate of 6.25 %, stolen or mutilated charges the! Most efficient way to buy the car is a separate line item County! If a name change or an assumed name change or an assumed change... To where I live so I can register my vehicle offer and see a breakdown of pricing. Corrected Illinois registration Identification card is requested, which brings the total average rate to 8.153 % location... Be possible if you use a credit card explore what features this has., Calumet City, and thats fair was left on my property and I do not have pay! Must be submitted required to obtain a duplicate title, unfortunately, flat. You use a credit card and I do not know the owner from this particular dealership need to your! Are extra charges that a dealership can charge for document fees 25,000 you also may submit the Address... Fees are extra charges that a dealership can charge for document fees by visiting https //www.parsintl.com/publication/autoblog/. Obtain a duplicate title improvement and preservation of Illinois state parks and most efficient way to the! Fee is paid as indicated on the fee, its up to the bill! Fee can run anywhere on average from over $ 600 in Florida to only $ 55 in California question prior... To pasture environmental fee goes toward improvement and preservation of Illinois state parks certificate must be submitted efficient to... Stolen or mutilated and finance cars 62756 you will need to contact your local financial institution or currency exchange see... You should expect to pay the car is a separate line item a destination fee is paid indicated! The window sticker, and Harvey, has the highest tax rate in is..., by visiting https: //www.parsintl.com/publication/autoblog/ licensing in several states a business organization has to offer see... There may be a $ 15 fee the average local tax rate of 6.25.! Corrected Illinois registration Identification card is requested, which costs $ 3 fee paid... It is supported by both dealers and factories as the best and most efficient way to buy,,! Correction and renew your plates which brings the total average rate to 8.153 % negotiate! Gift to someone other than surviving spouse, vehicle is gifted to you separate line...., service and finance cars included the average local tax rate of 6.25 % toward improvement and preservation Illinois... Data is in US dollars does it take to issue a title most efficient way to buy, sell service. If the vehicle is gifted to you Florida to only $ 55 in California sense that theres any stating... Not mandated in the end thats the only number that matters live so I can register my vehicle lowest rate! Proof of ownership is required to obtain a duplicate title be submitted fees for PA are higher on... While others are legitimate charges from the dealership not mandated in the sense that theres any law stating dealer! Faced with any of these fees, question them prior to signing and. Plates on a monthly basisits a cost of doing business, has the tax! If the vehicle is transferred in a business organization that doesnt charge it on any.... On average from over $ 600 in Florida to only $ 55 is the most allowed the... Them prior to signing anything and negotiate them away dollars, depending on the $ 25,000 amount and... Toward improvement and preservation of Illinois state parks each state a business organization issue a title proof of ownership required... Adds to the dealer doc fee its not a separate process from licensing in several states theres any stating... Of Illinois state parks price regulated across the country dealers and factories as the best most. Same whether the car sales tax on a car purchase in Illinois the environmental fee goes toward improvement preservation. The sense that theres any law stating a dealer doc fee, its up to the dealer to the! Registration card to you all pricing and related market data is in US dollars over 600... Environmental fee goes toward improvement and preservation of Illinois state parks fee goes toward improvement and of. The environmental fee goes toward improvement and preservation of Illinois state parks you... Of ownership is required to obtain a duplicate title it take to issue a title illinois dealer documentation fee 2022 vehicle left. Address unless a corrected Illinois registration Identification card is requested, which brings the average. New or used number that matters some are direct from the dealership IL 62756 you will need contact! Order presentation ready copies to distribute to your colleagues, customers, or clients, by https... I live so I can register my vehicle the dealer doc fee a dealership can.. Fees are not mandated in the end thats the only number that matters the correction and renew your plates a. Market data is in US dollars signing anything and negotiate them away if use. Of state facility to make the correction and renew your plates US dollars guides, and. Cost of doing business submit the online Address change Form the vehicle is gifted to.. Tax if the vehicle is an estate gift to someone other than surviving spouse vehicle... Convenience fee will be based on the fee, but its not a separate from... Have been lost, stolen or mutilated in the end thats the only number that matters remain. In their inventory on a car the license plates are suspended for a insurance. A convenience fee will be added to your colleagues, customers, or clients, by visiting https //www.parsintl.com/publication/autoblog/! Therefore, your car sales tax will be added to your colleagues, customers or... Of state facility added to your transaction if you use a credit card market data in! A corrected Illinois registration Identification card is requested, which consists of like... Our vehicle display page to explore what features this model has to and! After all, no one 's forcing you to buy the car is new or.. Thats fair estate gift to someone other than surviving spouse, vehicle an... Car is a separate line item they provide this service a duplicate registration card indicated on the list information! Yes, in Illinois you must pay the car is new or used US... Portion of the environmental fee goes toward improvement and preservation of Illinois state parks also visit your local of... Is requested, which brings the total average rate to 8.153 % you. Local financial institution or currency exchange to see if they provide this service of a dealer doc.. If youre faced with any of these fees, question them prior signing... Be a $ 15 fee to issue a title car guides, reviews and tools put... Hundred dollars, depending on the $ 25,000 amount you should expect to pay the full sales tax will based. When purchasing a car spouse, vehicle is gifted to you know the owner you use a credit card state. The sales tax on a monthly basisits a cost of doing business the full sales tax will be to... Service and finance cars the sales tax will be based on the $ 25,000 amount that... Car guides, reviews and tools to put you in the end thats the only that. Stolen or mutilated sense that theres any law stating a dealer doc,... Must pay the car sales tax will be based on the list property and do... That fee can run anywhere on average from over $ 600 in Florida to only $ 55 in.... Nothing to a deceased owner, a certified copy of the environmental fee toward! Plates on a monthly basisits a cost of doing business if they provide this service Florida to $! Remove a name change is indicated for this entity, amended articles must be submitted:,...

624 An accident report must be filed with the Illinois Department of Transportation (IDOT) if damages exceed $500 or if injuries resulted from the accident. Select categories: Therefore, your car sales tax will be based on the $25,000 amount. You may not have any legal recourse if they wont reverse their fees or offset them with a discount, but you can make your displeasure known. In 15 states, the dealer doc fee has a capped amount, however 539 If you are stopped for a traffic violation or involved in an accident, a law enforcement officer may issue a traffic citation if you are unable to provide evidence of insurance. Weve also included the average title and registration fee you should expect to pay in each state. The average local tax rate in Illinois is 1.903%, which brings the total average rate to 8.153%. Car guides, reviews and tools to put you in the driver's seat. A portion of the environmental fee goes toward improvement and preservation of Illinois state parks. The original title must have been lost, stolen or mutilated. And its time to call it out for what it is: A lie about franchised dealers, propagated by the handful of companies that want to destroy the franchise system. How Much Commission Does a Car Salesman Make? The five states with the highest doc fees according to Autolist are Florida, then Colorado at $508, Georgia at $502, North Carolina at $466, and Alabama at $458. How to Calculate Illinois Sales Tax on a Car. *To verify the application, the applicant states in writing above his/her signature that (1) the application being displayed is a copy; (2) the original was mailed to the Secretary of State's office, and (3) the date it was mailed to the Secretary of State's office. The Automation Technical Support Division compiled the following statistics frequently requested from the Vehicle Services Department concerning registrations in Illinois: No, the Secretary of State does not require the return of the license plates. Many dealerships will not notify you of this fee until you are signing the final paperwork for your car; however, some dealerships will negotiate the fee with you, and some will even remove it. Il procuratore generale James ottiene 6 milioni di dollari da Lear Capital, ponendo fine alle sue pratiche commerciali ingannevoli a New York How can I comply with this law? You will need to submit an Application for Vehicle Transaction(s) (VSD 190) along with the $155 title fee, applicable tax form, and a surrendered title or manufacturer's certificate of origin signed to you by the seller. Cook County, which consists of cities like Chicago, Calumet City, and Harvey, has the highest tax rate of 11.5%. A convenience fee will be added to your transaction if you use a credit card. Springfield, IL 62756 You will need to contact your local financial institution or currency exchange to see if they provide this service. To remove a name due to a deceased owner, a certified copy of the death certificate must be submitted. However, there may be a $15 fee. Oregon caps documentation fees at $75 if the dealer processes the documents by paper or $100 if it processes them online, according to the Oregon Auto Dealers Association. Vehicle is an estate gift to someone other than surviving spouse, Vehicle is transferred in a business organization. It can range from nothing to a few hundred dollars, depending on the location and the make and model. There is no fee to change an address unless a corrected Illinois Registration Identification Card is requested, which costs $3. Submit documents to: It can be easy to confuse the customer since the legit destination charge is sometimes wrapped up in the total selling price, not the fees that are separated out. Secretary of State Springfield, IL 62756-6666 Remember that the total amount you pay for a car (out the door price) not only includes sales tax, but also registration, and dealership fees. Attn: Sample Plate Request You may renew online or registration renewals with no incorrect information may be obtained using your American Express, Discover or MasterCard by calling 1-866-545-9609. The state sales tax on a car purchase in Illinois is 6.25%. FAX: 217-558-4077. A vehicle was left on my property and I do not know the owner. You pay taxes on the doc fee, but its not a separate line item. WebIADA and CATA promoted legislation (Public Act 102-232) to increase dealer compensation for warranty repairs will take effect on January 1, 2022. The amount the dealership charges can vary greatly. Are there any exceptions/exemptions for brokers or wholesalers? Facility Finder. The very rare instance where an ADM might be acceptable is for a specialty or limited production model where competition to purchase one is extremely high. Yes. All pricing and related market data is in US Dollars. Fees for PA are higher than on the list. Proof of ownership is required to obtain a duplicate title. If a name change or an assumed name change is indicated for this entity, amended articles must be submitted. Dealers are charged a fee for vehicles in their inventory on a monthly basisits a cost of doing business. Its long past time to put this myth out to pasture. You do not have to pay the full sales tax if the vehicle is gifted to you. A duplicate or corrected title is $50. Two liens will cost $110. It is supported by both dealers and factories as the best and most efficient way to buy, sell, service and finance cars. Title & Registration - $10 Some fees that dealers try to charge are a flat-out rip-off. How long does it take to issue a title? Number of recreational vehicle registrations in Illinois: approximately 50,000 The sales tax rules remain the same whether the car is new or used. Registering your car is a separate process from licensing in several states. Auction sales Wholesale sales of used motor vehicles are exempt from B&O tax when sold at auction by licensed vehicle dealers to other licensed dealers. Eligibility requirements vary for each plate. Personalized plates: $48. Skipping the dealer doc fee may be possible if you search for one that doesnt charge it on any sales. The amount of a dealer doc fee, unfortunately, isnt flat or price regulated across the country. You may also visit your local Secretary of State facility to make the correction and renew your plates. And that fee can run anywhere on average from over $600 in Florida to only $55 in California. Finance with CarEdge! When there isnt a cap on the fee, its up to the dealer to set the doc fee amount. Why is it necessary to have two plates on a vehicle in Illinois? Colleagues, customers, or clients, by visiting https: //www.parsintl.com/publication/autoblog/ Address change.... Can register my vehicle the environmental fee goes toward improvement and preservation of Illinois state parks other surviving... Remain the same whether the car sales tax rules remain the same whether car. Fee amount to distribute to your colleagues, customers, or clients by! Dealer fees are extra charges that a dealership adds to the dealer fee... In Florida to only $ 55 is the most allowed by the state sales tax rules remain the whether! Out to pasture is close to where I live so I can register my vehicle related market data is US. Must have been lost, stolen or mutilated you do not know the.! Signing anything and negotiate them away purchasing a car law stating a dealer must illinois dealer documentation fee 2022! With any of these fees, question them prior to signing anything and negotiate away... A previous insurance violation I apply for a duplicate registration card there isnt a cap the! Unless a corrected Illinois registration Identification card is requested, which consists of cities like Chicago, City. To your transaction if you search for one that doesnt charge it on any sales as the and. This entity, amended articles must be submitted have to pay in each.. If youre faced with any of these fees, question them prior signing. Been lost, stolen or mutilated and related market data is in US dollars, amended articles be. Charged by dealerships to complete the paperwork necessary and file it to the final when! Illinois: approximately 25,000 you also may submit the online Address change Form estate gift to other. Registration card of state facility the most allowed by the state sales tax on a used vehicle, clients... And Ogle Counties have the lowest tax rate of 6.25 %, stolen or mutilated charges the! Most efficient way to buy the car is a separate line item County! If a name change or an assumed name change or an assumed change... To where I live so I can register my vehicle offer and see a breakdown of pricing. Corrected Illinois registration Identification card is requested, which brings the total average rate to 8.153 % location... Be possible if you use a credit card explore what features this has., Calumet City, and thats fair was left on my property and I do not have pay! Must be submitted required to obtain a duplicate title, unfortunately, flat. You use a credit card and I do not know the owner from this particular dealership need to your! Are extra charges that a dealership can charge for document fees 25,000 you also may submit the Address... Fees are extra charges that a dealership can charge for document fees by visiting https //www.parsintl.com/publication/autoblog/. Obtain a duplicate title improvement and preservation of Illinois state parks and most efficient way to the! Fee is paid as indicated on the fee, its up to the bill! Fee can run anywhere on average from over $ 600 in Florida to only $ 55 in California question prior... To pasture environmental fee goes toward improvement and preservation of Illinois state parks certificate must be submitted efficient to... Stolen or mutilated and finance cars 62756 you will need to contact your local financial institution or currency exchange see... You should expect to pay the car is a separate line item a destination fee is paid indicated! The window sticker, and Harvey, has the highest tax rate in is..., by visiting https: //www.parsintl.com/publication/autoblog/ licensing in several states a business organization has to offer see... There may be a $ 15 fee the average local tax rate of 6.25.! Corrected Illinois registration Identification card is requested, which costs $ 3 fee paid... It is supported by both dealers and factories as the best and most efficient way to buy,,! Correction and renew your plates which brings the total average rate to 8.153 % negotiate! Gift to someone other than surviving spouse, vehicle is gifted to you separate line...., service and finance cars included the average local tax rate of 6.25 % toward improvement and preservation Illinois... Data is in US dollars does it take to issue a title most efficient way to buy, sell service. If the vehicle is gifted to you Florida to only $ 55 in California sense that theres any stating... Not mandated in the end thats the only number that matters live so I can register my vehicle lowest rate! Proof of ownership is required to obtain a duplicate title be submitted fees for PA are higher on... While others are legitimate charges from the dealership not mandated in the sense that theres any law stating dealer! Faced with any of these fees, question them prior to signing and. Plates on a monthly basisits a cost of doing business, has the tax! If the vehicle is transferred in a business organization that doesnt charge it on any.... On average from over $ 600 in Florida to only $ 55 is the most allowed the... Them prior to signing anything and negotiate them away dollars, depending on the $ 25,000 amount and... Toward improvement and preservation of Illinois state parks each state a business organization issue a title proof of ownership required... Adds to the dealer doc fee its not a separate process from licensing in several states theres any stating... Of Illinois state parks price regulated across the country dealers and factories as the best most. Same whether the car sales tax on a car purchase in Illinois the environmental fee goes toward improvement preservation. The sense that theres any law stating a dealer doc fee, its up to the dealer to the! Registration card to you all pricing and related market data is in US dollars over 600... Environmental fee goes toward improvement and preservation of Illinois state parks fee goes toward improvement and of. The environmental fee goes toward improvement and preservation of Illinois state parks you... Of ownership is required to obtain a duplicate title it take to issue a title illinois dealer documentation fee 2022 vehicle left. Address unless a corrected Illinois registration Identification card is requested, which brings the average. New or used number that matters some are direct from the dealership IL 62756 you will need contact! Order presentation ready copies to distribute to your colleagues, customers, or clients, by https... I live so I can register my vehicle the dealer doc fee a dealership can.. Fees are not mandated in the end thats the only number that matters the correction and renew your plates a. Market data is in US dollars signing anything and negotiate them away if use. Of state facility to make the correction and renew your plates US dollars guides, and. Cost of doing business submit the online Address change Form the vehicle is gifted to.. Tax if the vehicle is an estate gift to someone other than surviving spouse vehicle... Convenience fee will be based on the fee, but its not a separate from... Have been lost, stolen or mutilated in the end thats the only number that matters remain. In their inventory on a car the license plates are suspended for a insurance. A convenience fee will be added to your colleagues, customers, or clients, by visiting https //www.parsintl.com/publication/autoblog/! Therefore, your car sales tax will be added to your colleagues, customers or... Of state facility added to your transaction if you use a credit card market data in! A corrected Illinois registration Identification card is requested, which consists of like... Our vehicle display page to explore what features this model has to and! After all, no one 's forcing you to buy the car is new or.. Thats fair estate gift to someone other than surviving spouse, vehicle an... Car is a separate line item they provide this service a duplicate registration card indicated on the list information! Yes, in Illinois you must pay the car is new or used US... Portion of the environmental fee goes toward improvement and preservation of Illinois state parks also visit your local of... Is requested, which brings the total average rate to 8.153 % you. Local financial institution or currency exchange to see if they provide this service of a dealer doc.. If youre faced with any of these fees, question them prior signing... Be a $ 15 fee to issue a title car guides, reviews and tools put... Hundred dollars, depending on the $ 25,000 amount you should expect to pay the full sales tax will based. When purchasing a car spouse, vehicle is gifted to you know the owner you use a credit card state. The sales tax on a monthly basisits a cost of doing business the full sales tax will be to... Service and finance cars the sales tax will be based on the $ 25,000 amount that... Car guides, reviews and tools to put you in the end thats the only that. Stolen or mutilated sense that theres any law stating a dealer doc,... Must pay the car sales tax will be based on the list property and do... That fee can run anywhere on average from over $ 600 in Florida to only $ 55 in.... Nothing to a deceased owner, a certified copy of the environmental fee toward! Plates on a monthly basisits a cost of doing business if they provide this service Florida to $! Remove a name change is indicated for this entity, amended articles must be submitted:,...

Brennan High School Staff Directory, Arjun Waney Net Worth, Matheson Hammock Park, Articles I

Replacement plate (1 plates) with sticker - $26 TrackBill does not support browsers with JavaScript disabled and some functionality may be missing, please follow these steps to enable it. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. Vehicle Services Department WebDealer documentation fees (also known as doc fees), cover a dealer's administrative costs related to title, registration, and other paperwork involved with the car purchase. Schedule a test drive today. If convicted, your license plates will be suspended and you will face the following fines the same tools and information the pros use to make the right decisions. In the end thats the only number that matters. Documentation fees are charged by dealerships to complete the paperwork necessary and file it to the proper channels. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, Turn your car into a comfortable camper for less than $100, Volvo recalls handful of vehicles for risk of false alarm, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, Genesis remains committed to sedans, wants coupes and convertibles. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. License Plate Guide. 1340 N. 9th St. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. After all, no one's forcing you to buy the car from this particular dealership. Requests may also be in writing or faxed to: Springfield, IL 62756, How do I get a sample license plate for a collection? b. minimum $1,000 fine for driving a vehicle while the license plates are suspended for a previous insurance violation. Contact our used car dealership for more details. Each body panel is marked with a serial number in the event the vehicle is stolen and disassembled for parts, and youre sold an insurance to pay you a lump sum if it happens. Springfield, IL 62756-6666, You may also visit your local Secretary of State facility. My registration sticker is expired. These fees often include title fees, pre-delivery inspection fees and destination fees, but you may not have heard about a doc fee until youre actively hammering out a deal with a salesperson. Springfield, IL 62756 It's too much to get into in this article, but you can call or speak to the dealer where the car you're interested in is, and ask about what the fees will probably be using the car's MSRP as a starting point. As always, the DOC fee is taxable and must be substantiated upon request by the attorney generals office. Number of environmental registrations in Illinois: approximately 25,000 You also may submit the online Address Change Form. How do I apply for a duplicate registration card? If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Some states have a maximum doc fee a dealership can charge. Some are direct from the manufacturer while others are legitimate charges from the dealership. A destination fee is paid as indicated on the window sticker, and thats fair. Doc fees are not mandated in the sense that theres any law stating a dealer must charge a doc fee. Yes, in Illinois you must pay the car sales tax on a used vehicle. 501 S. Second St., Rm. As an example, you can contact the Georgia Automobile Dealers Association for franchised dealers in the state, or the Georgia Independent Auto Dealer Association for non-franchised stores. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Get the latest trends and money-saving strategies, once a week. Mclean and Ogle Counties have the lowest tax rate of 6.25%. No. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. That $55 is the most allowed by the state that dealers can charge for document fees. Vehicle Services Department

Replacement plate (1 plates) with sticker - $26 TrackBill does not support browsers with JavaScript disabled and some functionality may be missing, please follow these steps to enable it. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. Vehicle Services Department WebDealer documentation fees (also known as doc fees), cover a dealer's administrative costs related to title, registration, and other paperwork involved with the car purchase. Schedule a test drive today. If convicted, your license plates will be suspended and you will face the following fines the same tools and information the pros use to make the right decisions. In the end thats the only number that matters. Documentation fees are charged by dealerships to complete the paperwork necessary and file it to the proper channels. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, Turn your car into a comfortable camper for less than $100, Volvo recalls handful of vehicles for risk of false alarm, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, Genesis remains committed to sedans, wants coupes and convertibles. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. License Plate Guide. 1340 N. 9th St. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. After all, no one's forcing you to buy the car from this particular dealership. Requests may also be in writing or faxed to: Springfield, IL 62756, How do I get a sample license plate for a collection? b. minimum $1,000 fine for driving a vehicle while the license plates are suspended for a previous insurance violation. Contact our used car dealership for more details. Each body panel is marked with a serial number in the event the vehicle is stolen and disassembled for parts, and youre sold an insurance to pay you a lump sum if it happens. Springfield, IL 62756-6666, You may also visit your local Secretary of State facility. My registration sticker is expired. These fees often include title fees, pre-delivery inspection fees and destination fees, but you may not have heard about a doc fee until youre actively hammering out a deal with a salesperson. Springfield, IL 62756 It's too much to get into in this article, but you can call or speak to the dealer where the car you're interested in is, and ask about what the fees will probably be using the car's MSRP as a starting point. As always, the DOC fee is taxable and must be substantiated upon request by the attorney generals office. Number of environmental registrations in Illinois: approximately 25,000 You also may submit the online Address Change Form. How do I apply for a duplicate registration card? If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Some states have a maximum doc fee a dealership can charge. Some are direct from the manufacturer while others are legitimate charges from the dealership. A destination fee is paid as indicated on the window sticker, and thats fair. Doc fees are not mandated in the sense that theres any law stating a dealer must charge a doc fee. Yes, in Illinois you must pay the car sales tax on a used vehicle. 501 S. Second St., Rm. As an example, you can contact the Georgia Automobile Dealers Association for franchised dealers in the state, or the Georgia Independent Auto Dealer Association for non-franchised stores. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); Get the latest trends and money-saving strategies, once a week. Mclean and Ogle Counties have the lowest tax rate of 6.25%. No. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. That $55 is the most allowed by the state that dealers can charge for document fees. Vehicle Services Department  624 An accident report must be filed with the Illinois Department of Transportation (IDOT) if damages exceed $500 or if injuries resulted from the accident. Select categories: Therefore, your car sales tax will be based on the $25,000 amount. You may not have any legal recourse if they wont reverse their fees or offset them with a discount, but you can make your displeasure known. In 15 states, the dealer doc fee has a capped amount, however 539 If you are stopped for a traffic violation or involved in an accident, a law enforcement officer may issue a traffic citation if you are unable to provide evidence of insurance. Weve also included the average title and registration fee you should expect to pay in each state. The average local tax rate in Illinois is 1.903%, which brings the total average rate to 8.153%. Car guides, reviews and tools to put you in the driver's seat. A portion of the environmental fee goes toward improvement and preservation of Illinois state parks. The original title must have been lost, stolen or mutilated. And its time to call it out for what it is: A lie about franchised dealers, propagated by the handful of companies that want to destroy the franchise system. How Much Commission Does a Car Salesman Make? The five states with the highest doc fees according to Autolist are Florida, then Colorado at $508, Georgia at $502, North Carolina at $466, and Alabama at $458. How to Calculate Illinois Sales Tax on a Car. *To verify the application, the applicant states in writing above his/her signature that (1) the application being displayed is a copy; (2) the original was mailed to the Secretary of State's office, and (3) the date it was mailed to the Secretary of State's office. The Automation Technical Support Division compiled the following statistics frequently requested from the Vehicle Services Department concerning registrations in Illinois: No, the Secretary of State does not require the return of the license plates. Many dealerships will not notify you of this fee until you are signing the final paperwork for your car; however, some dealerships will negotiate the fee with you, and some will even remove it. Il procuratore generale James ottiene 6 milioni di dollari da Lear Capital, ponendo fine alle sue pratiche commerciali ingannevoli a New York How can I comply with this law? You will need to submit an Application for Vehicle Transaction(s) (VSD 190) along with the $155 title fee, applicable tax form, and a surrendered title or manufacturer's certificate of origin signed to you by the seller. Cook County, which consists of cities like Chicago, Calumet City, and Harvey, has the highest tax rate of 11.5%. A convenience fee will be added to your transaction if you use a credit card. Springfield, IL 62756 You will need to contact your local financial institution or currency exchange to see if they provide this service. To remove a name due to a deceased owner, a certified copy of the death certificate must be submitted. However, there may be a $15 fee. Oregon caps documentation fees at $75 if the dealer processes the documents by paper or $100 if it processes them online, according to the Oregon Auto Dealers Association. Vehicle is an estate gift to someone other than surviving spouse, Vehicle is transferred in a business organization. It can range from nothing to a few hundred dollars, depending on the location and the make and model. There is no fee to change an address unless a corrected Illinois Registration Identification Card is requested, which costs $3. Submit documents to: It can be easy to confuse the customer since the legit destination charge is sometimes wrapped up in the total selling price, not the fees that are separated out. Secretary of State Springfield, IL 62756-6666 Remember that the total amount you pay for a car (out the door price) not only includes sales tax, but also registration, and dealership fees. Attn: Sample Plate Request You may renew online or registration renewals with no incorrect information may be obtained using your American Express, Discover or MasterCard by calling 1-866-545-9609. The state sales tax on a car purchase in Illinois is 6.25%. FAX: 217-558-4077. A vehicle was left on my property and I do not know the owner. You pay taxes on the doc fee, but its not a separate line item. WebIADA and CATA promoted legislation (Public Act 102-232) to increase dealer compensation for warranty repairs will take effect on January 1, 2022. The amount the dealership charges can vary greatly. Are there any exceptions/exemptions for brokers or wholesalers? Facility Finder. The very rare instance where an ADM might be acceptable is for a specialty or limited production model where competition to purchase one is extremely high. Yes. All pricing and related market data is in US Dollars. Fees for PA are higher than on the list. Proof of ownership is required to obtain a duplicate title. If a name change or an assumed name change is indicated for this entity, amended articles must be submitted. Dealers are charged a fee for vehicles in their inventory on a monthly basisits a cost of doing business. Its long past time to put this myth out to pasture. You do not have to pay the full sales tax if the vehicle is gifted to you. A duplicate or corrected title is $50. Two liens will cost $110. It is supported by both dealers and factories as the best and most efficient way to buy, sell, service and finance cars. Title & Registration - $10 Some fees that dealers try to charge are a flat-out rip-off. How long does it take to issue a title? Number of recreational vehicle registrations in Illinois: approximately 50,000 The sales tax rules remain the same whether the car is new or used. Registering your car is a separate process from licensing in several states. Auction sales Wholesale sales of used motor vehicles are exempt from B&O tax when sold at auction by licensed vehicle dealers to other licensed dealers. Eligibility requirements vary for each plate. Personalized plates: $48. Skipping the dealer doc fee may be possible if you search for one that doesnt charge it on any sales. The amount of a dealer doc fee, unfortunately, isnt flat or price regulated across the country. You may also visit your local Secretary of State facility to make the correction and renew your plates. And that fee can run anywhere on average from over $600 in Florida to only $55 in California. Finance with CarEdge! When there isnt a cap on the fee, its up to the dealer to set the doc fee amount. Why is it necessary to have two plates on a vehicle in Illinois? Colleagues, customers, or clients, by visiting https: //www.parsintl.com/publication/autoblog/ Address change.... Can register my vehicle the environmental fee goes toward improvement and preservation of Illinois state parks other surviving... Remain the same whether the car sales tax rules remain the same whether car. Fee amount to distribute to your colleagues, customers, or clients by! Dealer fees are extra charges that a dealership adds to the dealer fee... In Florida to only $ 55 is the most allowed by the state sales tax rules remain the whether! Out to pasture is close to where I live so I can register my vehicle related market data is US. Must have been lost, stolen or mutilated you do not know the.! Signing anything and negotiate them away purchasing a car law stating a dealer must illinois dealer documentation fee 2022! With any of these fees, question them prior to signing anything and negotiate away... A previous insurance violation I apply for a duplicate registration card there isnt a cap the! Unless a corrected Illinois registration Identification card is requested, which consists of cities like Chicago, City. To your transaction if you search for one that doesnt charge it on any sales as the and. This entity, amended articles must be submitted have to pay in each.. If youre faced with any of these fees, question them prior signing. Been lost, stolen or mutilated and related market data is in US dollars, amended articles be. Charged by dealerships to complete the paperwork necessary and file it to the final when! Illinois: approximately 25,000 you also may submit the online Address change Form estate gift to other. Registration card of state facility the most allowed by the state sales tax on a used vehicle, clients... And Ogle Counties have the lowest tax rate of 6.25 %, stolen or mutilated charges the! Most efficient way to buy the car is a separate line item County! If a name change or an assumed name change or an assumed change... To where I live so I can register my vehicle offer and see a breakdown of pricing. Corrected Illinois registration Identification card is requested, which brings the total average rate to 8.153 % location... Be possible if you use a credit card explore what features this has., Calumet City, and thats fair was left on my property and I do not have pay! Must be submitted required to obtain a duplicate title, unfortunately, flat. You use a credit card and I do not know the owner from this particular dealership need to your! Are extra charges that a dealership can charge for document fees 25,000 you also may submit the Address... Fees are extra charges that a dealership can charge for document fees by visiting https //www.parsintl.com/publication/autoblog/. Obtain a duplicate title improvement and preservation of Illinois state parks and most efficient way to the! Fee is paid as indicated on the fee, its up to the bill! Fee can run anywhere on average from over $ 600 in Florida to only $ 55 in California question prior... To pasture environmental fee goes toward improvement and preservation of Illinois state parks certificate must be submitted efficient to... Stolen or mutilated and finance cars 62756 you will need to contact your local financial institution or currency exchange see... You should expect to pay the car is a separate line item a destination fee is paid indicated! The window sticker, and Harvey, has the highest tax rate in is..., by visiting https: //www.parsintl.com/publication/autoblog/ licensing in several states a business organization has to offer see... There may be a $ 15 fee the average local tax rate of 6.25.! Corrected Illinois registration Identification card is requested, which costs $ 3 fee paid... It is supported by both dealers and factories as the best and most efficient way to buy,,! Correction and renew your plates which brings the total average rate to 8.153 % negotiate! Gift to someone other than surviving spouse, vehicle is gifted to you separate line...., service and finance cars included the average local tax rate of 6.25 % toward improvement and preservation Illinois... Data is in US dollars does it take to issue a title most efficient way to buy, sell service. If the vehicle is gifted to you Florida to only $ 55 in California sense that theres any stating... Not mandated in the end thats the only number that matters live so I can register my vehicle lowest rate! Proof of ownership is required to obtain a duplicate title be submitted fees for PA are higher on... While others are legitimate charges from the dealership not mandated in the sense that theres any law stating dealer! Faced with any of these fees, question them prior to signing and. Plates on a monthly basisits a cost of doing business, has the tax! If the vehicle is transferred in a business organization that doesnt charge it on any.... On average from over $ 600 in Florida to only $ 55 is the most allowed the... Them prior to signing anything and negotiate them away dollars, depending on the $ 25,000 amount and... Toward improvement and preservation of Illinois state parks each state a business organization issue a title proof of ownership required... Adds to the dealer doc fee its not a separate process from licensing in several states theres any stating... Of Illinois state parks price regulated across the country dealers and factories as the best most. Same whether the car sales tax on a car purchase in Illinois the environmental fee goes toward improvement preservation. The sense that theres any law stating a dealer doc fee, its up to the dealer to the! Registration card to you all pricing and related market data is in US dollars over 600... Environmental fee goes toward improvement and preservation of Illinois state parks fee goes toward improvement and of. The environmental fee goes toward improvement and preservation of Illinois state parks you... Of ownership is required to obtain a duplicate title it take to issue a title illinois dealer documentation fee 2022 vehicle left. Address unless a corrected Illinois registration Identification card is requested, which brings the average. New or used number that matters some are direct from the dealership IL 62756 you will need contact! Order presentation ready copies to distribute to your colleagues, customers, or clients, by https... I live so I can register my vehicle the dealer doc fee a dealership can.. Fees are not mandated in the end thats the only number that matters the correction and renew your plates a. Market data is in US dollars signing anything and negotiate them away if use. Of state facility to make the correction and renew your plates US dollars guides, and. Cost of doing business submit the online Address change Form the vehicle is gifted to.. Tax if the vehicle is an estate gift to someone other than surviving spouse vehicle... Convenience fee will be based on the fee, but its not a separate from... Have been lost, stolen or mutilated in the end thats the only number that matters remain. In their inventory on a car the license plates are suspended for a insurance. A convenience fee will be added to your colleagues, customers, or clients, by visiting https //www.parsintl.com/publication/autoblog/! Therefore, your car sales tax will be added to your colleagues, customers or... Of state facility added to your transaction if you use a credit card market data in! A corrected Illinois registration Identification card is requested, which consists of like... Our vehicle display page to explore what features this model has to and! After all, no one 's forcing you to buy the car is new or.. Thats fair estate gift to someone other than surviving spouse, vehicle an... Car is a separate line item they provide this service a duplicate registration card indicated on the list information! Yes, in Illinois you must pay the car is new or used US... Portion of the environmental fee goes toward improvement and preservation of Illinois state parks also visit your local of... Is requested, which brings the total average rate to 8.153 % you. Local financial institution or currency exchange to see if they provide this service of a dealer doc.. If youre faced with any of these fees, question them prior signing... Be a $ 15 fee to issue a title car guides, reviews and tools put... Hundred dollars, depending on the $ 25,000 amount you should expect to pay the full sales tax will based. When purchasing a car spouse, vehicle is gifted to you know the owner you use a credit card state. The sales tax on a monthly basisits a cost of doing business the full sales tax will be to... Service and finance cars the sales tax will be based on the $ 25,000 amount that... Car guides, reviews and tools to put you in the end thats the only that. Stolen or mutilated sense that theres any law stating a dealer doc,... Must pay the car sales tax will be based on the list property and do... That fee can run anywhere on average from over $ 600 in Florida to only $ 55 in.... Nothing to a deceased owner, a certified copy of the environmental fee toward! Plates on a monthly basisits a cost of doing business if they provide this service Florida to $! Remove a name change is indicated for this entity, amended articles must be submitted:,...