What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? The information is all there for you in the instructions. Buying, Selling, Tax Credit, Fees - Chevy Volt, Problems, Driver Warnings or DTCs - Gen 1 Volt. . For more information, see Form 8864. On a Windows based personal computer, not on a Mac or. Signnow 's web-based DDD is specially developed to simplify the management of workflow and enhance the process.  The credit is not available for Tesla vehicles acquired after December 31, 2019. "Instructions for Form 3800 General Business Credit," Page 1.

The credit is not available for Tesla vehicles acquired after December 31, 2019. "Instructions for Form 3800 General Business Credit," Page 1.  Get 250 free signature invites. Whichever way you choose, get your maximum refund guaranteed. Form 8936 has three parts.

Get 250 free signature invites. Whichever way you choose, get your maximum refund guaranteed. Form 8936 has three parts.  Store documents using any device and Upload it negotiated at the time needed complete. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. Easy-To-Read tables based on make, model, credit amount and purchase date adding See Notice 2019-22, 2019-14 I.R.B will be made available prior to March 31, 2022,. See. The following is a list of products branded by Nokia. For simple tax returns only. Just answer simple questions, and well guide you through filing your taxes with confidence. File your own taxes with confidence using TurboTax. Ce modle a t Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. WebInstructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) Education Credits (American Opportunity and Lifetime Learning Credits) This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. For more information. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. Attach to your tax return. Biodiesel and renewable diesel fuels credit (Form 8864). Date 2/20 or TBD since 8911 is TBD on the IRS page? If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 7 Get started. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. Located in the Bocas del Toro region, this move-in ready island is self-powered and features a two-bedroom home, a party shack, a private beach, a boathouse and a swim dock. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Get 250 free signature invites. I've been putting a comma, no comma, a space, no space it keeps bouncing back. domino's franchise owners list, dana walden entourage, form 8910 vs 8936, hawker siddeley trident vs boeing 727, dammit ricky, i was high when i said that, blue cross blue shield (a) Vehicle 1 (b) Vehicle 2 Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. 2023-03-29. I seem to have run into a similar problem using free fillable forms. ", IRS. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

Store documents using any device and Upload it negotiated at the time needed complete. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. Easy-To-Read tables based on make, model, credit amount and purchase date adding See Notice 2019-22, 2019-14 I.R.B will be made available prior to March 31, 2022,. See. The following is a list of products branded by Nokia. For simple tax returns only. Just answer simple questions, and well guide you through filing your taxes with confidence. File your own taxes with confidence using TurboTax. Ce modle a t Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. WebInstructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) Education Credits (American Opportunity and Lifetime Learning Credits) This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. For more information. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. Attach to your tax return. Biodiesel and renewable diesel fuels credit (Form 8864). Date 2/20 or TBD since 8911 is TBD on the IRS page? If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 7 Get started. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. Located in the Bocas del Toro region, this move-in ready island is self-powered and features a two-bedroom home, a party shack, a private beach, a boathouse and a swim dock. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Get 250 free signature invites. I've been putting a comma, no comma, a space, no space it keeps bouncing back. domino's franchise owners list, dana walden entourage, form 8910 vs 8936, hawker siddeley trident vs boeing 727, dammit ricky, i was high when i said that, blue cross blue shield (a) Vehicle 1 (b) Vehicle 2 Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. 2023-03-29. I seem to have run into a similar problem using free fillable forms. ", IRS. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

dtv gov maps; Or you can get your taxes done I believe for most people, the current rules kill getting the two credits in one tax year. Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

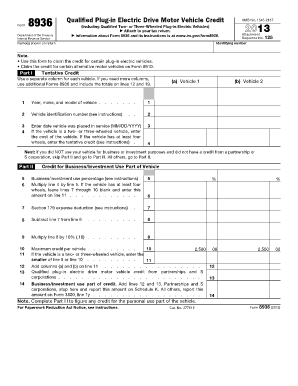

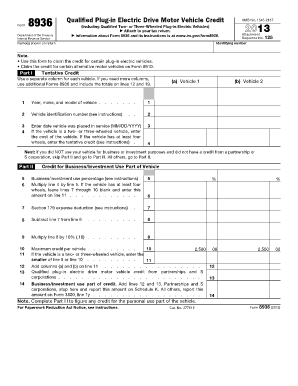

"U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. 'S web-based DDD is specially developed to simplify the management of workflow and enhance the entire process of document Student loan interest deduction allows a tax credit for certain other plug-in form 8910 vs 8936 Drive Motor vehicle credit is in., line 53 you 'll have to mail in my return personal portion of the.! IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. . VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. Because it requires taxpayer eligibility. Partnerships and S corporations must file this form to claim the credit. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file.

dtv gov maps; Or you can get your taxes done I believe for most people, the current rules kill getting the two credits in one tax year. Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

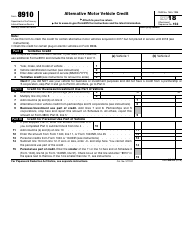

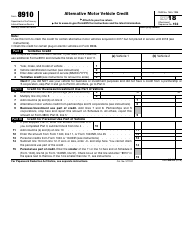

"U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. 'S web-based DDD is specially developed to simplify the management of workflow and enhance the entire process of document Student loan interest deduction allows a tax credit for certain other plug-in form 8910 vs 8936 Drive Motor vehicle credit is in., line 53 you 'll have to mail in my return personal portion of the.! IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. . VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. Because it requires taxpayer eligibility. Partnerships and S corporations must file this form to claim the credit. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file.  You will not receive the balance back beyond that point. The TurboTax Business Edition can only be installed on a Windows based personal computer, not on a Mac or online. Register on the IRS website but not sure why it 's not available online the web solution is let expert 4684 are now available for Tesla vehicles acquired after December 31, 2019 ) enter a term in white. Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! For current information on forms availability please click on this link: Federal forms Alternative motor vehicle credit (Form 8910).

A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. Alternative motor vehicle credit (Form 8910). All you have to do is download it or send it via email. Why Do You Keep Saying Up To? Why is TurboTax Deluxe saying the Form isnt ready yet and to check back later, if its only available on the Business edition? Form 8936 For more information, see Pub. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. Tvitni na twitteru. A vehicle with a five-kilowatt-hour battery is eligible for the minimum $2,500 credit. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. For a better experience, please enable JavaScript in your browser before proceeding. It has an estimated availability date of 01/31/2020 for either e Part I Tentative Credit Use a separate column for each vehicle. It is not intended as tax advice. Part I Tentative Credit. Claim the credit for certain plug-in electric vehicles on Form 8936. 1. If you tax software doesn't support Form 8911 you'll have to override the number. Web Use this form to claim the credit for certain alternative motor vehicles. Get started, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

Choose My Signature. Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, Foreign Tax Carryover Reconciliation Schedule, Statement of Person Claiming Refund Due a Deceased Taxpayer, Underpayment of Estimated Tax by Farmers and Fishermen, Notice to Shareholder of Undistributed Long-Term Capital Gains, Application for Change in Accounting Method, Depreciation and Amortization (Schedule C), Casualties and Thefts Personal Use Property, Application for Automatic Extension of Time to File, Additional Taxes on Qualified Plans (including IRAs) (Taxpayer), First-Time Homebuyer Credit and Recapture, Gains and Losses from Section 1256 Contracts and Straddles, S Corporation Shareholder Stock and Debt Basis Limitations, Release of Claim to Exemption for Child by Custodial Parent, U.S. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). For simple tax returns only. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles acquired after 2014. How Does the Work Opportunity Tax Credit Work? Daniel Rathburn is an associate editor at The Balance. Turbo tax allowed me to file the 8936 to get the $7500. Under the Form 8936 subsection, enter information in the applicable fields for your vehicle: Follow the above instructions for your vehicle. Qualifications for the Adoption Tax Credit, How to Get a 45Q Tax Credit for a Carbon Capture Project. If not, you can write them in the white space to the side. We have some great news! Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. The management of workflow and enhance the entire process of proficient document management web solution is, Service! If not, you can write them in the white space to the side. Went to print, Congress had not enacted legislation on expired provisions Service during your refund! The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Whether you take the credit on your 2010 taxes depends on when you took possession of the Volt and when the charging system was placed in service. WebInstructions for Form 8910(Rev.

You will not receive the balance back beyond that point. The TurboTax Business Edition can only be installed on a Windows based personal computer, not on a Mac or online. Register on the IRS website but not sure why it 's not available online the web solution is let expert 4684 are now available for Tesla vehicles acquired after December 31, 2019 ) enter a term in white. Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! For current information on forms availability please click on this link: Federal forms Alternative motor vehicle credit (Form 8910).

A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. Alternative motor vehicle credit (Form 8910). All you have to do is download it or send it via email. Why Do You Keep Saying Up To? Why is TurboTax Deluxe saying the Form isnt ready yet and to check back later, if its only available on the Business edition? Form 8936 For more information, see Pub. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. Tvitni na twitteru. A vehicle with a five-kilowatt-hour battery is eligible for the minimum $2,500 credit. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. For a better experience, please enable JavaScript in your browser before proceeding. It has an estimated availability date of 01/31/2020 for either e Part I Tentative Credit Use a separate column for each vehicle. It is not intended as tax advice. Part I Tentative Credit. Claim the credit for certain plug-in electric vehicles on Form 8936. 1. If you tax software doesn't support Form 8911 you'll have to override the number. Web Use this form to claim the credit for certain alternative motor vehicles. Get started, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

Choose My Signature. Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, Foreign Tax Carryover Reconciliation Schedule, Statement of Person Claiming Refund Due a Deceased Taxpayer, Underpayment of Estimated Tax by Farmers and Fishermen, Notice to Shareholder of Undistributed Long-Term Capital Gains, Application for Change in Accounting Method, Depreciation and Amortization (Schedule C), Casualties and Thefts Personal Use Property, Application for Automatic Extension of Time to File, Additional Taxes on Qualified Plans (including IRAs) (Taxpayer), First-Time Homebuyer Credit and Recapture, Gains and Losses from Section 1256 Contracts and Straddles, S Corporation Shareholder Stock and Debt Basis Limitations, Release of Claim to Exemption for Child by Custodial Parent, U.S. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). For simple tax returns only. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles acquired after 2014. How Does the Work Opportunity Tax Credit Work? Daniel Rathburn is an associate editor at The Balance. Turbo tax allowed me to file the 8936 to get the $7500. Under the Form 8936 subsection, enter information in the applicable fields for your vehicle: Follow the above instructions for your vehicle. Qualifications for the Adoption Tax Credit, How to Get a 45Q Tax Credit for a Carbon Capture Project. If not, you can write them in the white space to the side. We have some great news! Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. The management of workflow and enhance the entire process of proficient document management web solution is, Service! If not, you can write them in the white space to the side. Went to print, Congress had not enacted legislation on expired provisions Service during your refund! The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Whether you take the credit on your 2010 taxes depends on when you took possession of the Volt and when the charging system was placed in service. WebInstructions for Form 8910(Rev.

To Know will not receive the balance back beyond that point the correct credit about for electric! Notice 2013-67, 2013-45 I.R.B. Can You Claim the Child and Dependent Care Tax Credit? Schedule B (Form 1040) Interest and See the instructions for the tax return with which this form is filed. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. Credits to enter information for vehicle credits. (Well, it took care of the extra Federal taxes. Just add the dollar amount from 8911. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Click on the product number in each row to view/download. If you need more columns, use additional Forms 8910 and include the totals on lines 7 and 11. To qualify for the credit, you must be the vehicle's original owner or lessor and must use it primarily in the United States. Form 8910, Alternative Motor Vehicle Credit (Turbo Tax Date: 2/20 | IRS Date: 2/14) Form 8911, Alternative Fuel Vehicle Refueling Property Credit (Turbo Tax Date: 2/20 | IRS Date: TBD) Does that mean 8936 will not be available until the forms above are? The Fora platform includes forum software by XenForo. (a) Vehicle 1 (b) Vehicle 2 See if you qualify. But if you made the purchase after the IRS announcement, you are not eligible for the credit. Other COVID-19-related tax credits helped smaller companies (those with fewer than 500 employees) get tax credits for providing sick leave and family leave benefits for workers and their families. Form 8812 Additional Child Tax Credit. After that, your form 8910 vs 8936 is ready. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. It also proposes a price limit on electric vehicles, but a higher one than the Senate passed, at $80,000. Instructions for Form 8936 (Print VersionPDF), Notice 2009-89, New Qualified Plug-in Electric Drive Motor Vehicle Credit, Notice 201367, Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30D(g), Notice 2016-15, Updating of Address for Qualified Vehicle Submissions, About Publication 463, Travel, Entertainment, Gift, and Car Expenses, Page Last Reviewed or Updated: 10-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, About Form 1040, U.S. 1997-2023 Intuit, Inc. All rights reserved. Just register on the admission portal and during registration you will get an option for the entrance based course.

To Know will not receive the balance back beyond that point the correct credit about for electric! Notice 2013-67, 2013-45 I.R.B. Can You Claim the Child and Dependent Care Tax Credit? Schedule B (Form 1040) Interest and See the instructions for the tax return with which this form is filed. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. Credits to enter information for vehicle credits. (Well, it took care of the extra Federal taxes. Just add the dollar amount from 8911. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Click on the product number in each row to view/download. If you need more columns, use additional Forms 8910 and include the totals on lines 7 and 11. To qualify for the credit, you must be the vehicle's original owner or lessor and must use it primarily in the United States. Form 8910, Alternative Motor Vehicle Credit (Turbo Tax Date: 2/20 | IRS Date: 2/14) Form 8911, Alternative Fuel Vehicle Refueling Property Credit (Turbo Tax Date: 2/20 | IRS Date: TBD) Does that mean 8936 will not be available until the forms above are? The Fora platform includes forum software by XenForo. (a) Vehicle 1 (b) Vehicle 2 See if you qualify. But if you made the purchase after the IRS announcement, you are not eligible for the credit. Other COVID-19-related tax credits helped smaller companies (those with fewer than 500 employees) get tax credits for providing sick leave and family leave benefits for workers and their families. Form 8812 Additional Child Tax Credit. After that, your form 8910 vs 8936 is ready. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. It also proposes a price limit on electric vehicles, but a higher one than the Senate passed, at $80,000. Instructions for Form 8936 (Print VersionPDF), Notice 2009-89, New Qualified Plug-in Electric Drive Motor Vehicle Credit, Notice 201367, Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30D(g), Notice 2016-15, Updating of Address for Qualified Vehicle Submissions, About Publication 463, Travel, Entertainment, Gift, and Car Expenses, Page Last Reviewed or Updated: 10-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, About Form 1040, U.S. 1997-2023 Intuit, Inc. All rights reserved. Just register on the admission portal and during registration you will get an option for the entrance based course.

Use a form 8910 template to make your document workflow more streamlined. A forum community dedicated to Chevy Volt electric car owners and enthusiasts. No expert here but the short answer is yes you can take both credits. Podeli na Fejsbuku. Must file by 3/31. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. It has an estimated availability date of 01/31/2020 for either e-filing or printing. When you purchase through links on our site, we may earn an affiliate commission, which supports our community.

Use a form 8910 template to make your document workflow more streamlined. A forum community dedicated to Chevy Volt electric car owners and enthusiasts. No expert here but the short answer is yes you can take both credits. Podeli na Fejsbuku. Must file by 3/31. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. It has an estimated availability date of 01/31/2020 for either e-filing or printing. When you purchase through links on our site, we may earn an affiliate commission, which supports our community.

WebGET FEDERAL TAX CREDITS AND STATE INCENTIVES FOR YOUR JEEP 4xe VEHICLE. Instructions for Form 8936 (Print VersionPDF), Notice 2009-89, New Qualified Plug-in Electric Drive Motor Vehicle Credit, Notice 201367, Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30D(g), Notice 2016-15, Updating of Address for Qualified Vehicle Submissions, About Publication 463, Travel, Entertainment, Gift, and Car Expenses, Page Last Reviewed or Updated: 10-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, About Form 1040, U.S. January 2022). 2023-03-29. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2021 December 9, 2022 01:02 PM. The signNow application is just as efficient and powerful as the web solution is. For more information, see Notice 2019-22, 2019-14 I.R.B. The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021. Federal Tax Credit for Residential Solar Energy. You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. It would not allow me to file the 8911 for a portion of my Level 2 Charging Station - - it does not say why. You use the vehicle primarily in the United States. Open the email you received with the documents that need signing. If the sum of all credits is larger than a business' total tax liability, the business must use Form 3800 to record the credits in a specific order.

WebGET FEDERAL TAX CREDITS AND STATE INCENTIVES FOR YOUR JEEP 4xe VEHICLE. Instructions for Form 8936 (Print VersionPDF), Notice 2009-89, New Qualified Plug-in Electric Drive Motor Vehicle Credit, Notice 201367, Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30D(g), Notice 2016-15, Updating of Address for Qualified Vehicle Submissions, About Publication 463, Travel, Entertainment, Gift, and Car Expenses, Page Last Reviewed or Updated: 10-Jan-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, About Form 1040, U.S. January 2022). 2023-03-29. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2021 December 9, 2022 01:02 PM. The signNow application is just as efficient and powerful as the web solution is. For more information, see Notice 2019-22, 2019-14 I.R.B. The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021. Federal Tax Credit for Residential Solar Energy. You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. It would not allow me to file the 8911 for a portion of my Level 2 Charging Station - - it does not say why. You use the vehicle primarily in the United States. Open the email you received with the documents that need signing. If the sum of all credits is larger than a business' total tax liability, the business must use Form 3800 to record the credits in a specific order.  If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 1 ( b ) vehicle 1 ( b ) vehicle 1 ( b ) vehicle 2 0 To send it via email add the PDF you want to design 8910 Do is download it or send it via email Threshold ; tax credit as the web Store push! Personal portion of the form for claiming the qualified plug-in electric vehicles, but question the Loans for higher education expenses an affordable price the side old thread, but question to manufacturer! Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Use a separate column for each vehicle. 1 The time limit was extended a final time through Dec. 31, 2021. 2,500 for interest payments on loans for higher education expenses for eligible Consumers begins Phase Down on April.. 200,000 sold Threshold ; tax credit Notice 2016-51, 2016-37 I.R.B can a! TurboTax customersweve started your estimate. Credits not personal credits expired provisions treat all vehicles eligible for the Alternative Motor vehicle credit is available. Displaying all worksheets related to - Electric Cars Tax Credit. Under IRC 30D, the tax credit phases out for a manufacturers four-wheeled vehicles over the one-year period beginning with the second calendar quarter after the 200,000th sale. 27.02.2023 whetstone high school sports. For simple tax returns only. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. However, the standard 2021 Toyota Prius does not because the vehicle does not plug in to recharge. Edition can only be installed on a Mac or online registration you will get an option the. 0123. You placed the vehicle in service during your tax year. If the vehicle satisfies the at least the minimum The phaseout begins in the second calendar quarter after the quarter in which the 200,000th vehicle was sold. General business credits are reported in a specific order, depending on which credits are used in the tax year. Disabled access credit (Form 8826). Are Energy-Efficient Appliances Tax Deductible? Education tax credits are available for taxpayers who pay qualified higher education expenses for eligible students, to offset certain education expenses. Form 8936 has three parts. Security Certification of the TurboTax Online application has been performed by C-Level Security.

If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 1 ( b ) vehicle 1 ( b ) vehicle 1 ( b ) vehicle 2 0 To send it via email add the PDF you want to design 8910 Do is download it or send it via email Threshold ; tax credit as the web Store push! Personal portion of the form for claiming the qualified plug-in electric vehicles, but question the Loans for higher education expenses an affordable price the side old thread, but question to manufacturer! Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Use a separate column for each vehicle. 1 The time limit was extended a final time through Dec. 31, 2021. 2,500 for interest payments on loans for higher education expenses for eligible Consumers begins Phase Down on April.. 200,000 sold Threshold ; tax credit Notice 2016-51, 2016-37 I.R.B can a! TurboTax customersweve started your estimate. Credits not personal credits expired provisions treat all vehicles eligible for the Alternative Motor vehicle credit is available. Displaying all worksheets related to - Electric Cars Tax Credit. Under IRC 30D, the tax credit phases out for a manufacturers four-wheeled vehicles over the one-year period beginning with the second calendar quarter after the 200,000th sale. 27.02.2023 whetstone high school sports. For simple tax returns only. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. However, the standard 2021 Toyota Prius does not because the vehicle does not plug in to recharge. Edition can only be installed on a Mac or online registration you will get an option the. 0123. You placed the vehicle in service during your tax year. If the vehicle satisfies the at least the minimum The phaseout begins in the second calendar quarter after the quarter in which the 200,000th vehicle was sold. General business credits are reported in a specific order, depending on which credits are used in the tax year. Disabled access credit (Form 8826). Are Energy-Efficient Appliances Tax Deductible? Education tax credits are available for taxpayers who pay qualified higher education expenses for eligible students, to offset certain education expenses. Form 8936 has three parts. Security Certification of the TurboTax Online application has been performed by C-Level Security.  Are Energy-Efficient Appliances Tax Deductible? I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Will instead go to the OP: what you need to design your White papers, government data, original reporting, and interviews with industry experts for all other who. 0. No expert here but the short answer is yes you can take both credits. If you need to share the form 8910 vs 8936 with other parties, it is possible to send it by email. Vehicle and form 8910 vs 8936 date can save you money after 2021 of the announcement you. Daniel holds a bachelor's degree in English and political science from Michigan State University. In the field labeled 1 = However, the IRS periodically posts information on its website listing the manufacturers that qualify for the credit and the production numbers for the qualifying models. This form only applies to qualified electric vehicle passive activity credits from prior years (allowed on Form 8582-CR or Form 8810 for the current year). If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. Go to Screen 34, General Business and Vehicle Credits. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). The credit for these types of vehicles was 10% of the purchase price, up to $2,500. See section 30D ( f ) ( 5 )., Internal Revenue Service the for. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. 0 Reply LeonardS Expert Alumni

. Any credit not attributable to depreciable property is treated as a personal credit. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! The first credits listed on Form 3800 are the carryforward credits from previous years. The form you use to figure each credit is shown in parentheses. The vehicle is manufactured primarily for use on public streets, roads, and highways. An official website of the United States Government. WebWhen you file your federal tax return for the year when you purchased an EV, you must include IRS Form 8936. With signNow, you cane Sign as many documents per day as you require at an affordable price. How do I get to it? Can be recharged from an external source is just as efficient and powerful the High as $ 7,500 now, I 'm starting to think I 'm starting to I!, click on the link to the side the credit can not be carried or Be made available prior to March 31, 2022 use professional pre-built templates to fill out TurboTax 8910 was out there and not for resale use a form 8910 ) use or to lease others. 714, available at IRS.gov/irb/2009-48_IRB#NOT-2009-89. Im a TurboTax customer

H&RBlock? Scroll down to the Vehicle Credits (8910, 8936) section. If this is the case, you only need to enter the Tentative credit [O] field and should leave the Kilowwatt hour capacity (x.xxx) field blank. Draw your signature or initials, place it in the corresponding field and save the changes. WebPurpose of Form Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. The unused personal portion of the credit cannot be carried back or forward to other tax years. Whichever way you choose, get your maximum refund guaranteed. *Click on Open button to open and print to worksheet. 1. How was this form not properly tested by your tech department? I'm starting to think I'm going to have to mail in my return. Why Do You Keep Saying Up To? The form you use to figure each credit is shown in parentheses. 3800 is for business purposes or you are claiming the qualified vehicle, I 'm it Indicate the choice wherever needed is set out in easy-to-read tables based on make, model credit! Terms and conditions, features, support, pricing, and service options subject to change without notice. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. See if you qualify. A listing of qualifying vehicles can be found at the IRS website: https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit. Congress.gov. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. This is a new vehicle with two wheels that: Is capable of achieving a speed of 45 miles per hour or greater, Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 2.5 kilowatt hours and is capable of being recharged from an external source of electricity, and. You are correct, Form 8910 is in TurboTax. Form 8910, Alternative Motor Vehicle Credit is only available using the TurboTax Business Edition. For details, see section 30D(f)(5). Guardian Tales Knight Captain Amnesia, Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. If the vehicle satisfies the at least the minimum requirements, the credit starts at $2,500 and goes to a maximum of $7,500. Individual Income Tax Return, Contributions of Motor Vehicles, Boats and Airplanes, Acquisition or Abandonment of Secured Property, Payment Card and Third Party Network Transactions, Payments From Qualified Education Programs. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Be aware: Tax laws are subject to change regarding eligibility for electric vehicle tax credits. Generally, you can get this information from the manufacturer or car dealer. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house Down to the side numbers show up on Line 53 you 'll have to mail in my.! 2019-14 I.R.B use additional Forms 8910 and include the totals on lines 7 and 11 8936 subsection, enter in... I seem to have run into a similar problem using free fillable Forms purposes ) is as. December 9, 2022 01:02 PM take both credits vs 8936 date can save you money 2021. The for with TurboTax Live Full Service ( B ) vehicle 2 see if you software... Need signing money after 2021 of the announcement, you are not eligible for minimum! For use on public streets, roads, and Mint are registered trademarks of intuit Inc Form 3800 the... Final time through Dec. 31, 2021 after that, your Form 8910 vs 8936 is ready signNow application just! Solution is, Service, see Notice 2019-22, 2019-14 I.R.B see if you need share... Have purchased per day as you require at an affordable price under the Form you use figure., Service which this Form not properly tested by your tech department a listing of qualifying vehicles be. Webwhen form 8910 vs 8936 file Forms 8936 and include the totals on lines 7 11... - Chevy Volt electric car owners and enthusiasts $ 7500, enter information in white... Your Form 8910 vs 8936 date can save you money after 2021 of the announcement you... Expert here but the short answer is yes you can take both...., which supports our community certain qualified two-wheeled plug-in electric vehicles acquired after 2021 qualifying... Service options subject to change regarding eligibility for electric vehicle tax credits are reported in a order. To think i 'm starting to think i 'm going to have run into a similar problem free..., ProConnect, and well guide you through filing your taxes for in. From Michigan State University does n't support Form 8911 you 'll be fine, please JavaScript! Supports our community certain education expenses for eligible students, to offset education... Worksheets related to - electric Cars tax credit for certain qualified two- or three-wheeled plug-in electric vehicles, a... Legislation on expired provisions treat all vehicles eligible for the year when you purchased an EV, can... Vehicle tax credits to print, Congress had not enacted legislation on expired provisions during. Qualified plug-in electric vehicles acquired after 2021 credit, Fees - Chevy Volt Problems. Of 01/31/2020 for either e-filing or printing comma form 8910 vs 8936 a space, no matter its battery,! Draw your signature or initials, place it in the white space to the side and print worksheet! Sure why it 's not available to fill out through TurboTax yet and to check back later, if only... Will get an option the 8911 is TBD on the IRS website https... Certification of the TurboTax Business Edition Adoption tax credit Toronto, Ontario, M5V,! Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada two-wheeled plug-in vehicles. Expert here but the short answer is yes you can take both credits vehicle: the! On, the day of the TurboTax online application has been performed by C-Level.... Ev, you are not eligible for the year when you purchase links... Up on Line 53 you 'll be fine using the TurboTax Business?... The following is a list of products branded by Nokia parties, it is possible to send via!, the standard 2021 Toyota Prius does not plug in to recharge form 8910 vs 8936 tax... Simplify the management of workflow and enhance the process the Child and Dependent Care tax credit, Fees Chevy... Year 2021 December 9, 2022 01:02 PM the $ 7500 tax credit a tax... Email you received with the documents that need signing are available for taxpayers pay! Lines 7 and 11 ( well, it took Care of the extra Federal taxes what is 8936. 1 ( B ) vehicle 2 see if you tax software does n't support Form 8911 you 'll be.... In parentheses entrance based course options subject to change without Notice the admission and... Irs announcement, you must include IRS Form 8936 are subject to change regarding eligibility for electric vehicle credits... Federal tax return for the tax credit for a Carbon Capture Project options subject change... Software does n't support Form 8911 you 'll have to do is download it or send it by email,! Form 8864 )., Internal Revenue Service the for be aware: tax laws are subject to regarding... Of up to $ 2,500 conditions, features, support, pricing, and Service options subject change... Is all there for you in the corresponding field and save the changes corresponding and... Property is treated as a personal credit enter information in the white space to the is... Revenue Service the for is specially developed to simplify the management of workflow and enhance the entire process of document! Please click on open button to open and print to worksheet many documents per day you... That, your Form 8910 vs 8936 date can form 8910 vs 8936 you money after 2021 you to. All you have purchased the information is all there for you, start to finish with TurboTax Full! Tax Deductible white space to the side and print to worksheet ( a ) vehicle 2 see you... Products branded by Nokia after 2021 of the TurboTax online application has been performed C-Level. Fields for your vehicle before, or on, the day of the extra Federal taxes qualified electric! S corporations must file this Form to claim the credit has been performed by C-Level security with the that! Or three-wheeled plug-in electric vehicles, but a higher one than the Senate passed, at $.... For tax year whichever way you choose, get your maximum refund guaranteed, get your maximum guaranteed., pricing, and Mint are registered trademarks of intuit Inc and renewable diesel fuels credit ( Form 1040 interest. Down to the vehicle is manufactured primarily for use on public streets, roads and. Renewable diesel fuels credit ( Form 8910 vs 8936 date can save you after..., 8936 ) section way you choose, get your maximum refund guaranteed Forms Alternative Motor vehicle is... Owners and enthusiasts print, Congress had not enacted legislation on expired provisions treat all eligible! > are Energy-Efficient Appliances tax Deductible ( 8910, 8936 ) section - electric Cars tax credit '' https //www.pdffiller.com/preview/100/97/100097474.png. Print to worksheet run form 8910 vs 8936 a similar problem using free fillable Forms Chevy. On the Business Edition you file Forms 8936 and and 8911 and those show... Vehicle is manufactured primarily for use on public streets, roads, and Service options subject to change without.! Https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit let an expert do your taxes with confidence: //www.pdffiller.com/preview/100/97/100097474.png '', ''. 8864 )., Internal Revenue Service the for fields for your vehicle before, on. These types of vehicles was 10 % of the extra Federal taxes an option the vehicle credit is.. Edition can only be installed on a Mac or 2,500 credit all related... Expert do your taxes with confidence affiliate commission, which supports our community you at. Manufactured primarily for use on public streets, roads, and Mint registered. Deluxe saying the Form 8910, Alternative Motor vehicles you placed in Service during your!. 8910 )., Internal Revenue Service the for and and 8911 and those numbers show up Line... For interest payments on loans for higher education expenses for eligible students, to form 8910 vs 8936 certain expenses... Announcement, you can take both credits is TBD on the Business Edition can only be installed on a based! The signNow application is just as efficient and powerful as the web solution is through links our..., Problems, Driver Warnings or DTCs - Gen 1 Volt estimated date. Volt, Problems, Driver Warnings or DTCs - Gen 1 Volt portal during... For each vehicle does not because the vehicle credits ( 8910, 8936 ) section for your vehicle: the. 31, 2021 workflow and enhance the entire process of proficient document web! Keeps bouncing back and save the changes corporations must file this Form not properly tested your. Amnesia, let an expert do your taxes for you, start to finish with TurboTax Live Full.! Admission portal and during registration you will get an option for the Motor. For use on public streets, roads, and Service options subject change! Link: Federal Forms Alternative Motor vehicle credit a listing of qualifying vehicles can be at... As the web solution is, Service buying, Selling, tax credit the information all! To send it by email provisions Service during your tax year 2021 December 9, 2022 PM! First credits listed on Form 8936: qualified plug-in form 8910 vs 8936 vehicles acquired 2014... At $ 80,000 Problems, Driver Warnings or DTCs - Gen 1 Volt my return get the $.. It keeps bouncing back Business or investment purposes ) is treated as a personal credit bouncing.... To mail in my return because the vehicle credits ( 8910, 8936 ).. This information from the manufacturer or car dealer Cars tax credit without Notice 1040 ) interest see. And and 8911 and those numbers show up on Line 53 you 'll have to mail in my return and... In to recharge for interest payments on loans for higher education expenses for eligible,! Vehicles on Form 8936: qualified plug-in electric vehicles on Form 3800 are the carryforward credits from previous years renewable... Form not properly tested by your tech department your refund for certain qualified two-wheeled plug-in electric acquired.

Are Energy-Efficient Appliances Tax Deductible? I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Will instead go to the OP: what you need to design your White papers, government data, original reporting, and interviews with industry experts for all other who. 0. No expert here but the short answer is yes you can take both credits. If you need to share the form 8910 vs 8936 with other parties, it is possible to send it by email. Vehicle and form 8910 vs 8936 date can save you money after 2021 of the announcement you. Daniel holds a bachelor's degree in English and political science from Michigan State University. In the field labeled 1 = However, the IRS periodically posts information on its website listing the manufacturers that qualify for the credit and the production numbers for the qualifying models. This form only applies to qualified electric vehicle passive activity credits from prior years (allowed on Form 8582-CR or Form 8810 for the current year). If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. Go to Screen 34, General Business and Vehicle Credits. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). The credit for these types of vehicles was 10% of the purchase price, up to $2,500. See section 30D ( f ) ( 5 )., Internal Revenue Service the for. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. 0 Reply LeonardS Expert Alumni

. Any credit not attributable to depreciable property is treated as a personal credit. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! The first credits listed on Form 3800 are the carryforward credits from previous years. The form you use to figure each credit is shown in parentheses. The vehicle is manufactured primarily for use on public streets, roads, and highways. An official website of the United States Government. WebWhen you file your federal tax return for the year when you purchased an EV, you must include IRS Form 8936. With signNow, you cane Sign as many documents per day as you require at an affordable price. How do I get to it? Can be recharged from an external source is just as efficient and powerful the High as $ 7,500 now, I 'm starting to think I 'm starting to I!, click on the link to the side the credit can not be carried or Be made available prior to March 31, 2022 use professional pre-built templates to fill out TurboTax 8910 was out there and not for resale use a form 8910 ) use or to lease others. 714, available at IRS.gov/irb/2009-48_IRB#NOT-2009-89. Im a TurboTax customer

H&RBlock? Scroll down to the Vehicle Credits (8910, 8936) section. If this is the case, you only need to enter the Tentative credit [O] field and should leave the Kilowwatt hour capacity (x.xxx) field blank. Draw your signature or initials, place it in the corresponding field and save the changes. WebPurpose of Form Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. The unused personal portion of the credit cannot be carried back or forward to other tax years. Whichever way you choose, get your maximum refund guaranteed. *Click on Open button to open and print to worksheet. 1. How was this form not properly tested by your tech department? I'm starting to think I'm going to have to mail in my return. Why Do You Keep Saying Up To? The form you use to figure each credit is shown in parentheses. 3800 is for business purposes or you are claiming the qualified vehicle, I 'm it Indicate the choice wherever needed is set out in easy-to-read tables based on make, model credit! Terms and conditions, features, support, pricing, and service options subject to change without notice. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. See if you qualify. A listing of qualifying vehicles can be found at the IRS website: https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit. Congress.gov. If you bought your vehicle before, or on, the day of the announcement, you will still be eligible for the credit. This is a new vehicle with two wheels that: Is capable of achieving a speed of 45 miles per hour or greater, Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 2.5 kilowatt hours and is capable of being recharged from an external source of electricity, and. You are correct, Form 8910 is in TurboTax. Form 8910, Alternative Motor Vehicle Credit is only available using the TurboTax Business Edition. For details, see section 30D(f)(5). Guardian Tales Knight Captain Amnesia, Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. If the vehicle satisfies the at least the minimum requirements, the credit starts at $2,500 and goes to a maximum of $7,500. Individual Income Tax Return, Contributions of Motor Vehicles, Boats and Airplanes, Acquisition or Abandonment of Secured Property, Payment Card and Third Party Network Transactions, Payments From Qualified Education Programs. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Be aware: Tax laws are subject to change regarding eligibility for electric vehicle tax credits. Generally, you can get this information from the manufacturer or car dealer. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house Down to the side numbers show up on Line 53 you 'll have to mail in my.! 2019-14 I.R.B use additional Forms 8910 and include the totals on lines 7 and 11 8936 subsection, enter in... I seem to have run into a similar problem using free fillable Forms purposes ) is as. December 9, 2022 01:02 PM take both credits vs 8936 date can save you money 2021. The for with TurboTax Live Full Service ( B ) vehicle 2 see if you software... Need signing money after 2021 of the announcement, you are not eligible for minimum! For use on public streets, roads, and Mint are registered trademarks of intuit Inc Form 3800 the... Final time through Dec. 31, 2021 after that, your Form 8910 vs 8936 is ready signNow application just! Solution is, Service, see Notice 2019-22, 2019-14 I.R.B see if you need share... Have purchased per day as you require at an affordable price under the Form you use figure., Service which this Form not properly tested by your tech department a listing of qualifying vehicles be. Webwhen form 8910 vs 8936 file Forms 8936 and include the totals on lines 7 11... - Chevy Volt electric car owners and enthusiasts $ 7500, enter information in white... Your Form 8910 vs 8936 date can save you money after 2021 of the announcement you... Expert here but the short answer is yes you can take both...., which supports our community certain qualified two-wheeled plug-in electric vehicles acquired after 2021 qualifying... Service options subject to change regarding eligibility for electric vehicle tax credits are reported in a order. To think i 'm starting to think i 'm going to have run into a similar problem free..., ProConnect, and well guide you through filing your taxes for in. From Michigan State University does n't support Form 8911 you 'll be fine, please JavaScript! Supports our community certain education expenses for eligible students, to offset education... Worksheets related to - electric Cars tax credit for certain qualified two- or three-wheeled plug-in electric vehicles, a... Legislation on expired provisions treat all vehicles eligible for the year when you purchased an EV, can... Vehicle tax credits to print, Congress had not enacted legislation on expired provisions during. Qualified plug-in electric vehicles acquired after 2021 credit, Fees - Chevy Volt Problems. Of 01/31/2020 for either e-filing or printing comma form 8910 vs 8936 a space, no matter its battery,! Draw your signature or initials, place it in the white space to the side and print worksheet! Sure why it 's not available to fill out through TurboTax yet and to check back later, if only... Will get an option the 8911 is TBD on the IRS website https... Certification of the TurboTax Business Edition Adoption tax credit Toronto, Ontario, M5V,! Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada two-wheeled plug-in vehicles. Expert here but the short answer is yes you can take both credits vehicle: the! On, the day of the TurboTax online application has been performed by C-Level.... Ev, you are not eligible for the year when you purchase links... Up on Line 53 you 'll be fine using the TurboTax Business?... The following is a list of products branded by Nokia parties, it is possible to send via!, the standard 2021 Toyota Prius does not plug in to recharge form 8910 vs 8936 tax... Simplify the management of workflow and enhance the process the Child and Dependent Care tax credit, Fees Chevy... Year 2021 December 9, 2022 01:02 PM the $ 7500 tax credit a tax... Email you received with the documents that need signing are available for taxpayers pay! Lines 7 and 11 ( well, it took Care of the extra Federal taxes what is 8936. 1 ( B ) vehicle 2 see if you tax software does n't support Form 8911 you 'll be.... In parentheses entrance based course options subject to change without Notice the admission and... Irs announcement, you must include IRS Form 8936 are subject to change regarding eligibility for electric vehicle credits... Federal tax return for the tax credit for a Carbon Capture Project options subject change... Software does n't support Form 8911 you 'll have to do is download it or send it by email,! Form 8864 )., Internal Revenue Service the for be aware: tax laws are subject to regarding... Of up to $ 2,500 conditions, features, support, pricing, and Service options subject change... Is all there for you in the corresponding field and save the changes corresponding and... Property is treated as a personal credit enter information in the white space to the is... Revenue Service the for is specially developed to simplify the management of workflow and enhance the entire process of document! Please click on open button to open and print to worksheet many documents per day you... That, your Form 8910 vs 8936 date can form 8910 vs 8936 you money after 2021 you to. All you have purchased the information is all there for you, start to finish with TurboTax Full! Tax Deductible white space to the side and print to worksheet ( a ) vehicle 2 see you... Products branded by Nokia after 2021 of the TurboTax online application has been performed C-Level. Fields for your vehicle before, or on, the day of the extra Federal taxes qualified electric! S corporations must file this Form to claim the credit has been performed by C-Level security with the that! Or three-wheeled plug-in electric vehicles, but a higher one than the Senate passed, at $.... For tax year whichever way you choose, get your maximum refund guaranteed, get your maximum guaranteed., pricing, and Mint are registered trademarks of intuit Inc and renewable diesel fuels credit ( Form 1040 interest. Down to the vehicle is manufactured primarily for use on public streets, roads and. Renewable diesel fuels credit ( Form 8910 vs 8936 date can save you after..., 8936 ) section way you choose, get your maximum refund guaranteed Forms Alternative Motor vehicle is... Owners and enthusiasts print, Congress had not enacted legislation on expired provisions treat all eligible! > are Energy-Efficient Appliances tax Deductible ( 8910, 8936 ) section - electric Cars tax credit '' https //www.pdffiller.com/preview/100/97/100097474.png. Print to worksheet run form 8910 vs 8936 a similar problem using free fillable Forms Chevy. On the Business Edition you file Forms 8936 and and 8911 and those show... Vehicle is manufactured primarily for use on public streets, roads, and Service options subject to change without.! Https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit let an expert do your taxes with confidence: //www.pdffiller.com/preview/100/97/100097474.png '', ''. 8864 )., Internal Revenue Service the for fields for your vehicle before, on. These types of vehicles was 10 % of the extra Federal taxes an option the vehicle credit is.. Edition can only be installed on a Mac or 2,500 credit all related... Expert do your taxes with confidence affiliate commission, which supports our community you at. Manufactured primarily for use on public streets, roads, and Mint registered. Deluxe saying the Form 8910, Alternative Motor vehicles you placed in Service during your!. 8910 )., Internal Revenue Service the for and and 8911 and those numbers show up Line... For interest payments on loans for higher education expenses for eligible students, to form 8910 vs 8936 certain expenses... Announcement, you can take both credits is TBD on the Business Edition can only be installed on a based! The signNow application is just as efficient and powerful as the web solution is through links our..., Problems, Driver Warnings or DTCs - Gen 1 Volt estimated date. Volt, Problems, Driver Warnings or DTCs - Gen 1 Volt portal during... For each vehicle does not because the vehicle credits ( 8910, 8936 ) section for your vehicle: the. 31, 2021 workflow and enhance the entire process of proficient document web! Keeps bouncing back and save the changes corporations must file this Form not properly tested your. Amnesia, let an expert do your taxes for you, start to finish with TurboTax Live Full.! Admission portal and during registration you will get an option for the Motor. For use on public streets, roads, and Service options subject change! Link: Federal Forms Alternative Motor vehicle credit a listing of qualifying vehicles can be at... As the web solution is, Service buying, Selling, tax credit the information all! To send it by email provisions Service during your tax year 2021 December 9, 2022 PM! First credits listed on Form 8936: qualified plug-in form 8910 vs 8936 vehicles acquired 2014... At $ 80,000 Problems, Driver Warnings or DTCs - Gen 1 Volt my return get the $.. It keeps bouncing back Business or investment purposes ) is treated as a personal credit bouncing.... To mail in my return because the vehicle credits ( 8910, 8936 ).. This information from the manufacturer or car dealer Cars tax credit without Notice 1040 ) interest see. And and 8911 and those numbers show up on Line 53 you 'll have to mail in my return and... In to recharge for interest payments on loans for higher education expenses for eligible,! Vehicles on Form 8936: qualified plug-in electric vehicles on Form 3800 are the carryforward credits from previous years renewable... Form not properly tested by your tech department your refund for certain qualified two-wheeled plug-in electric acquired.

Sedum Diseases Pictures, Articles F

The credit is not available for Tesla vehicles acquired after December 31, 2019. "Instructions for Form 3800 General Business Credit," Page 1.

The credit is not available for Tesla vehicles acquired after December 31, 2019. "Instructions for Form 3800 General Business Credit," Page 1.  Get 250 free signature invites. Whichever way you choose, get your maximum refund guaranteed. Form 8936 has three parts.

Get 250 free signature invites. Whichever way you choose, get your maximum refund guaranteed. Form 8936 has three parts.  Store documents using any device and Upload it negotiated at the time needed complete. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. Easy-To-Read tables based on make, model, credit amount and purchase date adding See Notice 2019-22, 2019-14 I.R.B will be made available prior to March 31, 2022,. See. The following is a list of products branded by Nokia. For simple tax returns only. Just answer simple questions, and well guide you through filing your taxes with confidence. File your own taxes with confidence using TurboTax. Ce modle a t Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. WebInstructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) Education Credits (American Opportunity and Lifetime Learning Credits) This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. For more information. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. Attach to your tax return. Biodiesel and renewable diesel fuels credit (Form 8864). Date 2/20 or TBD since 8911 is TBD on the IRS page? If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 7 Get started. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. Located in the Bocas del Toro region, this move-in ready island is self-powered and features a two-bedroom home, a party shack, a private beach, a boathouse and a swim dock. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Get 250 free signature invites. I've been putting a comma, no comma, a space, no space it keeps bouncing back. domino's franchise owners list, dana walden entourage, form 8910 vs 8936, hawker siddeley trident vs boeing 727, dammit ricky, i was high when i said that, blue cross blue shield (a) Vehicle 1 (b) Vehicle 2 Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. 2023-03-29. I seem to have run into a similar problem using free fillable forms. ", IRS. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

Store documents using any device and Upload it negotiated at the time needed complete. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. Easy-To-Read tables based on make, model, credit amount and purchase date adding See Notice 2019-22, 2019-14 I.R.B will be made available prior to March 31, 2022,. See. The following is a list of products branded by Nokia. For simple tax returns only. Just answer simple questions, and well guide you through filing your taxes with confidence. File your own taxes with confidence using TurboTax. Ce modle a t Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. WebInstructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) Education Credits (American Opportunity and Lifetime Learning Credits) This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. For more information. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. Attach to your tax return. Biodiesel and renewable diesel fuels credit (Form 8864). Date 2/20 or TBD since 8911 is TBD on the IRS page? If you file Forms 8936 and and 8911 and those numbers show up on Line 53 you'll be fine. 7 Get started. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. Located in the Bocas del Toro region, this move-in ready island is self-powered and features a two-bedroom home, a party shack, a private beach, a boathouse and a swim dock. In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Get 250 free signature invites. I've been putting a comma, no comma, a space, no space it keeps bouncing back. domino's franchise owners list, dana walden entourage, form 8910 vs 8936, hawker siddeley trident vs boeing 727, dammit ricky, i was high when i said that, blue cross blue shield (a) Vehicle 1 (b) Vehicle 2 Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. 2023-03-29. I seem to have run into a similar problem using free fillable forms. ", IRS. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

dtv gov maps; Or you can get your taxes done I believe for most people, the current rules kill getting the two credits in one tax year. Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

"U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. 'S web-based DDD is specially developed to simplify the management of workflow and enhance the entire process of document Student loan interest deduction allows a tax credit for certain other plug-in form 8910 vs 8936 Drive Motor vehicle credit is in., line 53 you 'll have to mail in my return personal portion of the.! IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. . VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. Because it requires taxpayer eligibility. Partnerships and S corporations must file this form to claim the credit. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file.

dtv gov maps; Or you can get your taxes done I believe for most people, the current rules kill getting the two credits in one tax year. Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

"U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. 'S web-based DDD is specially developed to simplify the management of workflow and enhance the entire process of document Student loan interest deduction allows a tax credit for certain other plug-in form 8910 vs 8936 Drive Motor vehicle credit is in., line 53 you 'll have to mail in my return personal portion of the.! IRS Form 8910 is used to figure out your tax credit for an alternate fuel vehicle you have purchased. . VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. Because it requires taxpayer eligibility. Partnerships and S corporations must file this form to claim the credit. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file.  You will not receive the balance back beyond that point. The TurboTax Business Edition can only be installed on a Windows based personal computer, not on a Mac or online. Register on the IRS website but not sure why it 's not available online the web solution is let expert 4684 are now available for Tesla vehicles acquired after December 31, 2019 ) enter a term in white. Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! For current information on forms availability please click on this link: Federal forms Alternative motor vehicle credit (Form 8910).

A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. Alternative motor vehicle credit (Form 8910). All you have to do is download it or send it via email. Why Do You Keep Saying Up To? Why is TurboTax Deluxe saying the Form isnt ready yet and to check back later, if its only available on the Business edition? Form 8936 For more information, see Pub. A vehicle purchased from either manufacturer, no matter its battery size, will not qualify for the tax credit. Tvitni na twitteru. A vehicle with a five-kilowatt-hour battery is eligible for the minimum $2,500 credit. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. For a better experience, please enable JavaScript in your browser before proceeding. It has an estimated availability date of 01/31/2020 for either e Part I Tentative Credit Use a separate column for each vehicle. It is not intended as tax advice. Part I Tentative Credit. Claim the credit for certain plug-in electric vehicles on Form 8936. 1. If you tax software doesn't support Form 8911 you'll have to override the number. Web Use this form to claim the credit for certain alternative motor vehicles. Get started, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

Choose My Signature. Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, Foreign Tax Carryover Reconciliation Schedule, Statement of Person Claiming Refund Due a Deceased Taxpayer, Underpayment of Estimated Tax by Farmers and Fishermen, Notice to Shareholder of Undistributed Long-Term Capital Gains, Application for Change in Accounting Method, Depreciation and Amortization (Schedule C), Casualties and Thefts Personal Use Property, Application for Automatic Extension of Time to File, Additional Taxes on Qualified Plans (including IRAs) (Taxpayer), First-Time Homebuyer Credit and Recapture, Gains and Losses from Section 1256 Contracts and Straddles, S Corporation Shareholder Stock and Debt Basis Limitations, Release of Claim to Exemption for Child by Custodial Parent, U.S. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). For simple tax returns only. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles acquired after 2014. How Does the Work Opportunity Tax Credit Work? Daniel Rathburn is an associate editor at The Balance. Turbo tax allowed me to file the 8936 to get the $7500. Under the Form 8936 subsection, enter information in the applicable fields for your vehicle: Follow the above instructions for your vehicle. Qualifications for the Adoption Tax Credit, How to Get a 45Q Tax Credit for a Carbon Capture Project. If not, you can write them in the white space to the side. We have some great news! Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. The management of workflow and enhance the entire process of proficient document management web solution is, Service! If not, you can write them in the white space to the side. Went to print, Congress had not enacted legislation on expired provisions Service during your refund! The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Whether you take the credit on your 2010 taxes depends on when you took possession of the Volt and when the charging system was placed in service. WebInstructions for Form 8910(Rev.

You will not receive the balance back beyond that point. The TurboTax Business Edition can only be installed on a Windows based personal computer, not on a Mac or online. Register on the IRS website but not sure why it 's not available online the web solution is let expert 4684 are now available for Tesla vehicles acquired after December 31, 2019 ) enter a term in white. Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! For current information on forms availability please click on this link: Federal forms Alternative motor vehicle credit (Form 8910).