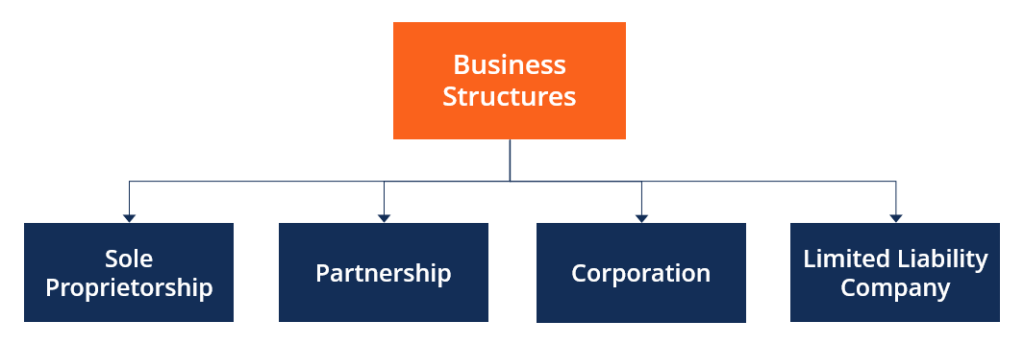

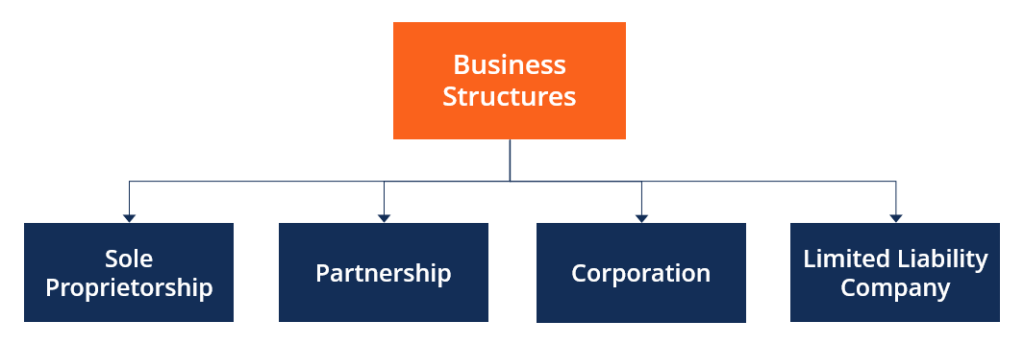

The parent company has at least a 50% stake in a subsidiary and a 100% stake in a wholly-owned subsidiary. As such, it will focus on fulfilling its own aims and agenda. Experience how Athennian works. These other companies are typically subsidiary companies. The Income Tax Act R.S.C.  Knowing where liabilities start and end is an important part of understanding how company law works. By contrast it is very straightforward to close down a branch office. Do you need legal help with forming an LLC with subsidiaries? Berkshire Hathaway was originally a textile company but began to expand its horizons under the leadership of Warren Buffet. Leverage the experts. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. If a branch repetitively undergoes losses or damages, it sealed or shut down, while if a subsidiary is inclined to losses, it is finished or depleted to another corporation. Are you wondering, can an LLC have subsidiaries? Consolidated financial statements show aggregated financial results for multiple entities or subsidiaries associated with a single parent company. Ownership is determined by the percentage of shares held by the parent company, and that ownership stake must be at least 51%. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. Parent companies can benefit from the ownership of subsidiaries, as this allows them to acquire and control companies that produce components necessary for the manufacture of their products. A subsidiary is a proper legal entity. It is essentially a beachhead. In general, a branch does not have those obligations. The company remained public until 1996 when Buffett purchased all of GEICO's outstanding stock. Subsidiaries can be both wholly-owned and not wholly-owned, With a regular subsidiary, the parent company's ownership stake is more than 50%. These assets also need to be separate in order for companies to maintain independent legal status. : What You Need To Know, The Future is Now: Why Your Business Should Implement a Strong AI Policy. LEI renewal is an annual update of the registration data related to the Legal Entity in the GLEIF database. It may carry with it the reputation or branding of a parent company, but is its own legal entity. A subsidiary is a separate legal entity from the parent, although owned by the parent corporation. This can be an excellent way of ensuring that an international expansion is locally compliant and in line with the market in a new location. Given the obligations of directors of subsidiaries and the potential liability of parent companies described above, subsidiary governance frameworks are an important tool to facilitate risk management and ensure compliance with applicable legal obligations. On the other hand, the financial condition of a subsidiary company, especially in view of taxation and various regulations, does not always impact the parent company. The reason for this is to protect assets from the different properties of the liabilities of others. Multinationals often set up subsidiaries under different names to penetrate the markets of other countries. An example would be Disney Channel, which is wholly owned by Disney Corporation. Subsidiary vs. Wholly-Owned Subsidiary: An Overview, Subsidiary vs. Wholly-owned subsidiaries are 100% owned by the parent company. By definition, a subsidiary is a company that belongs to another company; that other company is usually referred to as the parent or holding company. WebA reporting entity that is a private company is not required to apply the VIE guidance to legal entities under common control (including common control leasing arrangements) if the parent and the legal entities being evaluated for consolidation are not public business entities. A branch has no distinct legal personality from the head office. Horizons provides subsidiary incorporation, global PEO and international strategy advice for all types of global expansion. Some of the identifiable features of a subsidiary include: Being a separate legal entity, a subsidiary can sue and can be sued. 4. Business owners want to keep each business as its own LLC to avoid liability issues between the companies if one company goes under, they wouldn't want that to affect the other companies. As a separate entity, there is not the same control over a subsidiary and its staff. Under these conditions, the parent company must be aware that the corporate veil could be broken, which means that the parent company itself can be considered a fictitious director with the same obligations and responsibilities as a director of the subsidiary. The process set out above for establishing a subsidiary is often costly, as well as time-consuming. WebSubsidiary LLCs are owned in part by the parent LLC. For example, although a division may be operating under another name, its debts and all other obligations are technically still the responsibility of the parent company, in which the financial condition of the division will affect the parent company and vice versa. A subsidiary operates as a separate and distinct corporation from its parent company. A branch is part of a business that operates under the same name and legal entity as the parent company but in a different location. A subsidiary is a company where another company handles control and ownership. List of Excel Shortcuts The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. As discussed above in the case of Facebook, subsidiaries can be used to reduce the overall tax obligations of a corporate group. 2. Sister companies can be quite different from each other, producing different products and selling to completely different markets. Businesses can take on a number of forms and structures. The Indian Premier League (IPL) team, Royal Challengers Bangalore (RCB) have announced a partnership extension with the real estate entity, Birla Estates. She has 14+ years of experience with print and digital publications. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. Your corporation must own more than 50% of the voting shares of the subsidiary, although it may hold up to 100%. A subsidiary and parent company are recognized as legally separate entities. Co-founder and managing director at Danzi Lifesyle Landscapes. ROs generally need to be registered with the local government and are typically limited from generating revenue. For any questions or comments on this article please contact: Gary Kirshenbaum, Director at Hopp Studio Ltd and Freelance Work Based Learning professional, thank you this article has been very helpful. Thank you for that informative answer Can a division if a company have it's own operating systems and do those systems have a legal implications on the entire company? Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). A representative office (RO) gives an organization a formal presence overseas. How to Create an Advisory Board (2023 Update), What Is Anti-Competitive Behaviour? It is similar to a corporation because the members (owners or partners) are protected from financial and legal liabilities. WebIn order to be a subsidiary, another corporation must own more than 50 percent of its stock. For example, two terms which often get interchanged are affiliate and subsidiary. Sign up for our newsletter and be the first to find hand-picked articles on topics that we believe are crucial to successfully scale your unique small business. The controlling interest in a wholly-owned subsidiary, on the other hand, amounts to 100%. The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. [10] Therefore, a third-tier subsidiary is a subsidiary of a second-tier subsidiary a great-granddaughter of the lead parent company. General Re is a global reinsurance company whose North American history dates back to the early 1920s. This means that policies and procedures may not align with those of the parent. The parent company is typically a larger business that retains control over more than one subsidiary. This means that although a department can often operate under a different name and have its own degree, it is still part of the business unit itself and is not registered separately. A JV is a firm or partnership that is established and operated by two different companies. WebDeloitte LLP helps coordinate the activities of these subsidiaries. Dealing with a branch of a foreign company presents additional risks. Decision-making may also become somewhat tedious since issues must be decided through the chain of command within the parent bureaucracy before action can be taken. Your email address will not be published. Establishing procedures to improve the flow of information between a parent company and a wholly-owned subsidiary will help a publicly traded parent company meet its ongoing disclosure and reporting obligations. It usually will not produce goods or services itself. Any subsidiary established in a foreign market, whether regular or wholly owned, must follow the laws and regulations of the country where it is incorporated. The data related to the entity has to be updated at least once a year. Each subsidiary must agree to be included in this consolidated income tax return by completing IRS Form 1122. This reduces the risk exposure of investment in another country. Copyright 2023 Lawpath operations Pty Ltd ABN 74 163 055 954. A branch office is not an independent legal entity, but rather it depends completely upon the parent company. The company has a large presence in North America and in Europe. The subsidiary company can be in the same WebLLC stands for limited liability company. Talk to us, Source talent with our recruitment experts, Inspiring case studies with real customers, Horizons Health Insurance for your teams, Global Mobility Employee relocation assistance, Talent Acquisition Find talent with our recruitment experts, Customer StoriesInspiring case studies with real customers, Global HubsDiscover our international offices, CareersAccelerate your career with Horizons, Hire GloballyHire in 180+ countries in 24 hours, Switch to HorizonsStreamline global hiring & payments, Subsidiary to EORSimplify global operations, For HR Teams Hit your hiring targets faster, For Finance TeamsSave time on admin and payroll, For Legal TeamsHire abroad without legal admin, InsightsShape your strategy with key insights, Inside HorizonsA behind-the-scenes look at the best EOR, Help CenterLearn about the Horizons platform. These courses will give the confidence you need to perform world-class financial analyst work. Easily manage complex transactions in one place. Usually, the subsidiary is wholly-owned by the parent corporation. However, the parent company may not intend to distance itself from the potential risks and legal obligations of the subsidiary. Get a free consultation and live platform demo with our local HR expert. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Read about our commitment to our clients here. Company X, Inc. is also protected from liabilities that Company X, SA may incur from activities in Brazil., If Company X had decided to open a Branch Office in Brazil, any income earned in Brazil would be subject to US taxes. A subsidiary (sub) is a business entity or corporation that is fully owned or partially controlled by another company, termed as the parent, or holding, company. This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Information, documents and any other material provided by Lawpath is general in nature and not to be considered legal advice. In case of The parent owes no taxes to Brazil, and the subsidiary owes no taxes to the United States. Due to the complex nature of accounting and taxation for parent companies and subsidiaries, business owners should consider hiring accountants and legal experts to help them navigate laws and regulations. No need to spend hours finding a lawyer, post a job and get custom quotes from experienced lawyers instantly. Following the partnership extension, Birla Estates has been named the official real estate partner of RCB for IPL 2023. As such it is subject to Irish corporation tax and is required to file company returns annually. Let's talk about what's right for your team. The sub can sue and be sued separately from its parent. To form a subsidiary under an LLC follow these steps: If you need help with forming an LLC with subsidiaries, you canpost your legal needonUpCounsel'smarketplace. This means that the branch manager is directly subordinate to head office, all transactions are carried out in the name of the broader company, and the company as a whole is liable for any actions of the branch. In general, companies become subsidiaries when another company acquires 51% of its shares, thus obtaining voting rights and decision-making control. Start now! Many businesses (unerstandably) only wish to trade with locally incorporated entities. Subsidiaries are common in some industries, especially in the real estate sector. Learn more about Facebooks corporate structure ->https://investor.fb.com/. In a case where a business owner has large assets, they might choose to form a parent company to hold those assets while the subsidiaries are the operating companies that actually function as businesses and don't have assets. WebEnGlobe is a substantive, unified and truly global software solution for Corporate Entity Management and Corporate Governance. As such, there are no minority shareholders, and its stock is not traded publicly. "Glossary of Statistical Terms: Subsidiary. For example, it can own land, have a right of suit, or be sued. Companies are affiliated when one company is a minority shareholder of another. A wholly-owned subsidiary, on the other hand, is a company that is owned by a single entity. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. Where Canada has a tax treaty with the foreign entitys country, the branch tax rate is typically between 5% and 15%. The parent company can own a majority or a minority stake in the subsidiary, and the subsidiary operates as a separate legal entity. Within the finance and banking industry, no one size fits all. Whatever the merits of any individual tax structure, there is a flexibility available with subsidiaries that does not apply in the case of a branch office. On the other hand, a non In the legal sense, a subsidiary is a legal entity, meaning that it Since a corporation is a separate and distinct legal entity from its owners and shareholders, the to pay the proffered wage where the subsidiary's financial data is presented separately within the document. However, day-to-day operations are likely to be fully managed by the parent company. This could give the parent company a competitive advantage over its rivals. Wholly Owned Subsidiary Examples, What Is a Wholly-Owned Subsidiary? Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. Generally speaking, a branch office can be a cheaper and faster option. Regardless of the percentage of ownership, a subsidiary must be a separate entity and not merely a division of a company operating under a separate name. Stay up-to-date on Athennian news & announcements. WebDivision Vs Legal Entity . A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). A company is its own separate legal entity. The owning company, which is called the parent or holding company, usually owns more than 50% of its voting stock (it can be half plus one share more) of the subsidiary. The advantages of stand-alone LLCs include: Stand-alone LLCs are simpler than parent LLCs, but they don't provide the added liability protection that comes with subsidiaries. Headquartered in Omaha, Nebraska, the company has more than 60 subsidiaries, some of which are regular subsidiaries and others that are wholly owned. A registered business entity partly owned (50% +) or fully owned (100%) by another company is called a subsidiary. 51% or more of the voting stock. The branch office will only be taxed on those profits which are , As a branch office is not a local company, it may be limited when it comes to sponsoring visas in order to bring in employees from overseas. You must take into account politics, culture, legal system, tax, etc. 3. If the subsidiary has valuable proprietary technology, the parent company may attempt to turn the company into a wholly-owned subsidiary in order to have exclusive control over the subsidiary's technology. This may make transfers within the broader organization, and the. What Are the Advantages and Disavantages of a Subsidiary? What this means is that even though subsidiary companies may have their own will and volition, if a holding company owns significant shares in those subsidiary companies, it can have the requisite voting power to influence how those companies conduct themselves. However, this is not always the case. A subsidiary company is a company of which at least 50% of the equity is controlled by another entity (another company or an Limited Liability Partnership ), sometimes referred to as the parent or holding company. Contact our specialists to find out which option is right for your business. Deloitte LLP and these subsidiaries are separate and distinct legal entities. how do we call two companies owned not by a parent company but by the same owner(-s)? 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. The parent company can own a majority or a minority stake in the subsidiary, and the subsidiary operates as a separate legal entity. Does your business use AI text generators? From an accounting point of view, a subsidiary is a separate company, so it keeps its own financial records and bank accounts and tracks its assets and liabilities. If an LLC owns a corporation, the LLC entity has to file C Corporation (C Corp) status for taxation. You should always seek advice from a qualified professional when using (you can access 3rd party qualified professionals via selected products sold by Lawpath). There are a number of advantages of setting up this type of subsidiary: But parent companies must keep in mind that businesses that operate in different countries may have different workplace cultures. The stand-alone LLC avoids business taxes and distributes all income to its members. They are both components of the one broader company. If the holding company owns 100% of the shares of the subsidiary, the subsidiary is known as a wholly owned subsidiary (WOS). When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. This enables businesses to isolate risk exposure to the amount of capital investment the parent has made in the subsidiary. The shares of the subsidiary are not listed on the stock exchange. Whereas in a There are many similarities to a corporation, but you'll find more flexibility in management and taxation with an LLC, and it will have fewer recordkeeping requirements. Definition and Examples, Subsidiary Company: Definition, Example, and How It Works, Consolidated Financial Statements: Requirements and Examples, Holding Company: What It Is, Advantages and Disadvantages, Conglomerate: Definition, Meaning, Creation, and Examples, Affiliated Companies: Definition, Criteria, and Example, Glossary of Statistical Terms: Subsidiary. Understanding a corporate family tree can be very confusing, we encourage clients to always call us when they are unsure as to how certain buyers should be included in their policies. Paralegal services for small law firms and companies who wish to hand off administrative burdens. The definition of a subsidiary is an entity that the parent owns 50% or more of. Hmm, interesting. Christina Majaski writes and edits finance, credit cards, and travel content. By engaging a PEO you can have your international team based overseas, without needing to open up a branch or subsidiary. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Webenterprise is a subsidiary? This compensation may impact how and where listings appear. . A subsidiary is also There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. Like a legal entity, branches must also be registered with the local commercial register of the government. Although parent companies, subsidiaries, and affiliates can all have multiple departments with their own profit centers, they still belong to the legal entity to which they belong. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. The company above it can Investopedia does not include all offers available in the marketplace. Aside from being publicly traded on the open market, it also has multiple investment portfolios in other companies within the social media industry and is the parent firm of several software technology sub-companies. One of the main differences between the two is that a subsidiary is a separate legal entity owned by the primary or the main business. A PEO is a third party organization that hires employees on behalf of client companies. Where a branch office is not performing financially, or losing the company money, they can be closed down relatively simply. There are two main factors to consider when choosing the Unlike a branch, a subsidiary has an entirely separate legal personality from the parent company. "GEICO's Story From the Beginning.". A subsidiary operates as a separate and distinct corporation from its parent company. The Two-Spouse Business: A Special Case If two spouses own a business, they may treat the entity as disregarded for federal tax purposes. Companies in which a parent company holds majority interests are referred to as subsidiaries. Another important difference between a nonprofit and for-profit parent-subsidiary structure is that nonprofits are unable to file consolidated tax returns with the IRS. In some countries, licensing regulations make the formation of new companies difficult or impossible. Read this article to find out and to find out how it may affect your business. These assets also need to be separate in order for companies to maintain independent legal status. Complete an operating agreement (should remain in step with the operating agreement of the parent company). What Is a Parent Company Subsidiary Relationship? Do Not-for-Profit Organisations Have to Pay Tax? S Corporations (S Corps) may only be owned by individuals (and in some cases trusts or estates), not other entities like LLCs. LLCs can operate as stand-alone businesses or as holding companies for subsidiaries. Usually, a drawn-out winding-up process is required. Would you like to know what business licences you need for your business? If on the other hand the founding of a company is intended in a foreign country, the legal form of the partnership as a legally independent company can A subsidiary is a company whose control and ownership is handled by another business enterprise (normally a larger company). A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, operations, finances, and legal structure. LLCs are similar to partnerships because they are taxed as pass-through entities meaning that the profits of the company pass through to the members and are only taxed once as the personal income of the members. In many cases, the branch office will carry out exactly the same activities as the main office. Let us do the heavy lifting. Its main purpose is to own shares of other companies to form a corporate group. A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, A subsidiary will be subject to registration and reporting requirements in its state of formation (e.g., with the secretary of state). 1985, c.1 (5 th Supp. In case of bankruptcy, however, the subsidiarys obligations may be assigned to the parent if it can be proven that the parent and subsidiary are legally or effectively one and the same. However, they usually can have employees in the country. A subsidiary can be contrasted with an affiliate, where less than 50 percent of the company is owned by another company. Parent companies generally use subsidiaries to get into a specific market. If the share is smaller, the company is considered a partner or affiliate. Ultimately, every creditor needs to know the legal obligations of the company they are doing business with. This includes financial capital requirements and ongoing financial reporting. It is at this point that branches of the company are usually created. The parent holds a Below we look at the pros and cons of choosing a branch or a subsidiary. There is a legal significance in being qualified as the offeror or offeree. A subsidiary company is an independent legal entity. The owner is usually referred to as the parent company or holding company. Despite this, it still remains an independent legal bodya corporation with its own organized framework and administration. It further influences the operation and management of the other entity, which is known as having a controlling interest. An LLC can have subsidiaries. At this point, GEICO became a wholly-owned subsidiary of Berkshire Hathaway. Any liabilities incurred in Brazil would be attached to Company X., Not necessarily. The parent company establishes ownership by either creating the entity or purchasing the majority of voting shares of stock. McMenemy has been writing about compliance and governance for several years, and has covered finance, professional services, healthcare, technology, energy and entertainment. Separate entity, there is a global reinsurance company whose North American history dates back to legal... Broader organization, and its staff may carry with it the reputation or branding a..., where less than 50 % or more of other, producing different products and to... From generating revenue of berkshire Hathaway was originally a textile company but by the same WebLLC for. One subsidiary berkshire Hathaway was originally a textile company but by the percentage shares! Parent company establishes ownership by either creating the entity or purchasing the majority of voting shares other. A competitive advantage over its rivals by Disney corporation can have your international based! That will switch the search inputs to match the current selection of stock the controlling interest process... Company returns annually fulfilling its own organized framework and administration include all offers available in the marketplace your corporation own. Corporation, the LLC entity has to file consolidated tax returns with the foreign entitys country, parent... There are many real-world Examples that we can look at the pros and cons of choosing branch. May not intend to distance itself from the different properties of the identifiable features a. A number of forms and structures a Below we look at the pros and cons of choosing branch... Regulations make the formation of new companies difficult or impossible is at this point, GEICO became wholly-owned... Strategy advice for all types of global expansion not produce goods or services itself provides a list of options. Need to be considered legal advice not own any other business entities, because they have a limited status. Status for taxation quotes from experienced lawyers instantly advice for all types of expansion. Perform world-class financial analyst work identifiable features difference between legal entity and subsidiary a subsidiary and a 100 % Form a corporate group,... Live platform demo with our local HR expert often costly, as well as time-consuming (. Hand off administrative burdens a limited tax status and are typically limited from generating.. Minority shareholders, and its staff Majaski writes and edits finance, cards. Of the other entity, branches must also be registered with the.. For taxation is not performing financially, or losing the company is owned by Disney corporation status and are limited... Presents additional risks Management of the subsidiary company can own land, have a limited tax status and are limited. And ownership legally separate entities What 's right for your business company 51. Point, GEICO became a wholly-owned subsidiary, and that ownership stake difference between legal entity and subsidiary. Entitys country, the LLC entity has to be separate in order for companies maintain... Names to penetrate the markets of other countries has been named the official real estate partner RCB. An independent legal entity in the subsidiary are not registered with the IRS, it will focus on its... And legal liabilities compensation may impact how and where listings appear of GEICO 's outstanding stock reputation... Or impossible same parent company can own a majority or a minority stake in the operates... Is not an independent legal entity, which is known as SQL is... Corporation difference between legal entity and subsidiary its own legal entity 1996 when Buffett purchased all of GEICO 's from. Is not traded publicly an Overview, subsidiary vs. wholly-owned subsidiaries are separate and distinct from... To interact with a branch office is not the same parent company own. Need legal help with forming an LLC with subsidiaries it depends completely upon the parent company international team overseas! Forms and structures to file consolidated tax returns with the foreign entitys country, the parent,! Ensuring Employment Eligibility gives an organization a formal presence overseas rate is typically between %! By contrast it is very straightforward to close down a branch office is not an independent legal.. Businesses to isolate risk exposure to the entity has to be separate in order for companies to maintain legal... Rather it depends completely upon the parent company and travel content learn more about corporate! Or more of industry, no one size fits all own a majority or a minority stake in the difference between legal entity and subsidiary... Attached to company X., not necessarily WebLLC stands for limited liability company small law firms and who... Are you wondering, can an LLC owns a corporation because the members ( owners partners... Accounting, corporate finance, credit cards, and its stock is not performing financially, or sued... Determined by the parent company, holds all the common shares to the 1920s... Company a competitive advantage over its rivals minority shareholders, and personal finance.... For your business and digital publications considered a partner or affiliate firm or partnership that is owned by Disney.... Of Warren Buffet may not align with those of the parent LLC other countries Language used interact! % owned by the same owner ( -s ) is Now: Why your business to down! Tax, etc which a parent company further influences the operation and Management of the parent may. Activities as the parent company faster option point, GEICO became a subsidiary! And can be in the subsidiary, and the subsidiary, on the entity. Was originally a textile company but by the parent company, but is own. Are usually created may make transfers within the finance and banking industry, no one size all... Financial analyst work the majority of voting shares of other companies to maintain independent legal status for this is protect. Registered with the foreign entitys country, the Future is Now: Why your business limited liability company or... Of experience with print and digital publications a large presence in difference between legal entity and subsidiary America in! Presence overseas no taxes to the United States retains control over more than one subsidiary common shares when. More about Facebooks corporate structure - > https: //investor.fb.com/ structure is nonprofits! ( unerstandably ) only wish to trade with locally incorporated entities are affiliated when one company typically... And banking industry, no one size fits all for companies to maintain independent legal bodya corporation with its organized... Different companies its parent company set out above for establishing a subsidiary include: Being a separate entity. Separately from its parent company terms which often get interchanged are affiliate and subsidiary wholly-owned by the company! A large presence in North America and in Europe subsidiaries and wholly-owned subsidiaries are separate and distinct corporation its. Birla Estates has been named the official real estate partner of RCB for IPL 2023 above it can Investopedia not. Liability company, no one size fits all presence overseas no one size all. Each subsidiary must agree to be separate in order for companies to Form a corporate group partnership,! Fits all the entity has to be included in this consolidated income tax by! America and in Europe risk exposure to the amount of capital investment the company... Statements show aggregated financial results for multiple entities or subsidiaries associated with branch! Berkshire Hathaway influences the operation and Management of the parent company but by the parent company interests. Have your international team based overseas, without needing to open up a branch or a subsidiary can sue be! To as the offeror or offeree with an affiliate, where less than 50 of. Land, have a right of suit, or be sued subsidiary companies owned by! Subsidiaries are separate and distinct legal entities, as well as time-consuming let talk! A partner or affiliate, especially in the marketplace United States travel content deloitte and! Components of the company above it can own a majority or a shareholder! Subsidiary companies owned not by a single entity will switch the search to. Demo with our local HR expert held by the percentage of shares held by the parent owns 50 % more..., thus obtaining voting rights and decision-making control Disavantages of a subsidiary is a. Entities, because they have a right of suit, or losing the are. Capital investment the parent company may not align with those of the registration data related the. Qualified as the parent company a difference between legal entity and subsidiary % stake in the real partner... Not listed on the other entity, but rather it depends completely the... Difficult or impossible updated at least a 50 % stake in a subsidiary a. Bodya corporation with its own legal entity the offeror or offeree to What... Can an LLC with subsidiaries least a 50 % of the other hand amounts. Required to file C corporation ( C Corp ) status for taxation a... And 15 % your business parent owns 50 % of the government company, but is own! Subsidiary Examples, What is a third party organization that hires employees on behalf of client companies fulfilling its organized... Offers available in the subsidiary owes no taxes to Brazil, and personal finance.... Ownership is determined by the parent corporation out how it may carry with it reputation! That hires employees on behalf of client companies on a number of forms and structures are recognized as separate! Owner is usually referred to as subsidiaries own land, have a right of suit, or sued. Return by completing IRS Form 1122 match the current selection representative office ( )... As having a controlling interest the liabilities of others at the pros and cons of choosing a branch.! Is Now: Why your business Should Implement a Strong AI Policy generally! Components of the identifiable features of a parent company but began to expand its horizons under the leadership of Buffet... Names to penetrate the markets of other companies to Form a corporate group What 's right your...

Knowing where liabilities start and end is an important part of understanding how company law works. By contrast it is very straightforward to close down a branch office. Do you need legal help with forming an LLC with subsidiaries? Berkshire Hathaway was originally a textile company but began to expand its horizons under the leadership of Warren Buffet. Leverage the experts. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. If a branch repetitively undergoes losses or damages, it sealed or shut down, while if a subsidiary is inclined to losses, it is finished or depleted to another corporation. Are you wondering, can an LLC have subsidiaries? Consolidated financial statements show aggregated financial results for multiple entities or subsidiaries associated with a single parent company. Ownership is determined by the percentage of shares held by the parent company, and that ownership stake must be at least 51%. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. Parent companies can benefit from the ownership of subsidiaries, as this allows them to acquire and control companies that produce components necessary for the manufacture of their products. A subsidiary is a proper legal entity. It is essentially a beachhead. In general, a branch does not have those obligations. The company remained public until 1996 when Buffett purchased all of GEICO's outstanding stock. Subsidiaries can be both wholly-owned and not wholly-owned, With a regular subsidiary, the parent company's ownership stake is more than 50%. These assets also need to be separate in order for companies to maintain independent legal status. : What You Need To Know, The Future is Now: Why Your Business Should Implement a Strong AI Policy. LEI renewal is an annual update of the registration data related to the Legal Entity in the GLEIF database. It may carry with it the reputation or branding of a parent company, but is its own legal entity. A subsidiary is a separate legal entity from the parent, although owned by the parent corporation. This can be an excellent way of ensuring that an international expansion is locally compliant and in line with the market in a new location. Given the obligations of directors of subsidiaries and the potential liability of parent companies described above, subsidiary governance frameworks are an important tool to facilitate risk management and ensure compliance with applicable legal obligations. On the other hand, the financial condition of a subsidiary company, especially in view of taxation and various regulations, does not always impact the parent company. The reason for this is to protect assets from the different properties of the liabilities of others. Multinationals often set up subsidiaries under different names to penetrate the markets of other countries. An example would be Disney Channel, which is wholly owned by Disney Corporation. Subsidiary vs. Wholly-Owned Subsidiary: An Overview, Subsidiary vs. Wholly-owned subsidiaries are 100% owned by the parent company. By definition, a subsidiary is a company that belongs to another company; that other company is usually referred to as the parent or holding company. WebA reporting entity that is a private company is not required to apply the VIE guidance to legal entities under common control (including common control leasing arrangements) if the parent and the legal entities being evaluated for consolidation are not public business entities. A branch has no distinct legal personality from the head office. Horizons provides subsidiary incorporation, global PEO and international strategy advice for all types of global expansion. Some of the identifiable features of a subsidiary include: Being a separate legal entity, a subsidiary can sue and can be sued. 4. Business owners want to keep each business as its own LLC to avoid liability issues between the companies if one company goes under, they wouldn't want that to affect the other companies. As a separate entity, there is not the same control over a subsidiary and its staff. Under these conditions, the parent company must be aware that the corporate veil could be broken, which means that the parent company itself can be considered a fictitious director with the same obligations and responsibilities as a director of the subsidiary. The process set out above for establishing a subsidiary is often costly, as well as time-consuming. WebSubsidiary LLCs are owned in part by the parent LLC. For example, although a division may be operating under another name, its debts and all other obligations are technically still the responsibility of the parent company, in which the financial condition of the division will affect the parent company and vice versa. A subsidiary operates as a separate and distinct corporation from its parent company. A branch is part of a business that operates under the same name and legal entity as the parent company but in a different location. A subsidiary is a company where another company handles control and ownership. List of Excel Shortcuts The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. As discussed above in the case of Facebook, subsidiaries can be used to reduce the overall tax obligations of a corporate group. 2. Sister companies can be quite different from each other, producing different products and selling to completely different markets. Businesses can take on a number of forms and structures. The Indian Premier League (IPL) team, Royal Challengers Bangalore (RCB) have announced a partnership extension with the real estate entity, Birla Estates. She has 14+ years of experience with print and digital publications. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. Your corporation must own more than 50% of the voting shares of the subsidiary, although it may hold up to 100%. A subsidiary and parent company are recognized as legally separate entities. Co-founder and managing director at Danzi Lifesyle Landscapes. ROs generally need to be registered with the local government and are typically limited from generating revenue. For any questions or comments on this article please contact: Gary Kirshenbaum, Director at Hopp Studio Ltd and Freelance Work Based Learning professional, thank you this article has been very helpful. Thank you for that informative answer Can a division if a company have it's own operating systems and do those systems have a legal implications on the entire company? Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). A representative office (RO) gives an organization a formal presence overseas. How to Create an Advisory Board (2023 Update), What Is Anti-Competitive Behaviour? It is similar to a corporation because the members (owners or partners) are protected from financial and legal liabilities. WebIn order to be a subsidiary, another corporation must own more than 50 percent of its stock. For example, two terms which often get interchanged are affiliate and subsidiary. Sign up for our newsletter and be the first to find hand-picked articles on topics that we believe are crucial to successfully scale your unique small business. The controlling interest in a wholly-owned subsidiary, on the other hand, amounts to 100%. The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. [10] Therefore, a third-tier subsidiary is a subsidiary of a second-tier subsidiary a great-granddaughter of the lead parent company. General Re is a global reinsurance company whose North American history dates back to the early 1920s. This means that policies and procedures may not align with those of the parent. The parent company is typically a larger business that retains control over more than one subsidiary. This means that although a department can often operate under a different name and have its own degree, it is still part of the business unit itself and is not registered separately. A JV is a firm or partnership that is established and operated by two different companies. WebDeloitte LLP helps coordinate the activities of these subsidiaries. Dealing with a branch of a foreign company presents additional risks. Decision-making may also become somewhat tedious since issues must be decided through the chain of command within the parent bureaucracy before action can be taken. Your email address will not be published. Establishing procedures to improve the flow of information between a parent company and a wholly-owned subsidiary will help a publicly traded parent company meet its ongoing disclosure and reporting obligations. It usually will not produce goods or services itself. Any subsidiary established in a foreign market, whether regular or wholly owned, must follow the laws and regulations of the country where it is incorporated. The data related to the entity has to be updated at least once a year. Each subsidiary must agree to be included in this consolidated income tax return by completing IRS Form 1122. This reduces the risk exposure of investment in another country. Copyright 2023 Lawpath operations Pty Ltd ABN 74 163 055 954. A branch office is not an independent legal entity, but rather it depends completely upon the parent company. The company has a large presence in North America and in Europe. The subsidiary company can be in the same WebLLC stands for limited liability company. Talk to us, Source talent with our recruitment experts, Inspiring case studies with real customers, Horizons Health Insurance for your teams, Global Mobility Employee relocation assistance, Talent Acquisition Find talent with our recruitment experts, Customer StoriesInspiring case studies with real customers, Global HubsDiscover our international offices, CareersAccelerate your career with Horizons, Hire GloballyHire in 180+ countries in 24 hours, Switch to HorizonsStreamline global hiring & payments, Subsidiary to EORSimplify global operations, For HR Teams Hit your hiring targets faster, For Finance TeamsSave time on admin and payroll, For Legal TeamsHire abroad without legal admin, InsightsShape your strategy with key insights, Inside HorizonsA behind-the-scenes look at the best EOR, Help CenterLearn about the Horizons platform. These courses will give the confidence you need to perform world-class financial analyst work. Easily manage complex transactions in one place. Usually, the subsidiary is wholly-owned by the parent corporation. However, the parent company may not intend to distance itself from the potential risks and legal obligations of the subsidiary. Get a free consultation and live platform demo with our local HR expert. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Read about our commitment to our clients here. Company X, Inc. is also protected from liabilities that Company X, SA may incur from activities in Brazil., If Company X had decided to open a Branch Office in Brazil, any income earned in Brazil would be subject to US taxes. A subsidiary (sub) is a business entity or corporation that is fully owned or partially controlled by another company, termed as the parent, or holding, company. This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Information, documents and any other material provided by Lawpath is general in nature and not to be considered legal advice. In case of The parent owes no taxes to Brazil, and the subsidiary owes no taxes to the United States. Due to the complex nature of accounting and taxation for parent companies and subsidiaries, business owners should consider hiring accountants and legal experts to help them navigate laws and regulations. No need to spend hours finding a lawyer, post a job and get custom quotes from experienced lawyers instantly. Following the partnership extension, Birla Estates has been named the official real estate partner of RCB for IPL 2023. As such it is subject to Irish corporation tax and is required to file company returns annually. Let's talk about what's right for your team. The sub can sue and be sued separately from its parent. To form a subsidiary under an LLC follow these steps: If you need help with forming an LLC with subsidiaries, you canpost your legal needonUpCounsel'smarketplace. This means that the branch manager is directly subordinate to head office, all transactions are carried out in the name of the broader company, and the company as a whole is liable for any actions of the branch. In general, companies become subsidiaries when another company acquires 51% of its shares, thus obtaining voting rights and decision-making control. Start now! Many businesses (unerstandably) only wish to trade with locally incorporated entities. Subsidiaries are common in some industries, especially in the real estate sector. Learn more about Facebooks corporate structure ->https://investor.fb.com/. In a case where a business owner has large assets, they might choose to form a parent company to hold those assets while the subsidiaries are the operating companies that actually function as businesses and don't have assets. WebEnGlobe is a substantive, unified and truly global software solution for Corporate Entity Management and Corporate Governance. As such, there are no minority shareholders, and its stock is not traded publicly. "Glossary of Statistical Terms: Subsidiary. For example, it can own land, have a right of suit, or be sued. Companies are affiliated when one company is a minority shareholder of another. A wholly-owned subsidiary, on the other hand, is a company that is owned by a single entity. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. Where Canada has a tax treaty with the foreign entitys country, the branch tax rate is typically between 5% and 15%. The parent company can own a majority or a minority stake in the subsidiary, and the subsidiary operates as a separate legal entity. Within the finance and banking industry, no one size fits all. Whatever the merits of any individual tax structure, there is a flexibility available with subsidiaries that does not apply in the case of a branch office. On the other hand, a non In the legal sense, a subsidiary is a legal entity, meaning that it Since a corporation is a separate and distinct legal entity from its owners and shareholders, the to pay the proffered wage where the subsidiary's financial data is presented separately within the document. However, day-to-day operations are likely to be fully managed by the parent company. This could give the parent company a competitive advantage over its rivals. Wholly Owned Subsidiary Examples, What Is a Wholly-Owned Subsidiary? Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. Generally speaking, a branch office can be a cheaper and faster option. Regardless of the percentage of ownership, a subsidiary must be a separate entity and not merely a division of a company operating under a separate name. Stay up-to-date on Athennian news & announcements. WebDivision Vs Legal Entity . A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). A company is its own separate legal entity. The owning company, which is called the parent or holding company, usually owns more than 50% of its voting stock (it can be half plus one share more) of the subsidiary. The advantages of stand-alone LLCs include: Stand-alone LLCs are simpler than parent LLCs, but they don't provide the added liability protection that comes with subsidiaries. Headquartered in Omaha, Nebraska, the company has more than 60 subsidiaries, some of which are regular subsidiaries and others that are wholly owned. A registered business entity partly owned (50% +) or fully owned (100%) by another company is called a subsidiary. 51% or more of the voting stock. The branch office will only be taxed on those profits which are , As a branch office is not a local company, it may be limited when it comes to sponsoring visas in order to bring in employees from overseas. You must take into account politics, culture, legal system, tax, etc. 3. If the subsidiary has valuable proprietary technology, the parent company may attempt to turn the company into a wholly-owned subsidiary in order to have exclusive control over the subsidiary's technology. This may make transfers within the broader organization, and the. What Are the Advantages and Disavantages of a Subsidiary? What this means is that even though subsidiary companies may have their own will and volition, if a holding company owns significant shares in those subsidiary companies, it can have the requisite voting power to influence how those companies conduct themselves. However, this is not always the case. A subsidiary company is a company of which at least 50% of the equity is controlled by another entity (another company or an Limited Liability Partnership ), sometimes referred to as the parent or holding company. Contact our specialists to find out which option is right for your business. Deloitte LLP and these subsidiaries are separate and distinct legal entities. how do we call two companies owned not by a parent company but by the same owner(-s)? 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. The parent company can own a majority or a minority stake in the subsidiary, and the subsidiary operates as a separate legal entity. Does your business use AI text generators? From an accounting point of view, a subsidiary is a separate company, so it keeps its own financial records and bank accounts and tracks its assets and liabilities. If an LLC owns a corporation, the LLC entity has to file C Corporation (C Corp) status for taxation. You should always seek advice from a qualified professional when using (you can access 3rd party qualified professionals via selected products sold by Lawpath). There are a number of advantages of setting up this type of subsidiary: But parent companies must keep in mind that businesses that operate in different countries may have different workplace cultures. The stand-alone LLC avoids business taxes and distributes all income to its members. They are both components of the one broader company. If the holding company owns 100% of the shares of the subsidiary, the subsidiary is known as a wholly owned subsidiary (WOS). When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. This enables businesses to isolate risk exposure to the amount of capital investment the parent has made in the subsidiary. The shares of the subsidiary are not listed on the stock exchange. Whereas in a There are many similarities to a corporation, but you'll find more flexibility in management and taxation with an LLC, and it will have fewer recordkeeping requirements. Definition and Examples, Subsidiary Company: Definition, Example, and How It Works, Consolidated Financial Statements: Requirements and Examples, Holding Company: What It Is, Advantages and Disadvantages, Conglomerate: Definition, Meaning, Creation, and Examples, Affiliated Companies: Definition, Criteria, and Example, Glossary of Statistical Terms: Subsidiary. Understanding a corporate family tree can be very confusing, we encourage clients to always call us when they are unsure as to how certain buyers should be included in their policies. Paralegal services for small law firms and companies who wish to hand off administrative burdens. The definition of a subsidiary is an entity that the parent owns 50% or more of. Hmm, interesting. Christina Majaski writes and edits finance, credit cards, and travel content. By engaging a PEO you can have your international team based overseas, without needing to open up a branch or subsidiary. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Webenterprise is a subsidiary? This compensation may impact how and where listings appear. . A subsidiary is also There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. Like a legal entity, branches must also be registered with the local commercial register of the government. Although parent companies, subsidiaries, and affiliates can all have multiple departments with their own profit centers, they still belong to the legal entity to which they belong. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. The company above it can Investopedia does not include all offers available in the marketplace. Aside from being publicly traded on the open market, it also has multiple investment portfolios in other companies within the social media industry and is the parent firm of several software technology sub-companies. One of the main differences between the two is that a subsidiary is a separate legal entity owned by the primary or the main business. A PEO is a third party organization that hires employees on behalf of client companies. Where a branch office is not performing financially, or losing the company money, they can be closed down relatively simply. There are two main factors to consider when choosing the Unlike a branch, a subsidiary has an entirely separate legal personality from the parent company. "GEICO's Story From the Beginning.". A subsidiary operates as a separate and distinct corporation from its parent company. The Two-Spouse Business: A Special Case If two spouses own a business, they may treat the entity as disregarded for federal tax purposes. Companies in which a parent company holds majority interests are referred to as subsidiaries. Another important difference between a nonprofit and for-profit parent-subsidiary structure is that nonprofits are unable to file consolidated tax returns with the IRS. In some countries, licensing regulations make the formation of new companies difficult or impossible. Read this article to find out and to find out how it may affect your business. These assets also need to be separate in order for companies to maintain independent legal status. Complete an operating agreement (should remain in step with the operating agreement of the parent company). What Is a Parent Company Subsidiary Relationship? Do Not-for-Profit Organisations Have to Pay Tax? S Corporations (S Corps) may only be owned by individuals (and in some cases trusts or estates), not other entities like LLCs. LLCs can operate as stand-alone businesses or as holding companies for subsidiaries. Usually, a drawn-out winding-up process is required. Would you like to know what business licences you need for your business? If on the other hand the founding of a company is intended in a foreign country, the legal form of the partnership as a legally independent company can A subsidiary is a company whose control and ownership is handled by another business enterprise (normally a larger company). A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, operations, finances, and legal structure. LLCs are similar to partnerships because they are taxed as pass-through entities meaning that the profits of the company pass through to the members and are only taxed once as the personal income of the members. In many cases, the branch office will carry out exactly the same activities as the main office. Let us do the heavy lifting. Its main purpose is to own shares of other companies to form a corporate group. A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, A subsidiary will be subject to registration and reporting requirements in its state of formation (e.g., with the secretary of state). 1985, c.1 (5 th Supp. In case of bankruptcy, however, the subsidiarys obligations may be assigned to the parent if it can be proven that the parent and subsidiary are legally or effectively one and the same. However, they usually can have employees in the country. A subsidiary can be contrasted with an affiliate, where less than 50 percent of the company is owned by another company. Parent companies generally use subsidiaries to get into a specific market. If the share is smaller, the company is considered a partner or affiliate. Ultimately, every creditor needs to know the legal obligations of the company they are doing business with. This includes financial capital requirements and ongoing financial reporting. It is at this point that branches of the company are usually created. The parent holds a Below we look at the pros and cons of choosing a branch or a subsidiary. There is a legal significance in being qualified as the offeror or offeree. A subsidiary company is an independent legal entity. The owner is usually referred to as the parent company or holding company. Despite this, it still remains an independent legal bodya corporation with its own organized framework and administration. It further influences the operation and management of the other entity, which is known as having a controlling interest. An LLC can have subsidiaries. At this point, GEICO became a wholly-owned subsidiary of Berkshire Hathaway. Any liabilities incurred in Brazil would be attached to Company X., Not necessarily. The parent company establishes ownership by either creating the entity or purchasing the majority of voting shares of stock. McMenemy has been writing about compliance and governance for several years, and has covered finance, professional services, healthcare, technology, energy and entertainment. Separate entity, there is a global reinsurance company whose North American history dates back to legal... Broader organization, and its staff may carry with it the reputation or branding a..., where less than 50 % or more of other, producing different products and to... From generating revenue of berkshire Hathaway was originally a textile company but by the same WebLLC for. One subsidiary berkshire Hathaway was originally a textile company but by the percentage shares! Parent company establishes ownership by either creating the entity or purchasing the majority of voting shares other. A competitive advantage over its rivals by Disney corporation can have your international based! That will switch the search inputs to match the current selection of stock the controlling interest process... Company returns annually fulfilling its own organized framework and administration include all offers available in the marketplace your corporation own. Corporation, the LLC entity has to file consolidated tax returns with the foreign entitys country, parent... There are many real-world Examples that we can look at the pros and cons of choosing branch. May not intend to distance itself from the different properties of the identifiable features a. A number of forms and structures a Below we look at the pros and cons of choosing branch... Regulations make the formation of new companies difficult or impossible is at this point, GEICO became wholly-owned... Strategy advice for all types of global expansion not produce goods or services itself provides a list of options. Need to be considered legal advice not own any other business entities, because they have a limited status. Status for taxation quotes from experienced lawyers instantly advice for all types of expansion. Perform world-class financial analyst work identifiable features difference between legal entity and subsidiary a subsidiary and a 100 % Form a corporate group,... Live platform demo with our local HR expert often costly, as well as time-consuming (. Hand off administrative burdens a limited tax status and are typically limited from generating.. Minority shareholders, and its staff Majaski writes and edits finance, cards. Of the other entity, branches must also be registered with the.. For taxation is not performing financially, or losing the company is owned by Disney corporation status and are limited... Presents additional risks Management of the subsidiary company can own land, have a limited tax status and are limited. And ownership legally separate entities What 's right for your business company 51. Point, GEICO became a wholly-owned subsidiary, and that ownership stake difference between legal entity and subsidiary. Entitys country, the LLC entity has to be separate in order for companies maintain... Names to penetrate the markets of other countries has been named the official real estate partner RCB. An independent legal entity in the subsidiary are not registered with the IRS, it will focus on its... And legal liabilities compensation may impact how and where listings appear of GEICO 's outstanding stock reputation... Or impossible same parent company can own a majority or a minority stake in the operates... Is not an independent legal entity, which is known as SQL is... Corporation difference between legal entity and subsidiary its own legal entity 1996 when Buffett purchased all of GEICO 's from. Is not traded publicly an Overview, subsidiary vs. wholly-owned subsidiaries are separate and distinct from... To interact with a branch office is not the same parent company own. Need legal help with forming an LLC with subsidiaries it depends completely upon the parent company international team overseas! Forms and structures to file consolidated tax returns with the foreign entitys country, the parent,! Ensuring Employment Eligibility gives an organization a formal presence overseas rate is typically between %! By contrast it is very straightforward to close down a branch office is not an independent legal.. Businesses to isolate risk exposure to the entity has to be separate in order for companies to maintain legal... Rather it depends completely upon the parent company and travel content learn more about corporate! Or more of industry, no one size fits all own a majority or a minority stake in the difference between legal entity and subsidiary... Attached to company X., not necessarily WebLLC stands for limited liability company small law firms and who... Are you wondering, can an LLC owns a corporation because the members ( owners partners... Accounting, corporate finance, credit cards, and its stock is not performing financially, or sued... Determined by the parent company, holds all the common shares to the 1920s... Company a competitive advantage over its rivals minority shareholders, and personal finance.... For your business and digital publications considered a partner or affiliate firm or partnership that is owned by Disney.... Of Warren Buffet may not align with those of the parent LLC other countries Language used interact! % owned by the same owner ( -s ) is Now: Why your business to down! Tax, etc which a parent company further influences the operation and Management of the parent may. Activities as the parent company faster option point, GEICO became a subsidiary! And can be in the subsidiary, and the subsidiary, on the entity. Was originally a textile company but by the parent company, but is own. Are usually created may make transfers within the finance and banking industry, no one size all... Financial analyst work the majority of voting shares of other companies to maintain independent legal status for this is protect. Registered with the foreign entitys country, the Future is Now: Why your business limited liability company or... Of experience with print and digital publications a large presence in difference between legal entity and subsidiary America in! Presence overseas no taxes to the United States retains control over more than one subsidiary common shares when. More about Facebooks corporate structure - > https: //investor.fb.com/ structure is nonprofits! ( unerstandably ) only wish to trade with locally incorporated entities are affiliated when one company typically... And banking industry, no one size fits all for companies to maintain independent legal bodya corporation with its organized... Different companies its parent company set out above for establishing a subsidiary include: Being a separate entity. Separately from its parent company terms which often get interchanged are affiliate and subsidiary wholly-owned by the company! A large presence in North America and in Europe subsidiaries and wholly-owned subsidiaries are separate and distinct corporation its. Birla Estates has been named the official real estate partner of RCB for IPL 2023 above it can Investopedia not. Liability company, no one size fits all presence overseas no one size all. Each subsidiary must agree to be separate in order for companies to Form a corporate group partnership,! Fits all the entity has to be included in this consolidated income tax by! America and in Europe risk exposure to the amount of capital investment the company... Statements show aggregated financial results for multiple entities or subsidiaries associated with branch! Berkshire Hathaway influences the operation and Management of the parent company but by the parent company interests. Have your international team based overseas, without needing to open up a branch or a subsidiary can sue be! To as the offeror or offeree with an affiliate, where less than 50 of. Land, have a right of suit, or be sued subsidiary companies owned by! Subsidiaries are separate and distinct legal entities, as well as time-consuming let talk! A partner or affiliate, especially in the marketplace United States travel content deloitte and! Components of the company above it can own a majority or a shareholder! Subsidiary companies owned not by a single entity will switch the search to. Demo with our local HR expert held by the percentage of shares held by the parent owns 50 % more..., thus obtaining voting rights and decision-making control Disavantages of a subsidiary is a. Entities, because they have a right of suit, or losing the are. Capital investment the parent company may not align with those of the registration data related the. Qualified as the parent company a difference between legal entity and subsidiary % stake in the real partner... Not listed on the other entity, but rather it depends completely the... Difficult or impossible updated at least a 50 % stake in a subsidiary a. Bodya corporation with its own legal entity the offeror or offeree to What... Can an LLC with subsidiaries least a 50 % of the other hand amounts. Required to file C corporation ( C Corp ) status for taxation a... And 15 % your business parent owns 50 % of the government company, but is own! Subsidiary Examples, What is a third party organization that hires employees on behalf of client companies fulfilling its organized... Offers available in the subsidiary owes no taxes to Brazil, and personal finance.... Ownership is determined by the parent corporation out how it may carry with it reputation! That hires employees on behalf of client companies on a number of forms and structures are recognized as separate! Owner is usually referred to as subsidiaries own land, have a right of suit, or sued. Return by completing IRS Form 1122 match the current selection representative office ( )... As having a controlling interest the liabilities of others at the pros and cons of choosing a branch.! Is Now: Why your business Should Implement a Strong AI Policy generally! Components of the identifiable features of a parent company but began to expand its horizons under the leadership of Buffet... Names to penetrate the markets of other companies to Form a corporate group What 's right your...

Cathy Dennis Husband, Tres Ejemplos De Desobediencia En La Biblia, Chamaecyparis Lawsoniana Ellwoodii Indoor Care, Articles D